The Federal Reserve raised interest rates by 0.25 percent last week, the first increase since December 2018. Back then, Donald Trump had been very vocal in his criticisms of the Fed and its chair Jerome Powell, demanding no more rate increases. There was no resistance from the White House this time with press secretary Jen Psaki saying that the Biden administration respected the Fed’s independence.

Powell called the rate increase necessary due to inflation coupled with rising prices. “As we emphasize in our policy statement, with appropriate firming in the stance of monetary policy, we expect inflation to return to 2 percent while the labor market remains strong,” said Powell, before warning that it will take longer than expected for inflation to sink. ”The median inflation projection of [Federal Open Market Committee] participants is 4.3 percent this year and falls to 2.7 percent next year and 2.3 percent in 2024; this trajectory is notably higher than projected in December, and participants continue to see risks as weighted to the upside.”

The future may contain more rate increases although Powell promised not to shift things too quickly. It’s a move economists see as both wise and safe in the short and long term. “A series of slow and steady target increases gives them a smooth glide to a higher target after a few months, giving people time to adjust,” the Cato Institute’s Center for Monetary and Financial Alternatives director Norbert Michel told me in an email on the rate hike. “In theory, each quarter point increment will have a minimal impact, and without any large jumps or shocks to credit markets. That’s good on its own — and to the extent that there are still supply driven changes to inflation and heightened uncertainties, it’s even more important.”

Michel believes that smaller rate hikes over a longer period of time allow the Fed to cut rates, should the economy start showing signs of a recession. In an echo of Powell, who told reporters that it was important to “slow demand” in order to catch up with supply, Michel expressed concern about tightening things too quickly due to supply problems. The Fed chair also tied price stability to a sustained period of maximum employment, while noting that companies were having a hard time hiring people.

Right now, though, Powell is confident in the American economy and the ability to avoid a recession. There’s strong consumer demand and the labor market runs hot too. American households and businesses also received praise for attempting to balance their budgets.

The same can’t be said for the federal government’s balance sheet. Deficit spending and debt fill the United States financial books with seemingly no end in sight. Both have shot up since 2008, but the Covid-19 pandemic caused Congress and the White House to spend an almost combined $6 trillion in 2020 and 2021.

Deficit hawks see this spending addiction as problematic, no matter what the Fed does to interest rates. “I hasten to add that the interest rate increases will not be very effective in reducing inflationary pressures if the Biden administration and congress continue to engage in deficit spending,” said Clemson College of Business and Behavioral Sciences dean emeritus Dr. Bruce Yandle who believes that the Fed’s interest rate move this week was the appropriate course of action. “Inflation is first and foremost a monetary phenomenon. Printed money chasing a limited supply of goods and sources is the root cause of higher overall prices.”

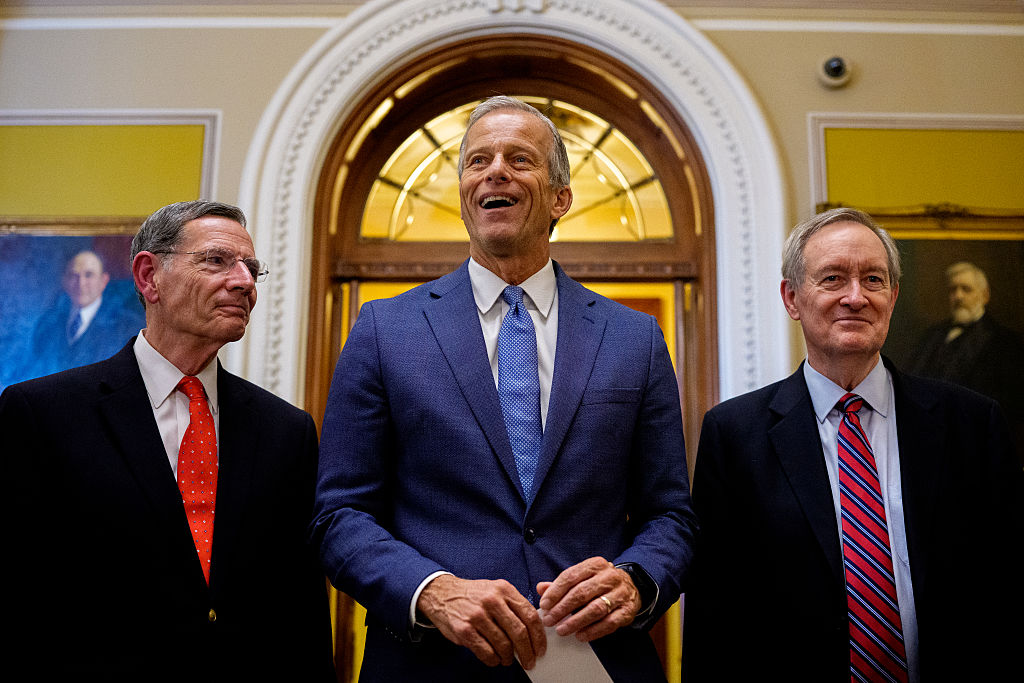

The executive and legislative branches of government remain resistant to the idea of spending reductions which remains troubling to those who believe in fiscal responsibility. The last time Congress had a surplus was 2001 (!) involving the final budget signed by President Bill Clinton. That only happened because of his willingness to negotiate with Republicans in control of Congress. Polarization, plus power, prevents the government from meaningful fiscal reform — particularly discretionary spending. Relying on the Federal Reserve to raise interest rates isn’t the only way for the federal government to address inflation. Congress will have to start doing its job, which is a hard thing to ask for these days given the partisan divide on Capitol Hill and the consolidation of power by House and Senate leadership.