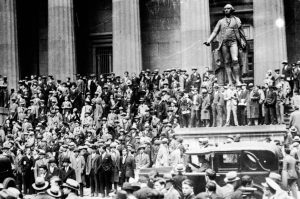

The markets are tumbling. Investors are bailing out. And there are already fears that the plunge in equities is a sign that a recession is just around the corner in America. With a presidential election only a few months away, the Federal Reserve will come under intense pressure to bail out the market with a cut in interest rates as it has done so often over the last quarter of a century. So will central banks in the UK and the Eurozone. This time around, though, it would be madness to cut rates: it will just make the asset bubble much worse.

The FTSE-100 has fallen sharply again this morning, and the brief rally experienced by the markets earlier this week has already run out of steam. In the US, the S&P 500 is down by 6 percent over the last week, the tech-heavy NASDAQ is down by 8 percent, while in Japan the Nikkei has lost almost 14 percent over the last three weeks. It is not yet a full-blown crash, but the markets are looking a lot more jittery than they have at any time since the start of the Covid crisis four years ago.

If rates are cut again now, prices are likely to start rising once more

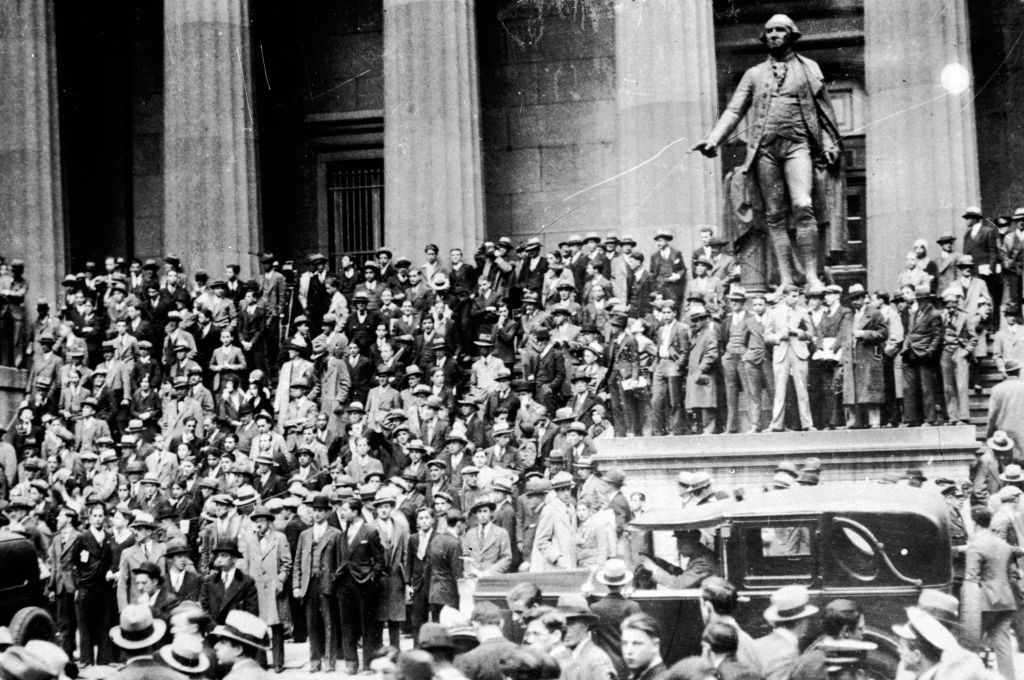

There are, inevitably, already plenty of calls for the Fed to cut rates to reassure investors. The trouble is, there are three big problems with that. First, the really big losses in equities are centered on the artificial intelligence stocks that have boomed over the last year. Nvidia, for example, which makes the chips that power super-smart computers is down by 22 percent over the last month, and so are many of its peers. And yet, it has become clear that in reality AI was wildly overhyped, and investors have quite rightly started to question whether it is creating anything of real value. Next, Japan has been at the epicenter of the crash, as the country’s “carry trade,” which allowed hedge funds to borrow cheaply in Tokyo and invest the money elsewhere, has started to come unstuck. All we are really witnessing is the unwinding of two decades of easy money in Japan — that was always going to create some volatility.

Finally, global inflation has not yet been convincingly defeated, and that was why the Fed and other central banks raised rates in the first place. If they are cut again now, prices are likely to start rising once more — and potentially quite sharply. Sure, investors have lost some money this month, although most major indices are still up by a decent amount over the last year: the NASDAQ is 16 percent higher than a year ago, the S&P500 is 15 percent higher, and even the FTSE-100 is 7 percent higher than in August 2023. It is not exactly a catastrophe. In reality the Fed and other central banks will lose all credibility if they bail this market out — and it would be far better to simply let the correction run its course.

This article was originally published on The Spectator’s UK website.

Leave a Reply