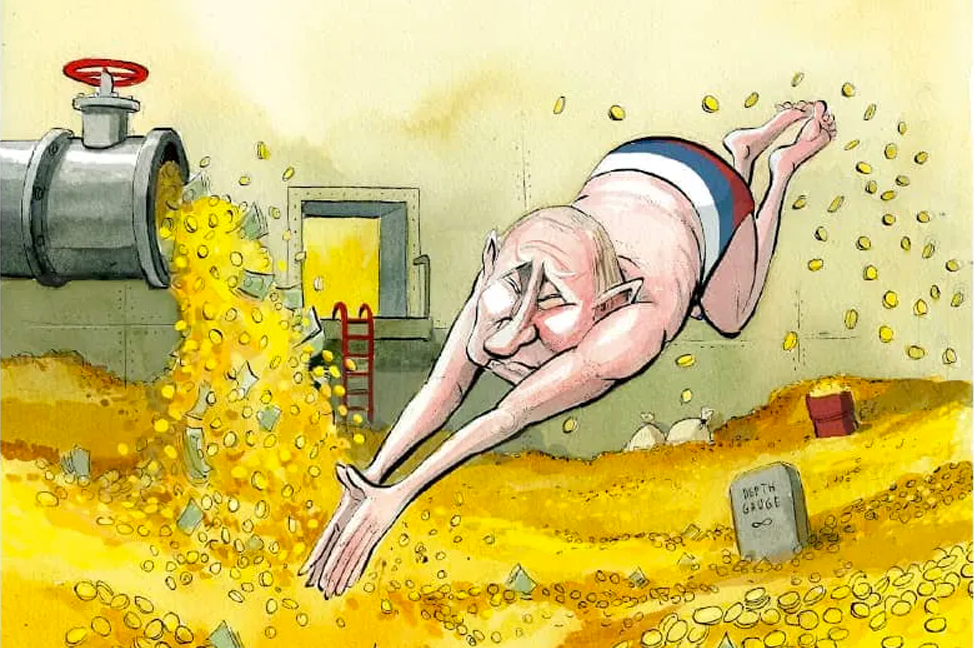

Don’t believe Vladimir Putin’s hype. The Russian economy is not OK. With western sanctions jeopardizing up to 40 percent of the country’s GDP, Putin’s assurances of an economic pivot to the East are a sham. And his weaponizing of gas supplies to Europe is the financial equivalent of strapping on a suicide vest.

That, roughly, is the message of a major new study published last week by the Yale School of Management about the impact of sanctions on Russia. Yale, working with a team of international economists, has looked past a wall of Russian obfuscation and used real-world data from retailers, energy traders and investors to reveal a picture very different from the rosy image presented by Putin at the St. Petersburg Economic Forum in June. “The economic blitzkrieg against Russia never had any chances of success,” he told an audience that included a delegation from the Taliban. “Like our ancestors, we will solve any problem; the entire thousand-year history of our country speaks of this… Gloomy predictions about the Russian economy’s future haven’t come true.”

The Yale study provides the first comprehensive set of data that proves Putin absolutely wrong. Let’s start with the outright lies. Many western commentators have latched on to the apparent stability of the rouble and the relative health of the stock market — the benchmark MOEX Russia Stock Index is down a mere 50 percent — as evidence that Russia’s economy is riding out sanctions relatively unscathed.

In truth, both of those indicators have been deliberately manipulated. After the outbreak of war, any company in Russia receiving income in foreign currency has been forced to convert 80 percent of it to roubles, skewing the market in the rouble’s favor. Only a fraction of pre-war volumes of roubles are actually traded, and then most are notional dollars, not real ones. As the Yale study points out, a parallel black market has sprung up where actual cash dollars trade at up to a 100 percent premium on the official rate: a return to a Soviet-style system of official and unofficial exchange rates.

As for the stock market, the reality is that foreign shareholders have been barred from closing out their positions — effectively keeping the market in a Lenin’s tomb-like state of suspended animation. Even with these controls in place, among the worst performing single stocks are those of Rosneft and Gazprom, the Russian state oil and gas giants, once the crown jewels of the country’s economy.

Now for the myths. In June, western news agencies reported that rising prices were compensating for Russia’s reduced export volumes. “Even with some countries halting or phasing out energy purchases, Russia’s oil-and-gas revenue will be about $285 billion this year,” wrote Bloomberg. “That would exceed the 2021 figure by more than one-fifth.” But according to the Yale study, the Russian government’s statistics were a carefully concocted lie, falsely projecting relatively stable March figures on to the future and, as key economic indices slid, cherry-picking numbers to conceal the true scale of the unfolding disaster. If you look at real-life market data on volumes of oil and gas actually traded, by May Russian energy export revenues had dropped to $14.9 billion, less than half of what it had earned in the first month after the invasion.

There are two reasons for this collapse. One is that China, supposedly Russia’s last major international ally, has ruthlessly insisted on a massive discount on Russian oil. (Beijing did the same to Iran — it’s one advantage of being the sanctions-busting buyer of last resort.) Brent and Urals crude, which for decades have traded at near-parity, radically bifurcated by the end of March, with Urals crude retailing at a $35-a-barrel discount. Moreover, shipping Russian oil from Novorossiysk has become much more expensive because of sanctions that complicate maritime and load insurance as well as payments.

Joe Biden caught considerable flak for going cap in hand to Saudi ruler Mohammed bin Salman to beg for OPEC to raise production and “stabilize” — i.e. lower — oil prices. But even a small fall in world prices would be devastating for Russia. A 2019 study by Saudi Aramco found that Russia was one of the most expensive places in the world to produce oil: around $42 a barrel for onshore projects, and $44 for offshore — compared with just $17 for Saudi crude. A $15 fall in the current price, plus the continuing discount on Urals crude, will push the profits from most Russian oil below zero.

