One of the major exchanges has gone spectacularly bust. Billions of investors’ money has been lost. There have been allegations of widespread fraud, and one of the biggest corporate trials in modern history is set to dominate the business pages over the rest of the year. The collapse of the FTX, and the arrest of its high-profile founder Sam Bankman-Fried, was meant to finish off bitcoin and the rest of the cryptocurrencies. And yet, this year digital money is staging a dramatic revival — and making fools of its critics all over again.

When FTX went down, there was no shortage of people telling us, with ill-disguised glee, that bitcoin was finished. The lurid tales of partner-swapping millennials trading billions in a Bahamas penthouse, while under the cover of “effective altruism,” certainly made for gripping reading. Charlie Munger, Warren Buffet’s right-hand man, argued it proved that crypto was a “demented” enterprise that “was rife with fraud,” while the European Union, somewhat predictably, decided that it was evidence more EU regulation was needed.

Well, perhaps. There is just one problem, however. You can see evidence of the demise of bitcoin everywhere, except, funnily enough, in the price. So far this year, bitcoin is up by 50 percent, rising from $17,000 to $25,000 a coin, True, it is a long way from its pandemic high of $60,000 when everyone in finance was stuck at home and trading cryptos because they had nothing else to do. But so are many other assets as well: bitcoin is now trading above the level it was at when FTX went down. For all the hullabaloo, it has made no difference to the value of the actual coins.

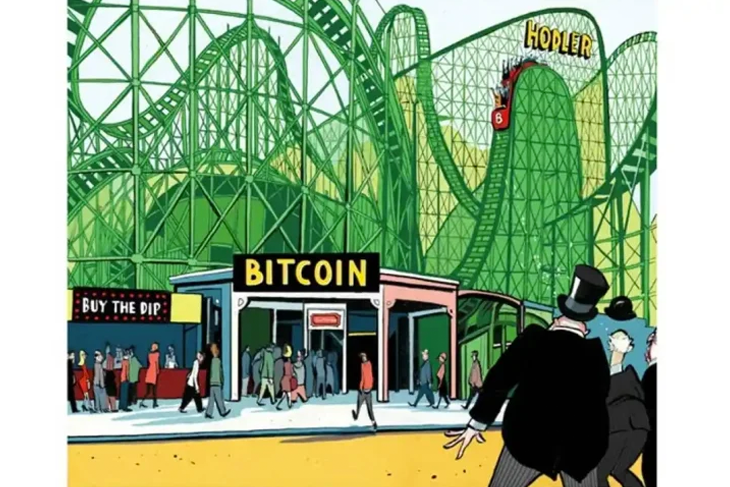

In reality, bitcoin has been through four crashes now, and recovered each time. That makes it different from a pure asset bubble. Tulips never recovered in price, neither did the South Sea company ever come back from its collapse. People are too quick to dismiss it, and they are also far too quick to start celebrating every time it runs into trouble. The truth is that we don’t know yet what kind of asset it is. It might be a replacement for gold, or for government-issued cash, or a way of trading stuff online, or something entirely new. But if it can survive FTX and still rally then it clearly has some real and enduring value.

While regulators in Brussels and Washington are still celebrating its demise, financial centers such as the City of London should keep trying to turn itself into a crypto hub — it is going to be around a lot longer than most people think.

This article was originally published on The Spectator’s UK website.