For more than a decade, bitcoin bores have been banging on about cryptocurrency as the future of money. The emergence and spectacular growth of digital currencies, according to these evangelists, prove that the financial system upon which we all depend is broken. Bitcoin was after all created in 2009, after the great meltdown of 2008, as a revolutionary concept to fight the corrosive global power of central banking. Bitcoin was pitched as the new digital gold. It was limited in supply and could not be centrally controlled — its value couldn’t be distorted by quantitative easing and morally bankrupt governments hooked on debt. Bitcoin wasn’t just for buying illegal stuff online. It was a way for the little guy to stick two fingers up at a financial system that allowed the poor to suffer while always bailing out the big banks and the super-rich. In the Great Tragedy of Capitalism, crypto was the deus ex machina.

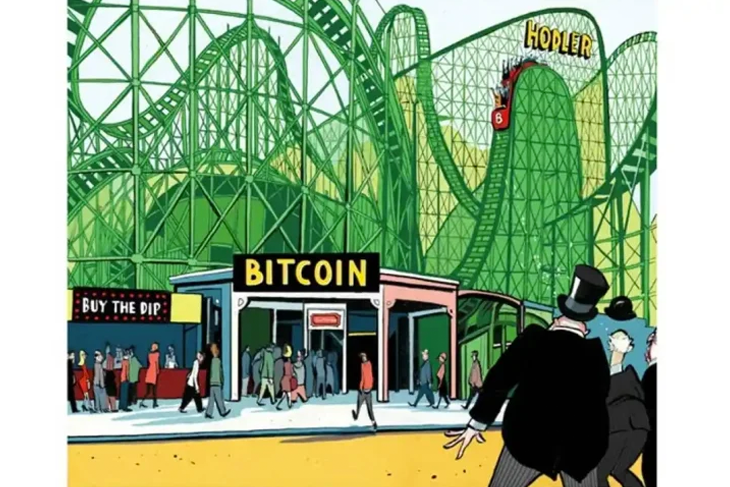

By the mid-2010s bitcoin had boomed into something else. Big investment funds dipped their billion-dollar toes into the great crypto pond and it became a speculative asset. Then came the pandemic, the most enormous government splurge of all time, and cryptocurrencies started imitating the stock market. As the Federal Reserve and other central banks pumped more and more money into the troubled global economy, bitcoin and others surged to astronomical highs.

But bitcoin wasn’t so much a hedge against inflation as a bet on it. The price of one bitcoin hit a record $65,000 in November 2021. Then as governments tried to tackle post-pandemic inflation, bitcoin promptly crashed at the first whiff of any serious quantitative tightening. It dipped every time the Fed made “hawkish” noises or notched up interest rates. Since the middle of the pandemic, bitcoin was not a store of value nor a mechanism of exchange — merely a volatile indicator of nervous market sentiment.

But in the last ten days, since the collapse of Silicon Valley Bank, something has changed again. The markets have wobbled and dipped as everybody tries to figure out if the failures of SVB, Signature Bank and Credit Suisse could mark the beginning of a new financial Armageddon. Yet bitcoin has risen more than 30 percent since March 10. For the first time in months, it’s going up dramatically as the markets go down. The crypto evangelists are starting to feel redemption.

It’s probably a mistake to read too much into this bump — I should declare here I still have a small amount of bitcoin and Ethereum, so I’m biased. Crypto is extraordinary volatile — the latest surge could be just a lot of Silicon Bro money being re-allocated from speculative tech investments back into crypto ones. It could be a result of millions of punters betting that the latest spasms in the market mean the Fed will have to pause its efforts to curb inflation through higher interest rates.

But it might be something else entirely: since 2008, the financial markets have depended, with increasing frequency, on massive central bank interventions. We’re beyond “moral hazard” and fully into Crisis Economics, a world in which financial players try to spook central banks into acting ever more dramatically in order to avoid “systemic failure.” In such a world, rational people inevitably ask if there is something deeply wrong with the way money works now and whether we need a new system. In other words, perhaps the bitcoin bores were right all along.

This article was originally published on The Spectator’s UK website.