This article is in

The Spectator’s November 2019 US edition. Subscribe here.

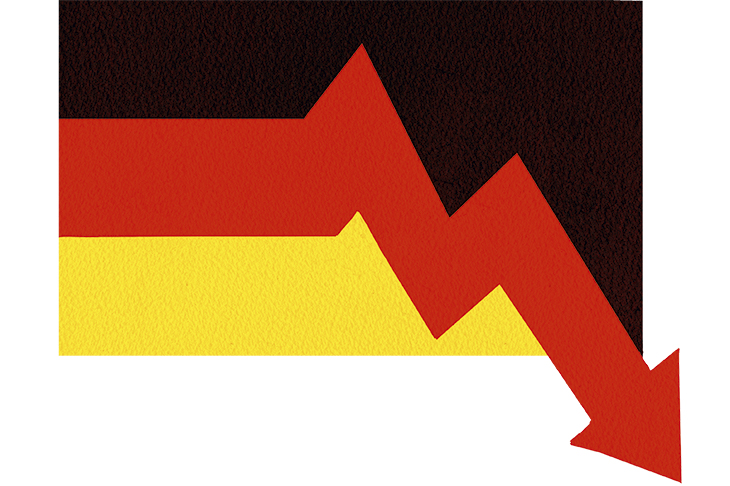

Germany has long been the beating heart of the eurozone. But that economic pulse has been getting weaker. The German economy shrank between April and June, the second contraction in less than 12 months. Preliminary data for the third quarter, July to September, shows the country’s mighty manufacturing sector rapidly declining.

To make matters worse, Germany’s new services sector orders just fell for the first time in five years. Its neighbors look on in horror, knowing what a German slump might mean for them. They want Angela Merkel to embark on a debt-fueled spending splurge to stave off a region-wide recession. She resists, insisting that Germany’s ‘culture’ is to avoid running up debt.

Merkel faces the dilemma at the heart of her country’s body politic — and its key role within the single European currency. If she is to boost Germany’s economy, spreading growth across the eurozone like a ‘good European’, the nation’s instinctive economic caution must be overcome. It’s about more than just Germany, of course. How Merkel responds to recession — and how she deals with or prevents Britain’s exit from the European Union — could determine whether or not the EU’s monetary union survives.

Germany is, to some extent, a victim of its own success. Its formidable export machine consistently generates trade surpluses equal to a massive 8 percent of GDP — a projected $276 billion this year, the biggest in the world. Yet heavy export reliance explains this dramatic domestic slowdown. When the global economy turns sour, there’s less demand for German wares.

At the last count, German export orders were dropping at the fastest rate for 10 years. Tit-for-tat US-China tariffs mean cars made by German firms in America are more expensive when exported to China, at a time when Chinese car demand is plunging. Two-fifths of Volkswagen’s global sales are in China, and a third for Daimler and BMW — with German brands accounting for a quarter of all Chinese car sales. All that, plus the emissions scandal, is hammering German carmakers, whose output nosedived last year, weighing on the wider economy.

China might grab the headlines but a fifth of German car exports are sold in Britain — the market with the highest profit margins. A no-deal Brexit could halve total exports to the UK, according to Germany’s respected Halle Institute, shattering domestic supply chains and costing 100,000 jobs.

Things became worse when the World Trade Organization ruled that the airplane manufacturer Airbus had received illegal subsidies for the past 15 years, paving the way for the US to hit the EU with goods tariffs of up to 25 percent as soon as this month. Successive shocks to Germany’s car industry add up to a major problem. The combination of a no-deal Brexit plus heavy US tariffs could do systemic damage to an industry vital to Germany and the eurozone.

Germany’s recent export success has been built — in part — on a cheap currency. Ahead of the euro’s 1999 launch, weaker currencies such as the Italian lira and Spanish peseta were hyped up, while reunification costs tempered the German mark. So monetary union ‘locked in’ Germany’s competitive advantage, while lumbering less productive countries with an inflexible currency that was far too high.

This initial mispricing explains why the Italian economy has barely grown over the past two decades, with Greece shrinking by 25 percent. The euro crisis of 2011-12 drove down the single currency against the dollar — extending Germany’s currency advantage to the global marketplace too. As Germany prospered, southern eurozone nations suffered. Then came the ignominy of those economies being bailed out by Berlin, which to assuage its own electorate imposed repayment conditions that were inevitably breached, spreading discontent all round. Designed to promote Europe-wide prosperity and unity, monetary union has instead spread nationalism and mutual distrust.

