Is this really about a virus? Oil has plunged 30 percent, the S&P Index seven percent. What is happening on the markets today has less the feel of a rational reaction to world events than one of the periodic panics which grips world markets — with coronavirus a mere excuse for a sell-off which was perhaps coming anyway. The deadliest words for world markets are not ‘coronavirus’ and ‘Covid-19’ but ‘decade-long bull market’. The latter idea has planted in many investors’ heads that the good times could not have gone on much longer — there had to be a correction or crash. It is true, as well, that the US, in common with many developed countries, has not suffered a recession for over 10 years. That, too, feels unnatural. We just sort of feel due another one to establish the proper order of things. It is as if market sentiment has suddenly been seized by a bunch of preppers from backwoods Virginia.It is easy to establish a narrative whereby a coronavirus epidemic leads to global recession: people stop traveling, stop shopping, stop visiting restaurants, and economic activity plunges. Yet an infectious disease has not previously caused a recession, at least not in modern times. The Hong Kong flu pandemic of 1968/69 killed a million people globally — an order of magnitude or three bigger than the 3,000 who have succumbed to coronavirus so far. Yet Hong Kong flu did not cause a recession — although it did cause a 21 percent plunge in the Dow Jones at one point. As for swine flu in 2009 — the next most serious outbreak of infectious disease in modern times — it is hard to separate the epidemic from the wider economic turmoil of the time. When swine flu appeared, in early 2009, markets and the economy were already in a deep trough. By the time the outbreak was declared over a year and a bit later the Dow Jones had soared 40 percent.As for coronavirus, the epidemic seems already to have peaked in China, where it began: new cases were running at 3,000 a day in the second week of February, but then started falling away, to the point on Sunday when just 46 new cases were recorded. If the disease follows the same pattern globally, we might expect the worst to be over in weeks. But that is not necessarily going to calm investors. The stock market plunge has exposed other fears: of sovereign and private debt, of an imbalanced economy distorted by years of quantitative-easing and ultra-low interest rates, of damage caused by the US-China trade war. The best we can hope for, perhaps, is that we reach a point at which markets fall just enough that no-one any longer talks about us being in a 10-year bull market, that we suffer a brief, shallow downturn so that recession can soon be consigned to the past, rather than something to be feared looming in the near future. Then we can reset everything and get on with life and business. As for the coronavirus, will we be talking about it in years to come as a great cataclysm which changed history? I doubt it. But the accompanying market crash has possibly ensured that it will remain a vague memory, a little ahead of swine flu, avian flu and Sars — those other great cataclysms which never quite happened.

The best we can hope for, perhaps, is that we reach a point at which markets fall just enough that no-one any longer talks about us being in a 10-year bull market, that we suffer a brief, shallow downturn so that recession can soon be consigned to the past, rather than something to be feared looming in the near future. Then we can reset everything and get on with life and business. As for the coronavirus, will we be talking about it in years to come as a great cataclysm which changed history? I doubt it. But the accompanying market crash has possibly ensured that it will remain a vague memory, a little ahead of swine flu, avian flu and Sars — those other great cataclysms which never quite happened.

Market hysteria is not all down to coronavirus

An infectious disease has not previously caused a recession, at least not in modern times

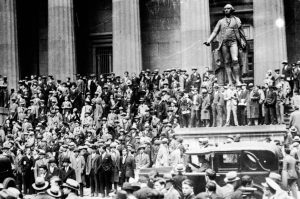

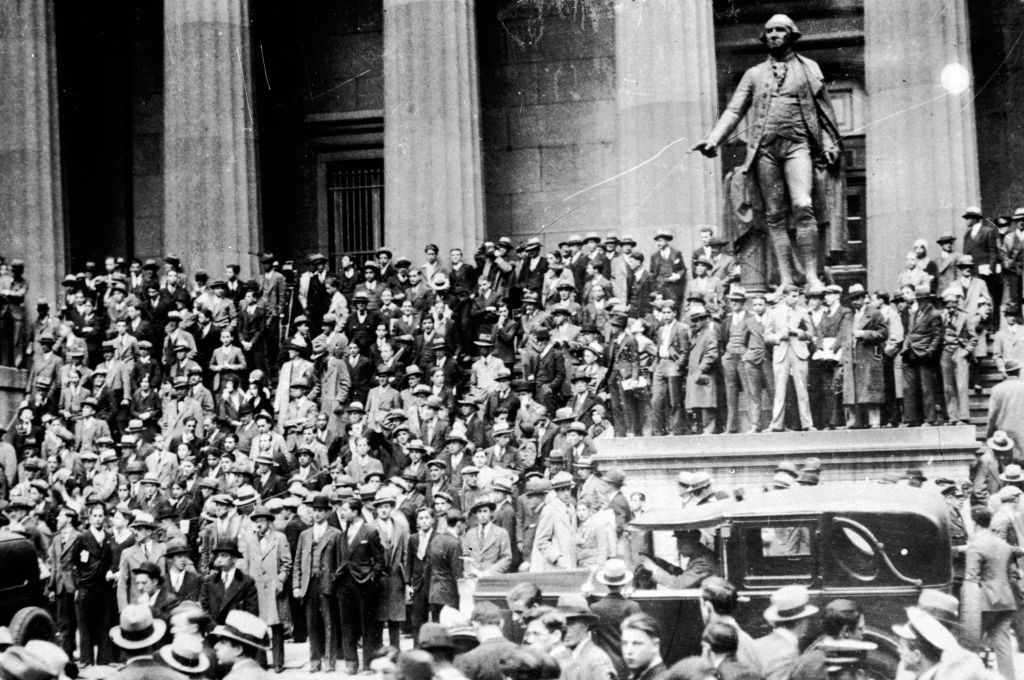

Traders work on the floor of the New York Stock Exchange

Is this really about a virus? Oil has plunged 30 percent, the S&P Index seven percent. What is happening on the markets today has less the feel of a rational reaction to world events than one of the periodic panics which grips world markets — with coronavirus a mere excuse for a sell-off which was perhaps coming anyway. The deadliest words for world markets are not ‘coronavirus’ and ‘Covid-19’ but ‘decade-long bull market’. The latter idea has planted in many investors’ heads that the good times could not have gone on much longer — there…

Comments

Share

Text

Text Size

Small

Medium

Large

Line Spacing

Small

Normal

Large