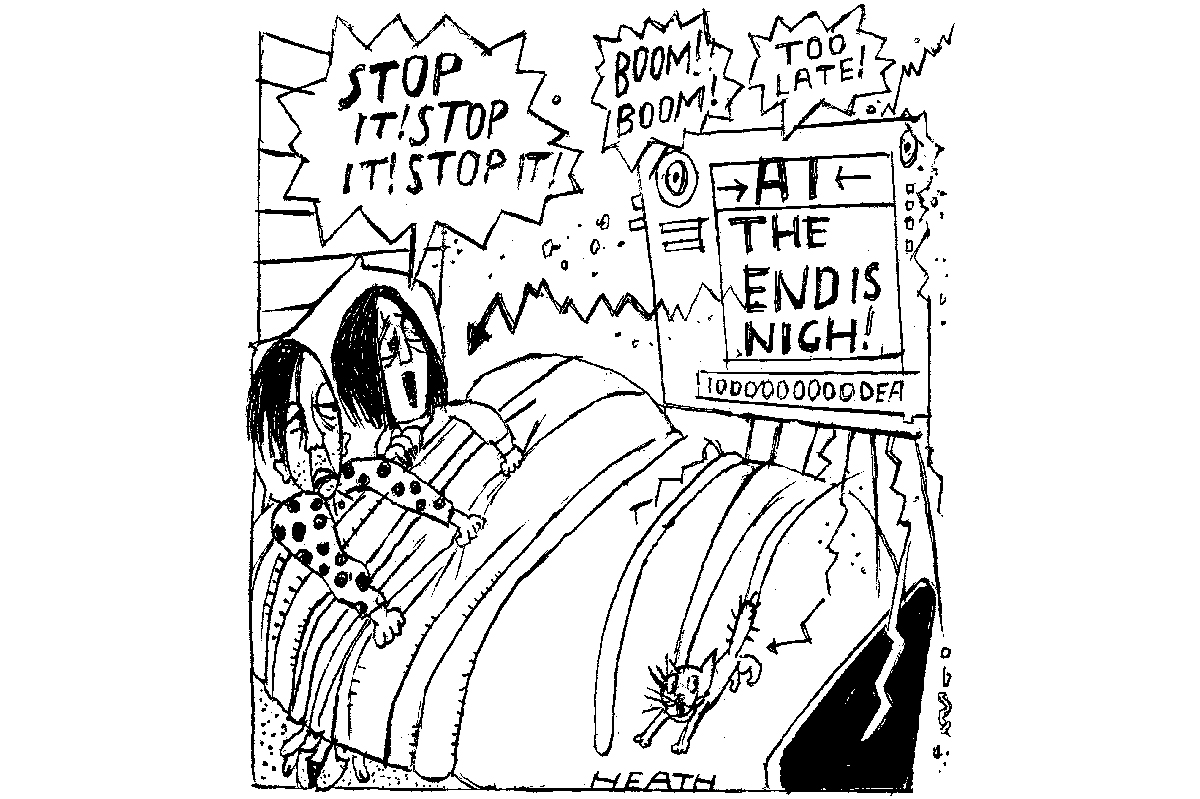

It will write your messages for you. It will post a cute picture of your cat on Instagram, even if you don’t actually have a cat. And it will put some enhanced memories up for you on Facebook, while cheerfully making connections with people you don’t know and who may well not actually exist… When Mark Zuckerberg started explaining his plans for Meta — the company formerly known as Facebook — to start investing billions of dollars in Artificial Intelligence (AI) yesterday, investors should have been cheering all the lucrative possibilities. Instead, the share price has promptly sunk like a stone. The stock market has started to become suspicious of the AI hype — and rightly so.

The best thing Zuckerberg could do when Meta’s next batch of quarterly results are announced is call in sick. The company churns out vast profits from its social media empire, serving up precision-targeted advertising whenever any of us go online. But when it tries to diversify it all goes badly wrong.

Virtual reality didn’t do much for Meta and it is unlikely that AI will either

When Zuckerberg rebranded the company as Meta, and pumped billions into virtual reality, its shares sank like a stone. They only recovered as he scaled back his ambitions. Now it has happened all over again. Announcing quarterly profits, Zuckerberg outlined his ambitions to invest heavily in AI. The result? In after-hours trading, the shares plunged by 15 percent, wiping billions from the value of the company.

But hold on. Surely AI is the technology of the future? It is so powerful that it is about to take over the planet and is the one sector everyone wants to get into. Meta’s shares should have been soaring on its investment. Well, perhaps. And yet right now, there are also signs that the AI bubble is starting to bust. Shares in Nvidia, the company that makes the high-performance chips that power most AI systems, have fallen by 16 percent over the last month. There are not many pure AI companies on the market, but if there were, their finances would be looking a lot shakier over the last few weeks.

No one would deny that AI is a significant technology. It has made huge strides in mimicking human intelligence, and it may well have lots of commercial potential, replacing millions of workers with smart chatbots and enabling lots of new products to be launched.

The trouble is, there are two huge problems. First, unlike websites which could be launched very cheaply (after all Zuckerberg started what was known as “the facebook” from his college dorm), AI systems are incredibly expensive. The chips command high prices, in part because Nvidia has a lock on the market. The electricity bills will be daunting. One estimate last year was that by 2027, AI servers would use as much electricity as the whole of Sweden.

Meanwhile, as competition becomes more intense, salary costs are going through the roof. Programmers can ask for whatever money they want. On top of that, many of the systems have to pay for copyrighted material to “train” the software. Add it all up, and a chatbot is very, very expensive to run. There are already estimates that ChatGPT is costing $700,000 a day to operate, and that will only rise as the technology becomes more popular.

And yet there is no guarantee there will be a profitable business at the end of it. Some of the main models have tried charging for access, but it remains to be seen whether they can make that stick. With so many rivals on the market, there will be lots of pressure to make the product free.

Advertising may well not ride to the rescue as it did in the early days of Facebook. We don’t mind a few sponsored messages on search engine results, but we won’t put up with a smart chatbot casually throwing in a suggestion for a new brand of shampoo into every conversation that we try to start.

It is starting to look as if AI will require huge levels of spending for very uncertain returns. In reality, virtual reality didn’t do much for Meta and it is unlikely that AI will either. It will have some uses, there is no question about that. But AI is not necessarily a hugely lucrative business — and even investors with basic flesh and blood-based intelligence have started to work that out.

This article was originally published on The Spectator’s UK website.

Leave a Reply