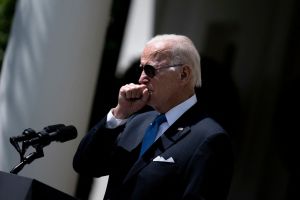

After a bank run on Silicon Valley Bank left the institution in ruins, the Federal Reserve announced it would make whole the bank’s customers, including those with uninsured deposits in excess of $250,000, which should have made them ineligible for the Deposit Insurance Fund. President Biden promised the American people that this was not a bailout because no losses would be borne by taxpayers — a claim the Wall Street Journal assessed as a “whopper.”

But the debate we should be having is not over the definition of the authorities’ actions, but how to judge them morally — especially given how the Fed has been trying to tame inflation for the past two years. The Fed’s plan is to cool the economy in the hopes that higher interest rates will lower investment and lead to less hiring, less wage growth for the working class, and thereby less inflation. So far, a red-hot jobs market and incredible wage gains made by working Americans have proven more stubborn than Jay Powell would have hoped.

Of course, inflation hurts the working class most of all, and finding ways to tame it is crucial to a monetary policy that works for working Americans. But there’s something deeply jarring about the contrast between the Fed’s interest rate policy and the response to SVB. Policymakers are happy to hurt the people whose ability to thrive is most crucial to the stability of our nation, targeting working class wages and first-time homeowners — in other words, throwing a bomb on the pathway to the middle class. Yet as soon as the tech bros who banked at SVB look to be in trouble, their rescue is seen as imperative.

Tellingly, the Biden administration appears uninterested in many of the high-cost fighting measures that do not hit the working class as hard as higher interest rates. The administration could be targeting the supply side, on energy, for example, or regulations that make housing needlessly expensive. There are ways for the White House to help reduce costs for working-class Americans, but all too often they involve breaching the progressive pieties of the modern Democratic party. And so calls for such proposals have fallen on deaf ears. But when SVB failed, it was a different story.

SVB’s customers were investors, tech startups, biotech firms, winemakers and Chinese businesses, the kinds of people who raise money from venture capitalists for a living, the well-heeled and well-connected. Unfortunately, they are also exactly the kind of people the Democratic Party caters to these days. Recall that 98 percent of political contributions from internet companies went to Democrats in 2020. This is why there was never a chance in hell the Biden administration was going to let them founder.

Instead, once again, they chose what the WSJ has called “an income transfer from average Americans to deep-pocketed investors.” As they always do.

This should be a moment of clarity. It’s deeply telling that the Fed has been raising interest rates in the explicit hope that it will cause thousands of American workers to stop seeing wage growth and even lose their jobs to “cool the economy” — while also deciding to put billions back into bailing out millionaires. The Fed has been making it impossible for middle-class Americans to buy homes, raising interest rates to slow investment and cool the market, and then when a bunch of millionaires lose their investments and may have to close their companies, the Fed decided to pay them back to stay open.

All the debates about whether you call this a bailout or not, about whether it is taxpayer funded or not, are less important than that fundamental juxtaposition. It’s rotten to its core — and it tells you who the Democrats really care about.