That the federal budget process is broken is the worst kept “secret” in Washington. The White House and Congress know it. The think tanks know it. A 2010 study from the progressive Center for American Progress called the budget process “not a pretty picture.” The conservative Heritage Foundation said in 2005 that the process “stifles debate, prevents cooperation, and frequently breaks down.” Proposals come along every few years to fix the problem, but nothing ever gets done.

“The fundamental reason why the federal process is broken is because Congress doesn’t have a budget,” says Kurt Couchman, a senior fellow at Americans for Prosperity. “Congress doesn’t do a budget. Congress does appropriation bills, there are 12 of them. Collectively they are only 30% of spending and no revenue.”

The rest of federal spending comes from mandatory programs like Social Security, Medicare and Medicaid, farm subsidies, and military and civilian worker pensions. What was once 53 percent of total federal spending in fiscal year 2000 is now 70 percent in FY 2020 and likely to keep growing.

According to President Joe Biden’s budget proposal, the Covid pandemic further worsened things because tax revenues shrank below mandatory spending outlays. That’s expected to improve a bit this year with tax revenues exceeding expected mandatory spending. However, the numbers don’t look good for future years as mandatory programs creep closer and closer to tax receipts. It’s unsustainable in the long haul.

Mandatory spending is handled through budget reconciliation, an expedited process for considering bills that the Congressional Budget Office says “would implement policies embodied in a Congressional budget resolution.” It’s been in place since 1980.

Couchman comments, “There was a time when reconciliation was used for deficit reduction on both the revenue and spending side. It’s really only used now for partisan purposes when there’s unified government…really kind of become a poisonous partisan process at this point and you can kind of understand why.”

“If you’re doing something on its own that is deficit reducing a lot of people interpret that as taking stuff away from people,” Couchman says. “And that’s just not something politicians like to do.”

Part of the problem appears to be that Congress puts together twelve separate appropriations bills in a calendar year. Couchman wants to see this consolidated into one bill that includes mandatory spending. He believes that will force politicians to make tougher decisions on mandatory spending because there will be political cover provided by discretionary spending programs. This avoids Congress using reconciliation to “give stuff away” through more and more deficit spending.

It’s not the first time this has been proposed. Former senator Pete Domenici and Alice Rivlin, who ran the Office of Management and Budget for two years under Bill Clinton, suggested it in a 2015 Brookings Institution study. The federal budget, they wrote, “should not leave entitlement spending or tax expenditures on automatic pilot, as they are now, but should allow Congress and the president to agree on all spending and revenues…” Their hope was that these changes would improve the budget process, since the government would see everything at once and be able to compare spending versus tax revenue.

Another proposal suggested by Domenici and Rivlin is for Congress to approve a budget every two fiscal years, instead of yearly. It’s a process used by most of the states. The pair believes this would ensure Congress would put together and approve a budget while also giving them time to adjust when necessary.

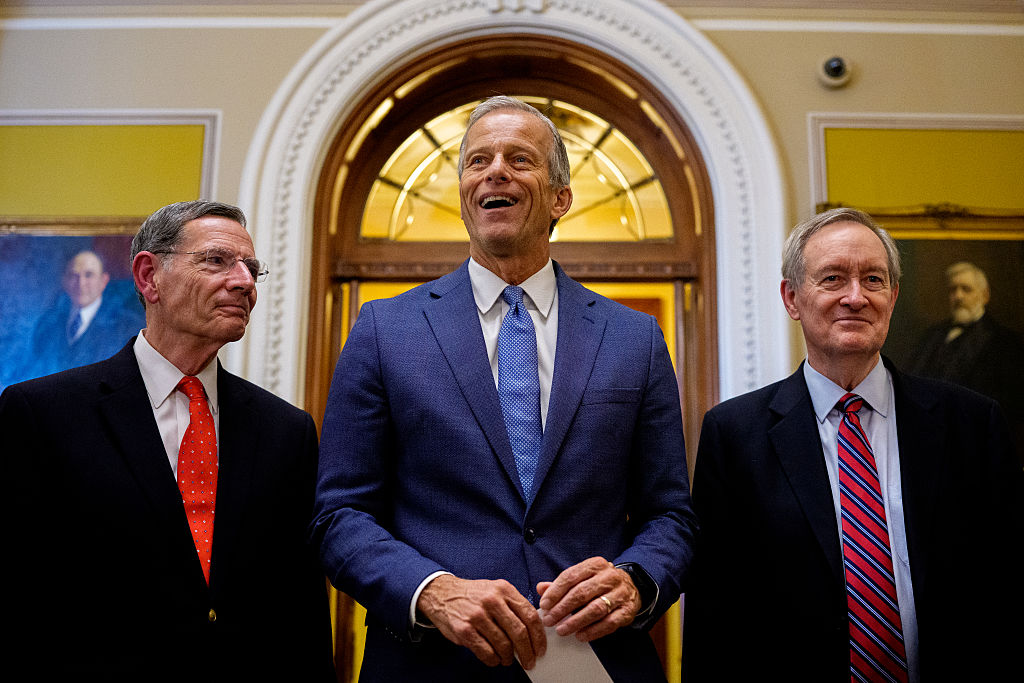

The late Wyoming senator Mike Enzi opined that a biennium budget cycle would reduce the chances for political showdowns and create more stability. He didn’t want to consolidate bills into one massive legislative piece but rather have the “more politically contentious bills to be completed in non-election years.” The other spending bills would be brought forth in an election year. The Reason Foundation published a similar idea earlier this month but noted there would need to be enforcement mechanisms like the docking of congressional and staff pay.

Couchman remains skeptical of the biennium budget notion. He suggests that the annual budget process works better because members of Congress can propose amendments, then “educate their colleagues and staff and the public and the broader policy community about why the thing that they’re trying to do is important and why people should get on board.” He’d prefer the focus be on a single bill.

The big question remains as to whether or not budget reform is possible. Reformers tend to make up a smaller sect of the political sphere with more focus given to high-profile issues like defense, health care, and whatever culture wars are dominating the headlines. Yet budgeting is still a vitally important issue — especially with the deficit and debt growing at unsustainable levels. The good news is that politicians appear interested in fixing the budget problem. The bad news is there may not yet be enough of them out there.