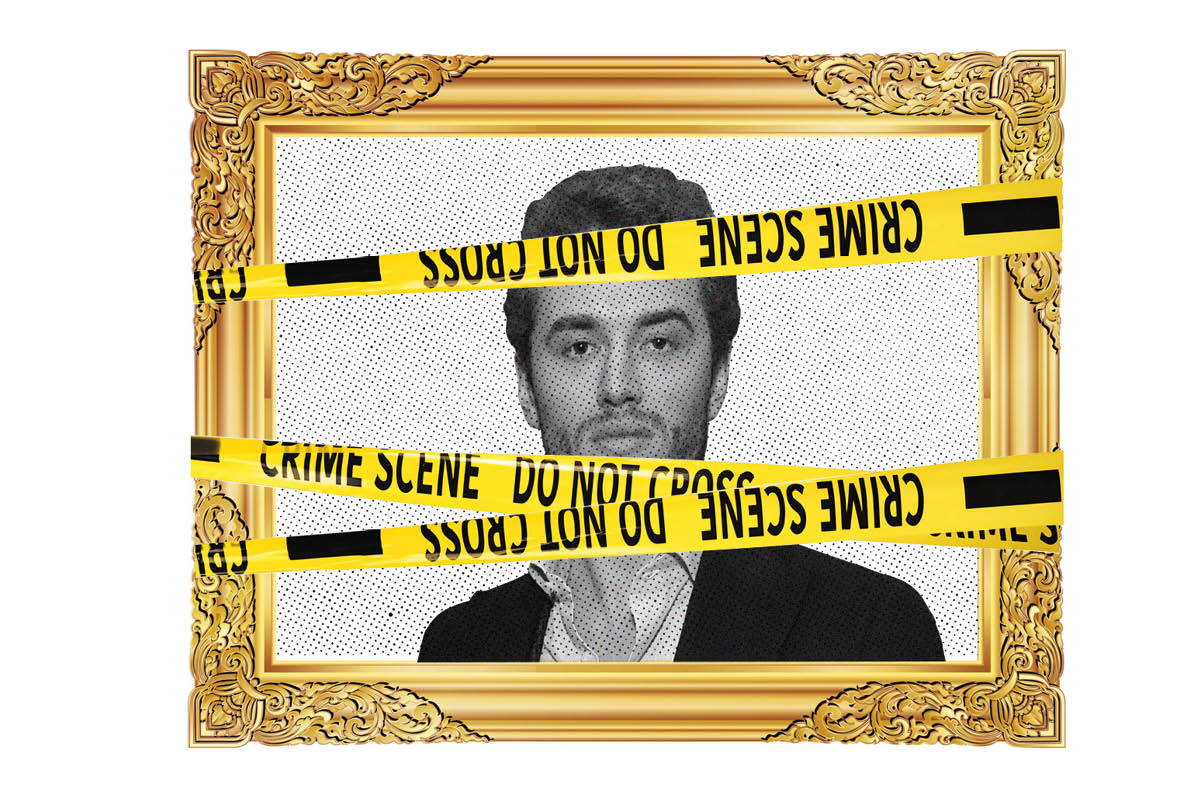

Be glad you’re not in Dr Mike Lynch’s shoes. A London judge has ruled that the founder of the Cambridge-based software venture Autonomy can be extradited to the US to face multiple fraud charges in relation to the takeover of Autonomy in 2011 by Hewlett-Packard of California. This was, undoubtedly, a disastrous purchase: HP paid a huge premium over Autonomy’s market value, swiftly found all was not as expected, wrote off most of the $11 billion price and accused Lynch of having artificially inflated the company’s numbers. His fate now hangs in the legal balance.

The Serious Fraud Office looked at the file but dropped it on grounds of insufficient evidence; meanwhile, judgment in a £3.8 billion civil action against Lynch is not due until September. But US prosecutors have pressed their case under a 2003 UK-US extradition treaty, which made it sufficient for the US merely to assert allegations rather than provide prima facie evidence when requesting an extradition from the UK. Conceived as an anti-terror measure, the unequal treaty has been used to extradite businessmen such as the ‘NatWest Three’ — David Bermingham, Gary Mulgrew and Giles Darby — whose dealings from the UK with the fraud-ridden Enron Corporation in Texas drew them into a US judicial nightmare, ultimately forcing them to plea-bargain for shorter sentences.

Whatever the rights and wrongs of this tale, Lynch was an entrepreneur from Essex running a London-listed UK company. Whenever US prosecutors have corporate suspects in their sights, they tend to ignore the issue of ‘extraterritoriality’ — whether or not any relevant offense might have been committed on US territory — and subject defendants to such pressure and cost that plea bargaining becomes their only viable option. You might say that’s the American way of encouraging rampant capitalism to behave itself — but before throwing any British citizen into its jaws, you’d want to be very sure he has a clear case to answer. The final say lies with the UK home secretary: Lynch’s last hope is that US justice will meet its match in Priti Patel.

Nuclear black hole

A short note on a big topic. If carbon-fuel burning is causing extreme weather that even leads to this week’s flooding of The Spectator’s offices, we need new nuclear power more than ever, and sooner. And if, as rumored, China General Nuclear pulls out as an investor in the Hinkley Point plant in Somerset because it is blocked for political reasons from participating in the follow-on Sizewell project in Suffolk and from building a reactor to its own design at Bradwell in Essex, there’s a huge black hole in the UK’s clean energy plan.

George Osborne’s wheeze of inviting China to help build the UK’s most sensitive infrastructure may have been a very bad idea, but today’s ministers had better tell us urgently how that hole can be filled. The answer surely can’t be wind farms, even if winds are getting wilder.

Dimon geezer

How much is Jamie Dimon worth? The answer, says Forbes, is $1.8 billion. And given that he’s 65, had emergency heart surgery last year and has been doing the demanding job of chairman and chief executive of the US mega-bank JP Morgan Chase for 15 years, you might think he’d be ready to ease into retirement. But the other measure to be taken into account in Dimon’s case is what proportion of the bank’s $450 billion market value is attributable to his leadership and reputation as (to quote the New York Times) the world’s ‘most talked-about and most powerful’ banker. Evidently his board thinks that’s worth a great deal: to persuade him not to go, they’ve offered him a ‘special’ stock option award that could win him another $50 million in five years’ time.

No banker has a run as long as Dimon’s without mishap, but he sailed through the 2008 crisis and when I wrote in 2013 that ‘word on the Street is the Dimon days are numbered’ after a $6 billion trading scandal blamed on a Morgan trader known as the ‘London Whale’, the rumor was wrong. He survived that one by being frank about it, just as he later spoke bluntly about bitcoin investors (‘stupid’) and rising inequality in the Trump era (‘The American dream is fraying’). If I were a shareholder I’d happily pay him to stay — even though that holds back for the time being the possible promotion to CEO of Marianne Lake, an English-educated Anglo-American who might one day join Scottish-born Jane Fraser, current chief executive of Citigroup, at the pinnacle of US banking.

And if that double British gold-medal story eventually happens, by the way, it will reinforce this column’s long-held belief that women tend to be better managers of complex financial risk than men. The fact that the other contender for JP Morgan’s deferred succession is also female — Jennifer Piepszak — suggests even macho Jamie Dimon may secretly subscribe to my theory.

This article was originally published in The Spectator’s UK magazine. Subscribe to the World edition here.