It more than doubled its sales. It unveiled a new line of microchips. It promised to keep rolling out new products for the next few years. In the end, Nvidia, the chip manufacturer, delivered the kind of blockbuster results that traders and investors had been waiting for. Yesterday’s “Nvidia Day” (as the company’s quarterly results days are now known on Wall Street) turned out to be better than even the most bullish investor could have hoped for. There is just one snag. The company is now powering the bull market. If anything goes wrong with its turbo-charged expansion, it will bring equities down with it.

It’s great for the moment

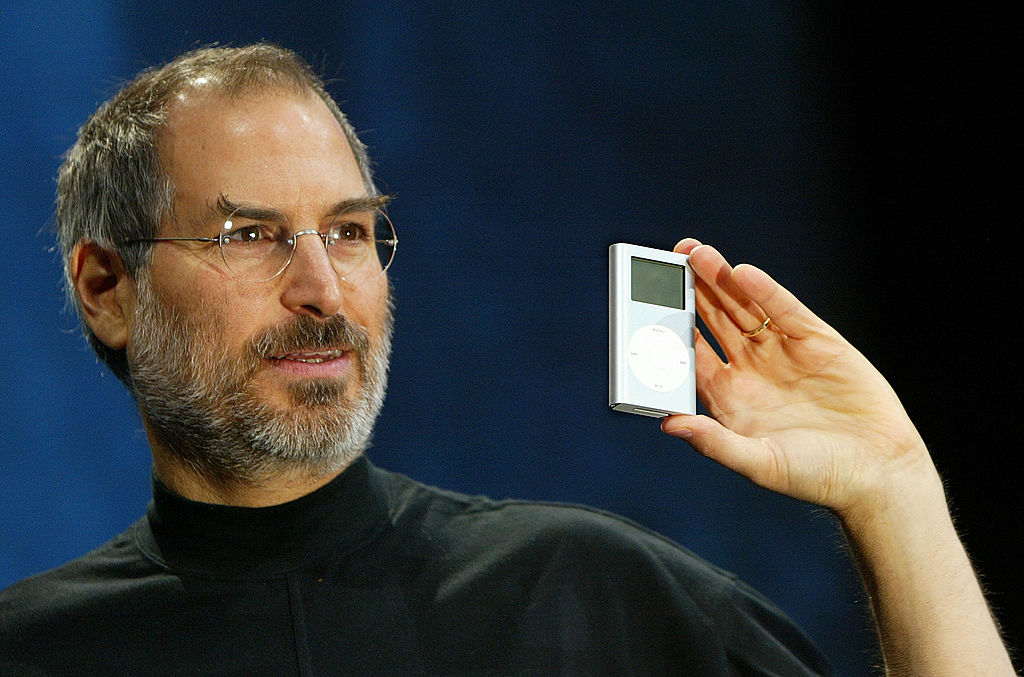

There was no question that it was an impressive set of figures. Overall sales were up by 262 percent year on year, and in the latest quarter alone Nvidia delivered revenues of $26 billion, well ahead of the $24 billion that was forecast. According to the company’s chief executive, Jensen Huang, its new Blackwell chip will deliver the next phase of growth, and Nvidia is on track to keep rolling out new and yet more powerful microprocessors over the next few years. With its lock on the high-powered kit needed to drive Artificial Intelligence systems, Nvidia is the main beneficiary of the boom in super-smart computers. So long as money keeps pouring into ChatGPT and the host of rival bots that replicate human intelligence, the company can keep on expanding. Alongside Apple, Amazon, Meta and Microsoft, it is the latest in the line of world-beating technology companies to emerge from the United States.

Investors, unsurprisingly, liked what they heard. Even after a 90 percent rise in the share price over the last year, taking it past a $2 trillion market value, in after-hours trading another $180 billion — equivalent to almost three times the GDP of Ghana — was added to its value. Investors had bet big on Nvidia maintaining its expansion, and for now that has paid off handsomely. The only problem is that the stock market is now dangerously dependent on this one company. According to an analysis by UBS, Nvidia alone now accounts for 5.3 percent of the value of the S&P 500, while its 411 percent increase in earning per share compared to a year ago by itself contributed 2.5 percent to the market’s 10.3 percent growth in profits. Put simply, Nvidia is now powering not just the world’s AI bots but the stock market as well.

That’s great for the moment. So long as it keeps on over-delivering, the markets will keep on rising. And yet, it also means there will be a nasty fall if it stumbles — because the bull market is increasingly buoyed by just a single company, and however brilliant its senior executives might be, it is hard to keep that going forever.

This article was originally published on The Spectator’s UK website.

Leave a Reply