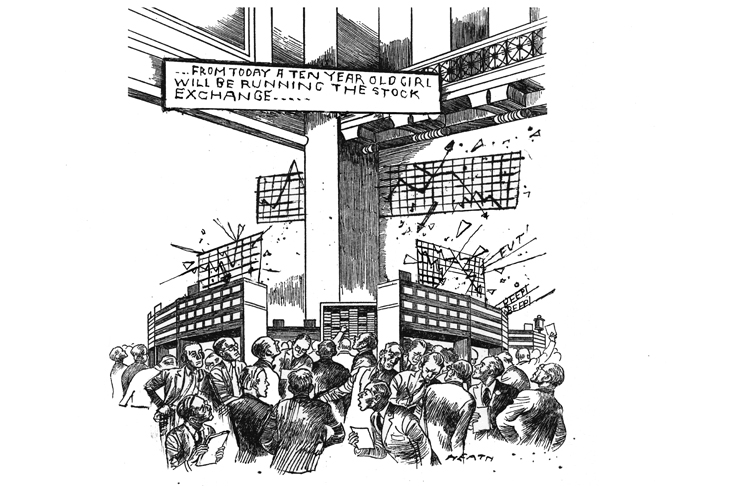

The Hong Kong Stock Exchange has tabled a $37 billion bid for its London rival. Li Ka-shing is buying the pub chain Greene King for $3.3 billion. The American buy-out firm Advent has offered $5 billion for aerospace supplier Cobham. On an almost weekly basis, foreign predators are swooping on one British company after another. But hold on: the UK is meant to be plunging into an economic abyss. A chaotic departure from the European Union, a political system in meltdown and the looming threat of a Marxist hard-left government have made Britain the one country that investors don’t want to touch. To many, the ZAVs — Zimbabwe, Argentina, and Venezuela — look attractive by comparison.

And yet, the flurry of buyouts by foreign firms is not as odd as it may seem. For a corporate buyer, the drama around Brexit is short-term noise. What they see are lots of decent companies they can buy on the cheap, and which will look like bargains once our departure from the EU has finally been resolved. In truth, there are likely to be a lot more takeover offers in the months ahead. Smart investors should get ahead of that trend — and pay special attention to sectors such as media, financial services and technology that may well have the most tempting targets.

Takeover bids for the London Stock Exchange (LSE) come along every couple of years, so this one isn’t surprising. The Exchange had already agreed a tie-up with Refinitiv, once part of Reuters, to create an information, trading and technology powerhouse to rival Bloomberg. But the Hong Kong Exchange clearly saw an opportunity to crash the party with a counter-offer of its own. What happens to that offer remains to be seen: bids for the LSE have a tendency to fail. Greene King is a done deal.

Cobham shareholders approved the takeover by Advent earlier this month, but the deal was swiftly called in by business secretary Andrea Leadsom on national security grounds. What these deals make clear, however, is that predictions of hysterical Remainers that whole sectors are about to be wiped out by our departure from the EU are wide of the mark. The City, for example, was meant to be destroyed by losing access to the single market and its passporting rules for banks and brokers — which is hard to square with the fact that someone is prepared to pay $37 billion for the LSE.

Why is there global demand for UK companies? First, many are really, really cheap. Amid political chaos, the UK stock market is now one of the most miserably priced in the developed world. Whether it is on price/earnings ratios or dividend yields or book value, British shares are trading at about 30 percent less than their global peers. They have consistently under-performed the rest of Europe since the referendum. Add in the weakness of sterling, and valuations in this country look even more tempting. The result? You can buy a decent, successful company in this country for far less than you can in any other major economy.

Next, our looming departure from the EU is a worry but only a short-term one: most experts don’t think the UK will be permanently crippled by leaving a big but not terribly successful trade bloc, even if it is next door. There may well be a recession, but not a deep one, and within a couple of years everything will be back to normal. When you are buying a whole company, you aren’t looking at the next one or two years, but the next decade or two. On that time frame, British companies look tempting.

Finally, the UK has lots of great businesses, with a secure niche in a global market. Three decades on from the pro-business reforms of the Thatcher era, most UK companies are well run, profitable, and with motivated, flexible workforces. Britain is not likely to grow rapidly, but once you take Brexit out of the equation it does not face any major structural problems. In London, it has arguably the world’s most successful city economy, and that effect is starting to ripple out to other regions as well. On top of that, the UK economy remains one of the world’s most open. You can buy a British company without having to face the kind of political opposition you would in France, Germany, Japan or, increasingly, the US. If you are willing to pay the right price, it is yours.

So where should investors be looking for the next round of takeovers? There are some obvious candidates in the FTSE 100 or just outside it. In media, ITV has some great content that must look tempting to the tech giants fighting for streaming customers. Pearson has struggled to make a success of its education business but a rival might reckon it could do a better job. The global brands controlled by Reckitt Benckiser would be attractive to any of the giants of the consumer goods industry or a private equity firm. Ocado’s delivery expertise might be valuable to any of the cash-rich technology firms. The pharmaceuticals giant AstraZeneca has already fended off one huge takeover bid, but another is always possible.

True, bids may or may not materialize for any of those companies. Some of us might even be sad to see them fall into foreign hands. Even so, a wave of takeovers has only just started, and that is likely to accelerate in the months ahead — and if it happens, it will keep the whole stock market buoyant.

This article was originally published in The Spectator’s UK magazine. Subscribe to the US edition here.