The other reason for the country’s collapsing energy revenues is the bizarre fact that Putin has effectively chosen to sanction his own gas by reducing supplies to Europe. Last month, Fareed Zakaria wrote in the Washington Post that “it is now clear that the economic war against Russia is not working nearly as well as people thought it would,” and blasted western sanctions as “toothless” because they did not include gas. He rightly pointed out that the West was not really ready to fight total economic war against Russia because key countries remained fixated with green-energy agendas that inexplicably excluded nuclear power. (Germany, for instance, shut down three of its remaining six nuclear power stations before the beginning of the war.)

However Putin has now fixed that problem by sanctioning himself. Since June Gazprom has cut off Poland, Latvia, Lithuania and Finland and reduced flows to Germany through Nord Stream 1. Only Putin-friendly Hungary is still getting its full whack — a repeat of the carrot-and-stick gas diplomacy that the Kremlin has sporadically deployed since 2007. In a video conference with top energy and economy officials in April this year, Putin emphasized that it was essential for Russia “to redirect our exports gradually to the rapidly growing markets of the South and the East. To achieve this, we must determine the key infrastructure facilities and start their construction in the near future.”

Yet, as the authors of the Yale report point out, Putin’s plans for a povorot na vostok — a pivot to the East — make no economic or practical sense. In 2021 Russia exported just 16.5 billion cubic meters (bcm) of gas to China compared with 170bcm to Europe. Currently the westernmost Russian gas field with a pipeline connection to China via the Power of Siberia 1 pipeline is Chayanda, some 1,500 miles north of Beijing, with a maximum projected annual capacity of just 25bcm, and then only by 2025. Other gas fields such as Kovytka, Sakhalin and Khabarovsk are due to be linked up with Power of Siberia soon — but even when the whole far-eastern gas network is complete, its capacity will still fall short of that of a single one of Russia’s Europe-bound pipelines, the 55bcm Nord Stream 1.

The projected 50 bcm-per-year Power of Siberia 2 pipeline would link the Yamal peninsula in the Arctic to China via 1,700 miles of pipe running across Siberia and Mongolia. But that so far remains a plan on paper. And who will finance it? Not Gazprom, cut off by sanctions from raising international finance and buying western equipment. In anticipation of “massive capital expenditures,” the company took the unprecedented step of suspending dividends for the first time in thirty years in April.

Putin’s proposed “pivot” is therefore entirely reliant on Beijing’s money. The $45 billion cost of Power of Siberia 1, completed in 2014, was wholly financed by China. But despite ostensible diplomatic support from Beijing for Moscow, the threat of US sanctions on their global operations have caused many leading Chinese banks such as ICBC, the New Development Bank and the Asian Infrastructure Investment Bank to withdraw all credit and financing from Russia. Chinese energy giants such as Sinochem have also suspended all Russian investments and joint ventures.

Some Chinese companies remain active in Russia — but only those who have no operations outside Russia and China, and so have nothing to lose from international sanctions. That leaves only the Chinese state as a creditor of last resort for a massive cash injection into the Power of Siberia 2 project — and that support will come at major political cost. Russia imagines itself a major economic partner of Beijing’s, but the truth is that Russia is only China’s eleventh most important market, buying $72.69 billion of Chinese goods and commodities a year. By contrast, the US bought $506 billion’s worth in 2021.

Simon Jenkins has argued in the Guardian that historically sanctions have had little or no effect in changing regimes’ behavior. That is a legitimate debate and remains an open question. But much as I hate to disagree with my wise friend, he is factually wrong when he says that the current sanctions on Russia are “ineffective” and “the most ill-conceived and counterproductive policy in recent international history.” The old sanctions were indeed ineffective — but the new ones that include oil and gas are evidently biting hard.

According to the Yale study, the withdrawal of more than 1,000 international companies in the wake of Putin’s invasion will affect up to 40 percent of Russia’s GDP. A collapse of imports has devastated its foreign-technology-dependent automotive, aviation and arms industries. Russian gross domestic value added indicators have fallen by 62 percent in the construction sector, 55 percent in agriculture and 25 percent in manufacturing. “Despite Putin’s delusions of self-sufficiency and import substitution, Russian domestic production has come to a complete standstill with no capacity to replace lost businesses, products and talent,” says the Yale study. “Kremlin finances are in much, much more dire traits than conventionally understood.”

For evidence, look no further than finance minister Anton Siluanov’s recent acknowledgement that the Russian government budget will likely be in deficit this year by an amount equivalent to 2 percent of GDP — a gap that he suggested closing by withdrawing fully a third of Russia’s National Wealth Fund. To help cover the deficit, Russia’s money supply also doubled between February and June. Inflation is officially pushing 20 percent, but in some retail sectors such as electronics it’s closer to 60 percent, according to real sales data. Russian foreign exchange reserves have declined by $75 billion since the start of the Ukraine war. And while the direct costs of the conflict are a state secret, the military-news website SOFREP estimates that the Kremlin is laying out some $900 million a day.

The endgame of this war will be a battle between guns and gas. Putin is gambling that the economic pain of his gas cut-off will break western support for Ukraine before western guns break his army. But sanctions have opened another economic front where Russia is suffering far more than was previously thought. Putin can and does deny that economic pain. But illusion has a price. Economic crisis will soon enough become a political one.

This article was originally published in The Spectator’s UK magazine. Subscribe to the World edition here.