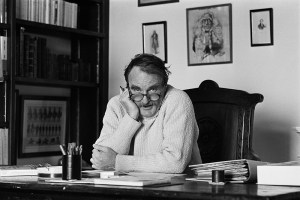

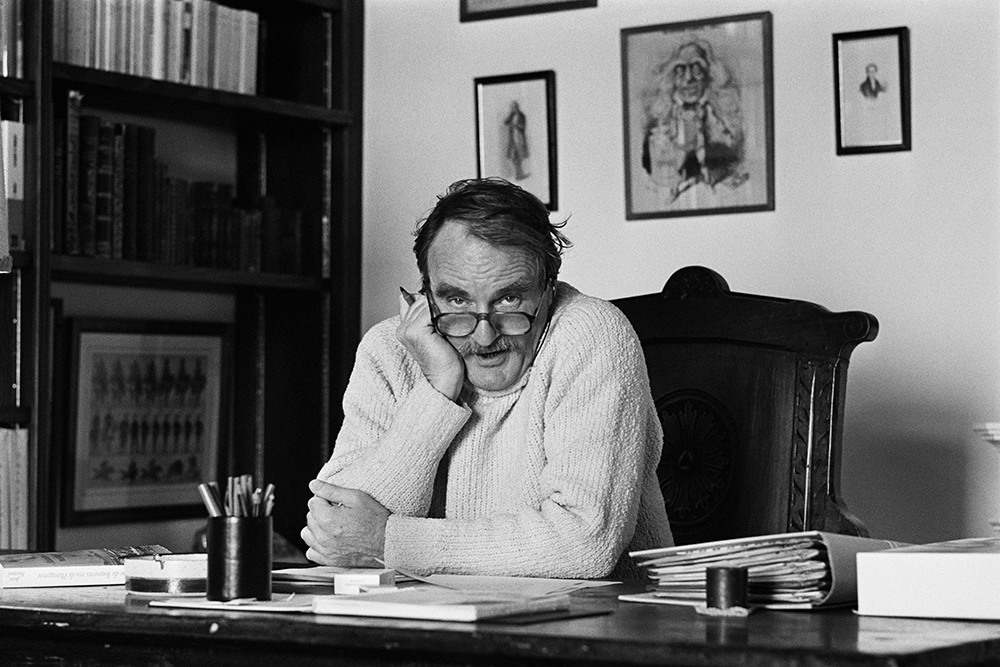

Even by his usual standards of self-satire, Jean-Claude Juncker was on top form to open the new year. As he uncorked his final bottle of wine for the year, the president of the European Commission found time to blast out a tweet celebrating the 20th anniversary of the launch of the euro. It has, according to Juncker, become a ‘symbol of unity, sovereignty and stability’, which has delivered ‘prosperity and protection’ to the people of Europe.

Juncker was right about one thing of course. The single currency is indeed 20 this week. It was launched on January 1, 1999, at least for financial transactions, with the actually notes and coins arriving later. And he was right as well that it has some significant achievements to its name. The trouble is, they have not involved much in the way of ‘unity’ or ‘stability’, and even less in the way of ‘prosperity’. In fact, the euro has managed four milestones which most mainstream economists might have previously considered virtually impossible – and the arrival of its third decade is a good moment to pause to record them.

First, the deepest depression ever recorded. True, there might have been some worse setbacks to growth over the centuries – the Black Death was apparently pretty bad for GDP – but since we started collecting reliable statistics the worst depression in history was recorded in Greece in this decade. According to numbers from the IMF published in 2018, Greece witnessed a bigger fall in output than the United States in the Great Depression of the 1930s, and it has lasted for longer as well. Given the advances in macro-economics since then, and the greater understanding of monetary and demand management, that is a heck of an achievement.

Second, it has created the world’s first post-growth economy. The Greens keep telling us we should wean ourselves off our childish, planet-destroying addiction to economic expansion. So maybe the euro was a clever environmental plot all along. Why? Because Italy has become the first major developed economy to go post-growth, with an economy that is no larger now than it was when it replaced the lira with the euro two decades ago. Of course, many Italians are not too happy with that. But it is quite a feat to bring the process of expansion that started with the industrial revolution to an end.

Next, the world’s greatest imbalances. China’s export machine, the wilder hedge funds, and central banks printing money are generally reckoned the main sources of financial instability in the world. But the German trade surplus, at more than eight percent of that country’s GDP, and a direct result of its currency remaining persistently under-valued, is the biggest the world has ever witnessed. The result? Every year, more than £236bn ($300bn) has to be recycled through the banking system to keep the euro ticking over, creating a vast mountain of debts and credits in the process. It is the major fracture in the global financial system.

Finally, shattered banks. You might think the euro-zone’s strongest economy would have strong banks. Think again. Shares in Germany’s Deutsche Bank have fallen by 90 percent in the last decade, and just before Christmas it had to deny it would need a bail-out (which is the banking equivalent of having ‘complete faith in the coach’ of a football team). Meanwhile, the Italian banks limp from crisis to crisis and so do the Greek ones as a half-built currency destroys the profitability of an industry that should be one of the foundations of a prosperous economy.

In truth, the euro is the most dysfunctional currency ever created – the gold standard of the 1930s, but worse. With its toxic mixture of depression, stalled growth, financial chaos and mass unemployment, its only real achievement is to erase a generation of economic progress. Jean-Claude Juncker might want to toast that – but it is unlikely many other people will join him.

This article was originally published on The Spectator’s UK website.