Now, with Germany itself on its economic uppers and eurozone bond markets distressed, there is massive pressure for policy stimulus. Having done so well out of eurozone membership at the expense of others, Germany is now expected to show ‘solidarity’ with weaker states.

The European Central Bank cut interest rates again in September and returned to quantitative easing, churning out another €20 billion a month for the foreseeable future. But more ECB funny money could easily backfire, spooking financial markets more than it calms. Driving eurozone rates even further into negative territory (the base rate is now minus 0.5 percent) also makes life harder for the eurozone’s fragile banking sector. The region’s stock of dodgy (nonperforming) loans is three times higher than in the US and four times that of Japan. The likes of Greece and Cyprus remain the worst culprits, but Germany’s banks are not immune. Shares at Deutsche Bank remain over 90 percent below their pre-crisis peak, as traders question the stability of this European banking linchpin. Yet by eating into profits, the ECB’s latest rate cut makes eurozone bank balance sheets even weaker.

Such monetary quackery certainly upsets Germany, where memories of inter-war hyperinflation and resulting political chaos, run deep. A previously obscure ECB internal accounting system known as ‘Target-2’ — showing massive IOUs being racked up between Germany and weaker eurozone members — often features in the popular press. German tabloid Bild portrays Italian ECB supremo Mario Draghi as a vampire: ‘Count Draghila, sucking our accounts dry.’ Any Berlin-boost, then, will be fiscal — lower taxes and/or higher spending. Germany has pretty low national debt, having run budget surpluses since 2013, so Merkel does have scope to act. She faces, though, a national aversion to borrowing, known as schwarze Null, or black zero — a deep-seated cross-party belief in balanced budgets, another reflection of Germany’s tumultuous past. Such caution would limit any German stimulus, to the dismay of the French. Many in Germany now question the black zero logic. ‘In a fragile economic situation, black zero should be put under review,’ says Joachim Lang, director-general of the BDI industry group, a bastion of German conservatism. ‘German fiscal policy must change.’

After all, with negative bond rates, markets are offering to pay to lend money to German government. A €50 billion growth package has been officially mooted, but only if recession happens. Waiting for the slump before you act risks serious damage to business and consumer sentiment. And €50 billion isn’t much — less than 1.5 percent of German GDP.

What’s clear is that a fresh eurozone crisis is looming — and it could be a lot more serious than in 2011. Back then it was the economic minnows in trouble — Greece, Portugal, Ireland. This time, much bigger economies could face bank runs and crises of confidence. A eurozone implosion sparked by Italy, for instance, would roil global markets, risking a 2008 re-run.

Italian banks have bought at least €360 billion of domestic government debt, representing more than 10 percent of bank assets. This has created a ‘doom loop’, with the state itself heavily exposed in any banking crisis. Even the eurozone authorities would struggle to fund any Italian rescue plan — giving Rome kamikaze bargaining power in its ongoing budget rows with Brussels. During the last crisis, too, Draghi could credibly promise to do ‘whatever it takes’, cutting rates and dousing down bond and equity markets with QE cash. Now, government debts across the board are much higher. And with rates already negative, and endless QE a given, the ECB’s medicine cupboard is bare.

Unless Germany takes bold fiscal action, boosting growth elsewhere, we can expect populist Euroskepticism to rise in Italy, France and Germany itself. That could cause bond markets finally to crack, the ECB unable to stop the patient from slipping away.

For years, France has said Germany must ‘stabilize’ the eurozone — that is, write off inter-eurozone debts and spread cash across the continent. Now Macron’s government is telling furious French street protesters that their woes are Germany’s fault. The European Commission, too, wants ‘pre-emptive, rather than reactive’ fiscal policy — which only Germany can deliver. It is against this background that Berlin, and all EU governments, must consider whether they want the fallout from a no-deal Brexit.

‘The economic sky is not cloudless,’ said Merkel as she met UK prime minister Boris Johnson in Berlin over the summer — adding that Brexit is ‘already causing us headaches’ so an ‘orderly withdrawal is preferable’. Can Germany — or Europe — cope with anything else?

This article is in The Spectator’s November 2019 US edition. Subscribe here.