China hit back on Wednesday with an additional 50 percent tariff on US imports, matching the extra levy imposed overnight by Donald Trump on Chinese goods. That made the running totals 104 percent so far from Washington, vs 84 percent from Beijing, prompting one analyst to compare them to two racing cars driving straight at each other in a high stakes game of chicken. Though in the immediate aftermath of China’s latest hike, the loudest cackling came from panicked stock markets, which continue to tumble amid a growing realization that for the moment neither side is going to swerve.

For good measure, China also added 12 more US companies to export control and unreliable entity lists, which restrict Chinese companies from doing business with them. They included the manufacturers of laser optics, medical devices and a subsidiary of Boeing that makes drones.

Beijing’s tariff commission called the US escalation a “mistake on top of a mistake,” demanding Washington “cancel all unilateral tariff measures against China.” While the Commerce Ministry said in a statement, “China will firmly defend its interests, multilateral trade system and international economic order.” That was accompanied by an orchestrated campaign of defiance across state and social media, ridiculing those countries which sought an accommodation with Trump.

The China Daily declared in an editorial: “Global unity can triumph over trade tyranny.” That came after US Treasury Secretary Scott Bessent warned that there would be serious consequences for US partners tempted to take up Beijing’s offer. Aligning more closely with China would be like “cutting your own throat,” he told a summit in Washington. For her part, China’s foreign affairs spokesperson Lin Jian declared Wednesday that Beijing “firmly opposes and will never accept such hegemonic and bullying practices.”

So, safe to say, little sign of compromise there. The ball is now back in the court of Donald Trump, whose demand for China to rescind its retaliatory tariffs has been well and truly rebuffed. His courtiers are beginning to look increasingly fractious, with Elon Musk describing Trump’s senior trade advisor Peter Navarro as “truly a moron.” Musk’s Tesla stands to suffer not only from tariffs on goods produced in China, but also from any targeted retaliatory action by Beijing against US companies based in China. In another post on X he called Navarro “Peter Retarrdo.”

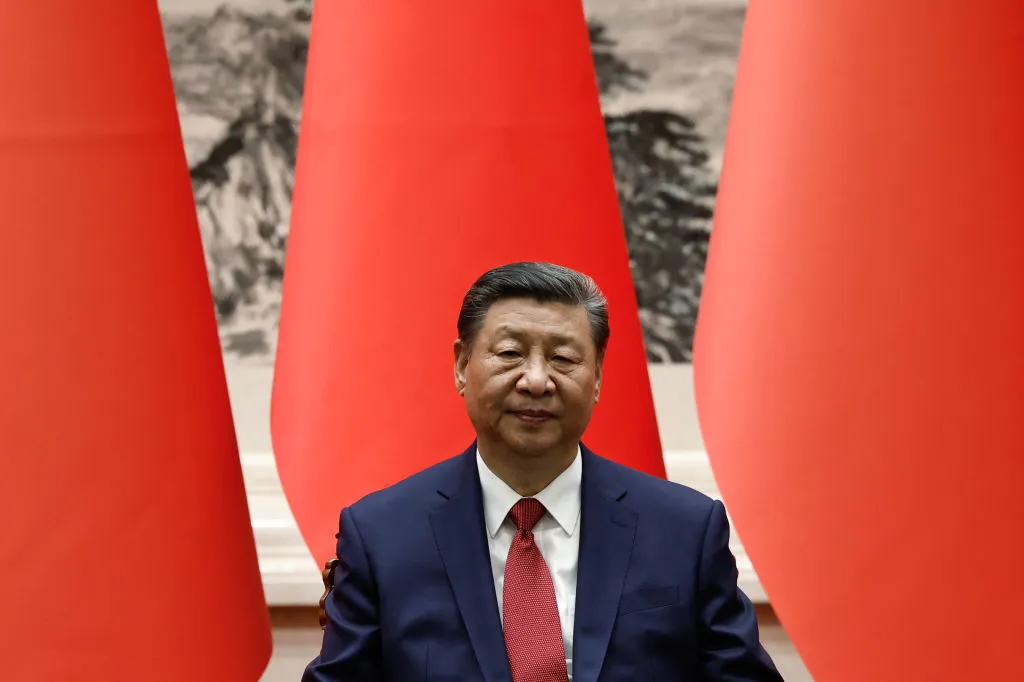

Which will be music to the ears of the Chinese Communist party, whose best hope of winning a trade war lies in Washington losing its nerve. The calculation in Beijing will be that Trump is far more susceptible to popular and corporate anger over inflation and possibly a recession than China is, which as a dictatorship can impose far more pain on its people. That may be to underestimate Trump’s stubbornness and the broad Chinese skepticism in Washington fueled by years of rule-breaking by China. And while President Xi Jinping’s China is no democracy, the CCP’s legitimacy does lie on its ability to deliver growth, which was being eroded well before the latest trade war.

China, as a dictatorship, can impose far more pain on its people

The tariff escalator may well have reached its limits, raising the question of, what next? Beijing could rescind its recent modest cooperation on the flow of pre-curser chemicals that have helped fuel America’s fentanyl crisis, and the laundering of the proceeds, where Chinese banks have been implicated. It could also further restrict imports of US agricultural products over and about the tariffs. The CCP also has a well-developed box of coercive tools, ranging from orchestrated boycotts of US goods, targeted “investigations” against companies on spurious tax or cyber security grounds and hostage diplomacy. The latter is particularly worrying for companies based in China, with the authorities making increased use of exit bans against foreign executives engaged in business disputes, real or imagined. Things could, in other words, quickly get even uglier. For the moment though, the focus is back on Donald Trump.

Leave a Reply