Inflation continues to be the economic story of the day. While Democrats try to divert attention to the job market, and many Republicans seem more interested in appealing to “gut feelings” on issues like crime, the latest polling shows that rising prices remain top of mind for most voters.

To the extent that the Biden administration is talking about inflation, it’s generally been to downplay the latest numbers (at least when not accidentally highlighting it with ill-fated tweets that take credit for historically high Social Security cost-of-living adjustments).

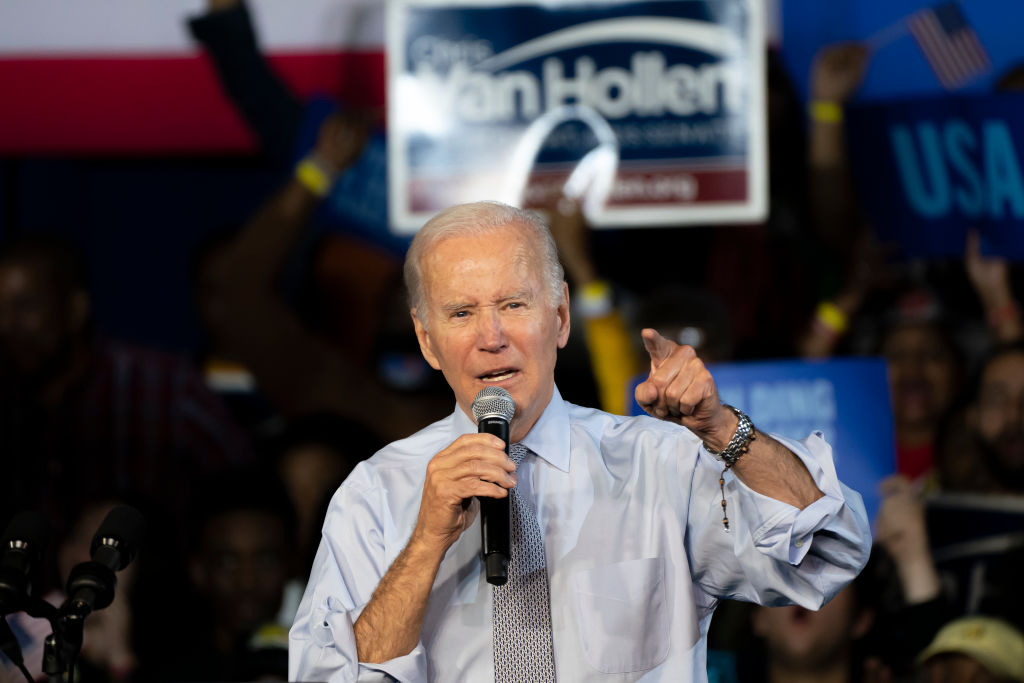

But there is another talking point that some Democrats are taking as an alternative: big corporations are to blame, and windfall taxes are the solution. Joe Biden recently accused oil companies of “war profiteering” and raised the possibility of slapping a windfall tax on their profits.

In addition to Biden, one of the chief cheerleaders for a windfall tax has been Representative Katie Porter, otherwise known for making the most out of her seat on the House Oversight Committee. Locked in a tight reelection race, Porter has been accusing “greedy corporations” of “cheating Americans” by “overcharging families so they can earn record profits.” Similarly, California Governor Gavin Newsom has called for a new windfall tax “exclusively on oil companies.”

They may be onto something, at least politically. A recent YouGov survey found that two thirds of Democrats and nearly 40 percent of Republicans buy the story that “large corporations seeking maximum profits” are to blame, at least in part, for recent inflation.

But for this to be the whole story, Porter and Newsom would also have to credit corporate benevolence for the long decline in prices since the 1980s and before current inflation. The limitations of this way of thinking become obvious immediately. Unsurprisingly, the vast majority of economists — regardless of where they fall on the political spectrum — reject the notion that greed plays any real role in causing rising prices.

The more truthful answer is that inflation is a multifaceted economic phenomenon with many complex causes. In other words, there’s plenty of blame to go around.

The question remains, though, of whether a windfall profit tax is ever a good idea, high inflation or not. After all, that same YouGov survey found that while even Democrats are split on increasing corporate taxes to solve inflation, a third of Republicans are willing to support seemingly similar policy prescriptions like fines for price gouging or government-imposed limits on price increases.

The case against windfall taxes is straightforward. Oil companies may earn a lot of profit, but their profit margin is actually quite small. Last year, a survey by S&P Global IQ found that energy companies ranked tenth out of eleventh in terms of profitability, with a profit margin of 8.3 percent compared with 10.6 percent across all sectors.

Another analysis found similar results for “Big Oil” specifically, concluding that “their actual profit margin is fairly low compared to most other industries.” As one commentator has put it, “Big Oil isn’t as rich as everybody thinks.”

But even if energy companies were experiencing an uncommon windfall, it’s common knowledge that world events have a lot to do with it. The administration even has a term for the phenomenon — let’s not forget about “Putin’s price hike.”

What’s more, the idea of a windfall tax was tried once before, and was unsuccessful. Back in the 1970s, the federal government tried taxing oil companies that then were the beneficiaries of the energy crisis. The result was even higher energy prices because corporations can pass taxes along to consumers just as they have rising costs of energy production recently. Not to mention such taxes also discourage new market entrants, which only keeps prices higher longer. No wonder, then, that revenue fell far short of expectations and inflation only abated once the Federal Reserve got serious about price stability.

At a time when even rising interest rates are failing to contain stubbornly high prices, it’s natural to want someone to blame. No one is an easier boogeyman than the big, bad oil companies. Unsurprisingly, some in the Senate are introducing new proposals that would punish market participants, even though the Joint Committee on Taxation found that any impact on inflation would be minimal.

But policymakers should eschew easy answers to complex questions, especially when the body of evidence shows that such ideas would not be solutions at all. It might not be easy, but some Democrats should look in the mirror and start getting serious about the big government spending that has contributed to their economic and political woes.

Jonathan Bydlak is director of the Governance Program at the R Street Institute, a center-right think tank, and the creator of SpendingTracker.org