Has Donald Trump’s return to the White House triggered a second round of inflation? Not yet, according to the Bureau of Labor Statistics, which revealed this morning that the consumer price index rose to 2.8 percent in February — 0.1 percent less than markets had expected. The rise is being described as “stable,” as annualized core inflation (which excludes more volatile prices like food and energy) rose to 3.1 percent — also a smaller rise than expected.

While inflation on the year is ticking up slightly, it remains in the ballpark of what has been expected. It is also not out of line with what is happening in other developed countries (inflation in the United Kingdom is expected to peak at around 4 percent this year, before the number falls back down closer to the central bank’s target).

There are whispers that today’s inflation update could placate markets somewhat, which have spent two days tumbling in the wake of Trump’s tariff announcements — announcements that are becoming increasingly bullish and grand. It might help. One of the biggest concerns about the impact of Trump’s tariffs domestically is that they will have an inflationary effect, pushing prices up once again, as consumers are still reeling from the impact of near double-digit inflation after the pandemic. This lower-than-expected rise might help remind investors that the worst-case scenario is often never realized.

But it’s unlikely to do much convincing, not least because the large bulk of the tariff announcements were never implemented last month. At the last hour, Trump delayed the 25 percent levies on both Canadian and Mexican goods, giving both countries an additional 30 days to tackle what Trump perceives to be a drug-smuggling issue at both borders.

During this time tariffs were ramping up on China — as additional 10 percent levies kept getting announced. But markets were far better prepared for these events, which were expected and reflected his first term in office.

What markets have not been ready for have been what’s happened this month: the green-light for those 25 percent tax hits, Trump’s threat (then rollback) to double levies on Canadian metals to 50 percent. That all happened before the 25 percent levy announcement on European steel and aluminum — and seems like the precursor to the “reciprocal” tariffs that are supposed to take effect on April 2 on all countries that don’t match US tax brackets (not just on trade, but reportedly on sales taxes, too).

February’s figures are not going to account for any of that. Neither will March’s figures, when many of these announcements came into effect. It is going to take time for the impact of these tariffs to work their way into the system. While some consequences will have immediate effect — an overnight jump in the price to import critical building materials, for example — larger changes in behavior from businesses and consumers may take many months to be fully realized.

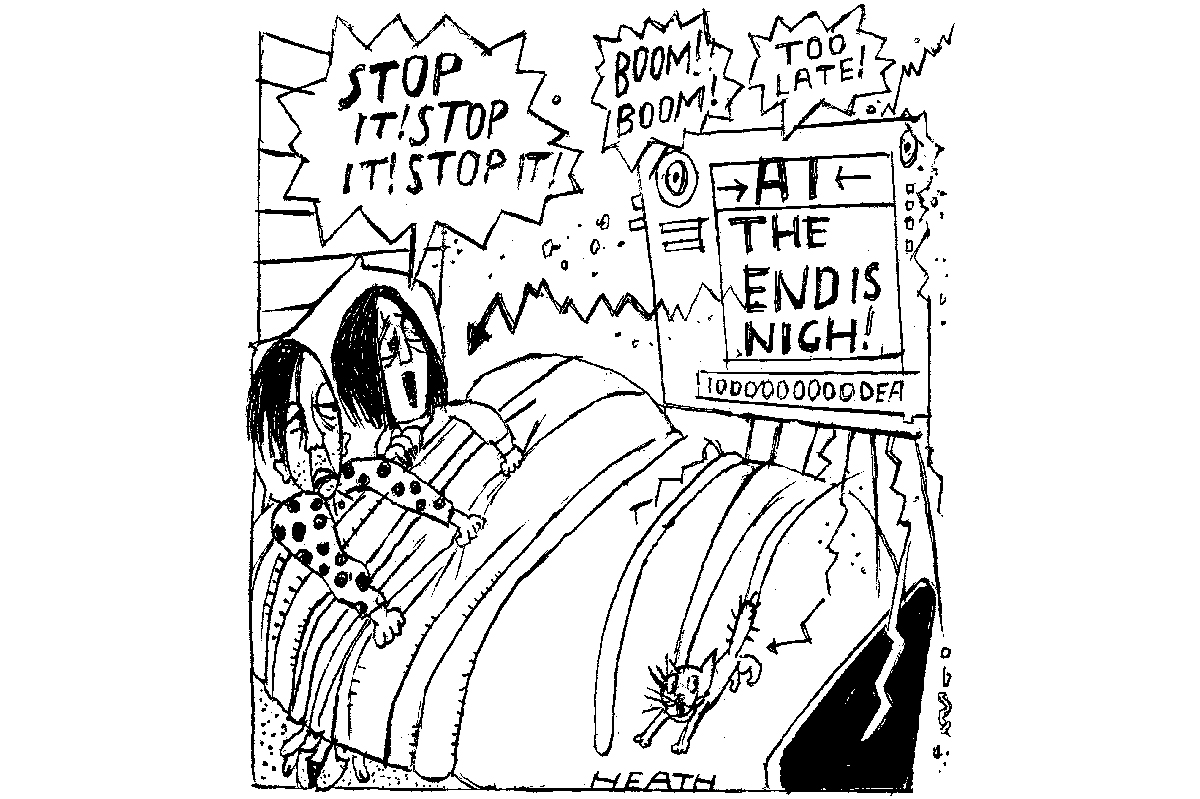

In the meantime, expect the debate to ramp up to the extreme, with Team Trump continuing to insist these tariffs will make Americans richer, while those horrified by his actions proclaim that the global order as we knew it has come to an end. If policy continues on the President’s stated path (a big “if” — he’s changing his mind by the day), American businesses and consumers will do what they always do: move around, adjust, keep going. But it won’t be a cheap or painless process.

Leave a Reply