The price of petroleum products is inherently cyclical, rising and falling over time due to natural and ineluctable economic forces. This has been going on since the dawn of the petroleum industry 163 years ago.

The reason is that exploration for and development of petroleum resources are extremely capital intensive activities. Thus when prices are low, there is little incentive to increase production by taking the risks inherent in looking for and developing new supplies. But then, as the world economy expands over time, the demand for petroleum products increases, and prices rise. This increases the incentive to go look for more oil and gas, and the rig count goes up. New fields are located and new technologies (such as fracking) come on line. As the new energy sources come to market, supply increases relative to demand, the price of oil products declines and the cycle repeats.

Politics, of course, can also play a part. Political disturbances and war can interrupt production and delivery. Using oil as a strategic weapon, such as the Arab oil embargo of the 1970s, can also severely impact supply.

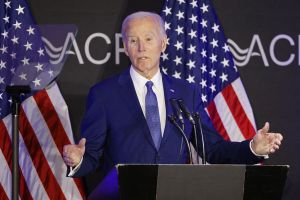

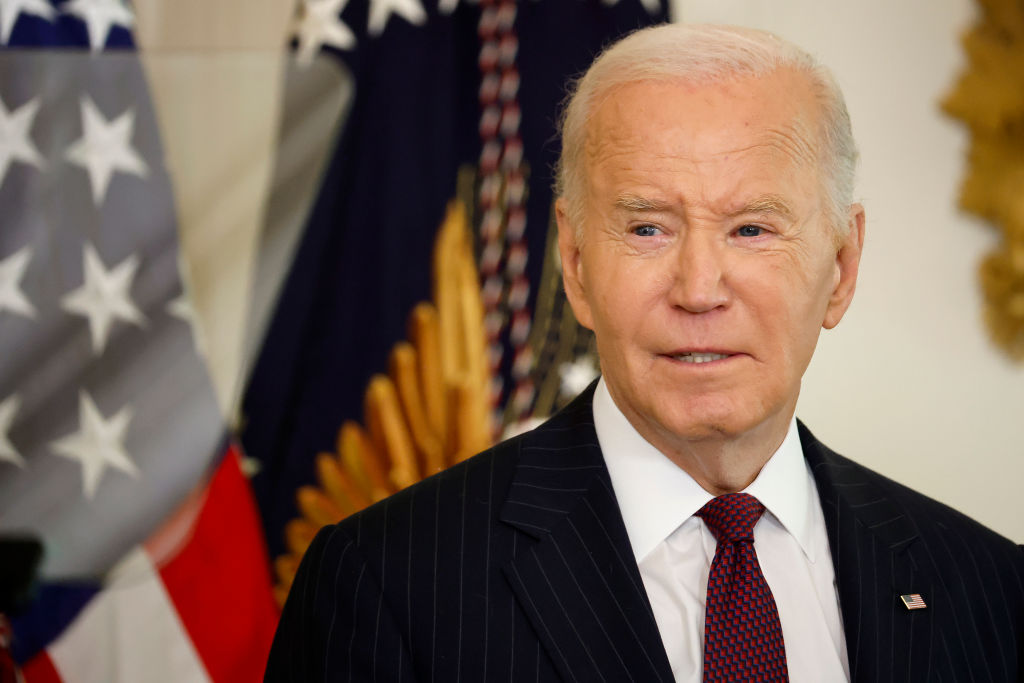

Then there is the deliberate governmental policy of limiting domestic oil and gas exploration and distribution in pursuit of “clean” and carbon-neutral energy. This has been the explicit policy of the Biden administration since the day it took office in January 2021, and substantially explains the movement of energy prices since then.

The price of gasoline, together with other petroleum products such as natural gas and oil for heating, has been rising almost since that day. Gasoline averaged $2.73 a gallon in January 2021, and today is $4.40, the highest in fourteen years. The administration’s claim that the Russian attack on Ukraine last month is the cause of the surge is nonsense.

Biden shut down the Keystone XL pipeline that would bring Canadian oil to US refineries on Inauguration Day. He has ended on-shore lease sales for drilling on federal land and has been slow-walking drilling permits for leases already sold. It takes two days for the state of Texas to issue a drilling permit; it takes the federal government 140 days. Other permits are needed for rights of way to access drilling leases on federal land and to build pipelines to bring the oil and gas out.

Worse, federal financial regulators, together with leftist investors such as Larry Fink of Blackstone, have been pressuring banks to cut off financing to the oil and gas industry. The attorney general of Arizona is investigating whether the private investors are engaged in an illegal combination in restraint of trade.

Biden has nominated Sarah Bloom Rankin to be the Federal Reserve’s top bank regulator. She wants to use the power of that office to redirect capital away from fossil fuels and towards renewable energy.

The last time gas prices spiked, in 2008, President Bush relaxed federal regulations and streamlined permitting. Although it took time for oil and gas production to increase, prices immediately began to decline. The reason, of course, is that markets looked forward and saw more abundant future supplies in the offing.

Faced with the same problem, President Biden is begging foreign — and mostly autocratic — regimes to increase production. He only forbade the import of Russian oil because of bipartisan political pressure to do so. When he called the heads of Saudi Arabia and the UAE to ask for greater production, they refused to take his calls.

Banning Russian imports will have little impact on prices in itself. The United States has been getting only 8 percent of its oil imports from Russia. (Much of that Russian oil goes to Hawaii, thanks to the Jones Act, which requires that cargoes carried between US ports must be transported in ships that are built, owned and crewed by Americans. This makes Russian oil delivered to Hawaii much cheaper than Alaskan oil.)

The United States achieved energy independence during the Trump administration for the first time in seventy years. This not only assured our own ample supply of energy — and energy is an economic input in all forms of economic activity — it also greatly improved our balance of payments. Even more, it was a geopolitical tool of immense utility, allowing the United States to raise or lower the world’s energy supply at will.

The Biden administration threw that tool away solely for ideological reasons. But a world free of fossil fuel is, at least, decades away. And, unless the opposition of environmentalists to nuclear power is reversed, it can never be achieved with present technology.

Solar and wind power can produce energy only when the sun is out and the wind is blowing. Electricity cannot be stored in industrial quantities, and so it must be generated at the moment it is needed. This requires nuclear or fossil-fuel back up.

Seventy percent of solar panels and 60 percent of wind turbines are produced in China. Even if they were manufactured in this country, they would require the importation of such minerals as cobalt, nickel and rare earths. The disposal of worn-out solar panels and wind turbines present intractable problems.

Electric automobiles cost much more, even with subsidies, than gas- and diesel-powered ones and would require the importation of vast quantities of lithium for the batteries.

So, in pursuit of a chimera — “clean energy” — the Biden administration has caused the price of gasoline and other forms of energy to soar to heights almost never before seen, and the worst is undoubtedly yet to come. Inflation in February reached a new forty-year high of 7.9 percent on an annual basis, thanks to soaring energy prices.

President Biden is likely to pay a fearful political price for this come next November.