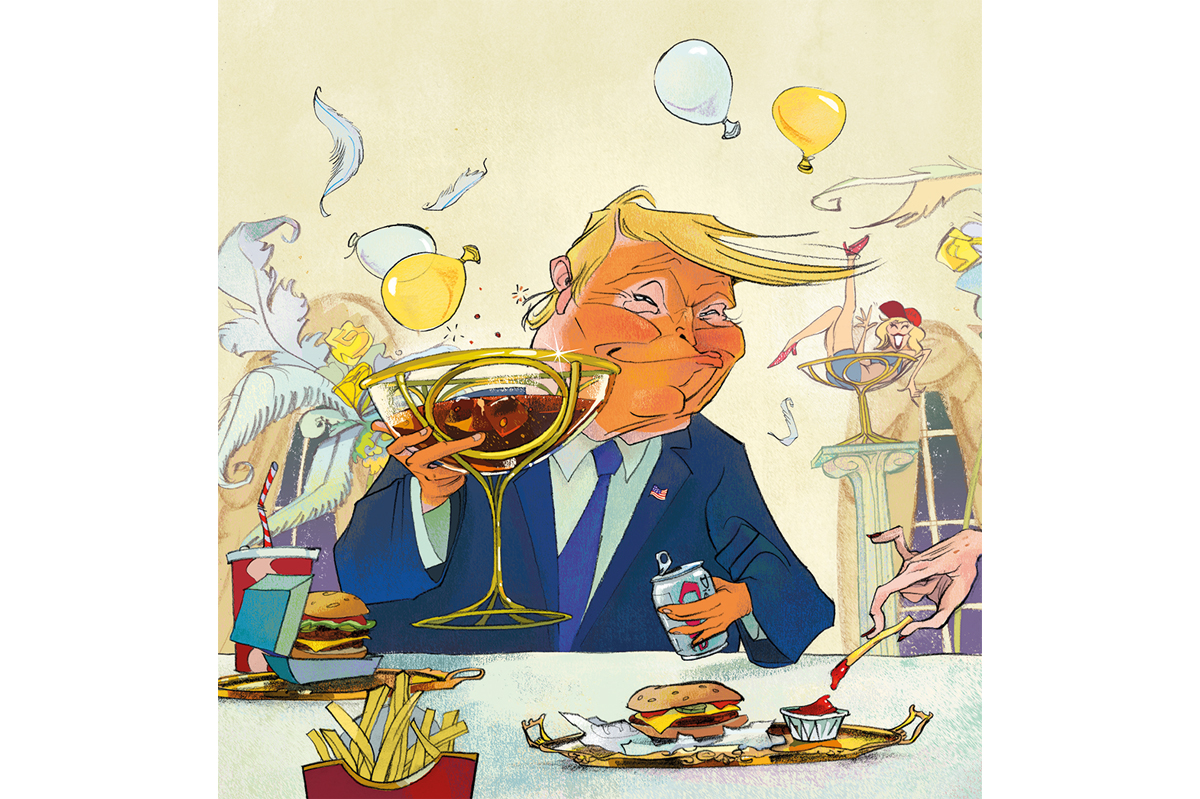

By one recent estimate, Trump’s foray into crypto has made his family almost $3 billion in six months and now accounts for up to 40 percent of his wealth.

At the same time, his administration has been quietly dismantling guardrails around the crypto industry. Trump has slashed funding for key Treasury initiatives, scrapped proposed anti-fraud rules, and even pardoned crypto felons.

Much of the hype – and money – comes from $TRUMP and $MELANIA, two so-called meme coins: cryptocurrencies driven by branding, jokes, or online fandom rather than real-world use. Yet despite having little practical function, the pair has already generated over $140 million in trading volume in just four months.

Then there’s Trump’s sizable stake in World Liberty Financial, a crypto exchange backed by his family. A Trump business entity owns 60 percent of World Liberty and is entitled to 75 percent of all revenue from coin sales. Eric Trump and Don Trump Jr. are actively involved in the management of the company. The Trump family is currently entitled to about $400 million in fees

But at the center of the family crypto operation is a far more powerful instrument: USD1, a dollar-pegged “stablecoin” – a cryptocurrency designed to maintain a fixed value by being backed one-to-one by traditional assets like U.S dollars or Treasury bonds. USD1’s market capitalization stands at more than $1 billion.

What USD1 actually represents is a private money-printing machine tied directly to the Oval Office. Trump’s financial disclosure form shows the family holds at least a 28 percent stake in USD1’s managing entity, with additional holdings spread across shell companies controlled by Trump Organization affiliates.

That money-printing machine is being operated by his son Don Trump Jr., and Zach Witkoff, co-founder of the aforementioned World Liberty and son of Steve Witkoff, Trump’s handpicked Special Envoy to the Middle East. The potential conflicts of interest here are mind-boggling. The two princelings were last week in Abu Dhabi to ink a lucrative and rather murky deal.

They were there to witness state-run Emirati fund, MGX, agree to use USD1 to pour $2 billion into Binance, a crypto exchange long known for breaking the rules. Under its founder, Changpeng Zhao, Binance routinely ignored US sanctions and anti-money laundering laws. Zhao eventually pled guilty to federal charges, stepped down, and became a convicted felon.

And now, a year later, a sitting US President is helping to funnel billions into the platform via his family’s crypto product. According to analysts familiar with the deal structure, Trump-linked entities could stand to gain hundreds of millions in fees, equity exposure, and token issuance linked to Binance’s rebranding and relisting efforts.

Zhao, who was imprisoned in the US for four months last year, met Zach Witkoff in Abu Dhabi, according to a photo posted on Twitter. “It was great to see our friends in Abu Dhabi,” Zhao replied to the post. Zhao remains a major shareholder of Binance.

World Liberty claims USD1 is backed by US Treasuries, dollars, and similar cash equivalents. But who actually owns those reserves? Who audits them? Who earns the interest on billions in parked capital? As of this week, one anonymous wallet, identified by the firm Arkham, holds over $2 billion in USD1. It received its entire balance in less than two weeks. No one knows who owns it. No agency is investigating. The Treasury Department remains silent. The SEC is nowhere to be seen.

In short, it means that if a sanctioned regime – say Iran, or a Russian oligarch – wanted to discreetly funnel millions into the US financial ecosystem, they could do so through USD1 with zero disclosure. In exchange, all they’d need is a quiet favor: a permit here, a tariff rollback there, a softened sanction list.

And that wasn’t the only deal announced involving USD1 in Abu Dhabi. Witkoff said Trump’s stablecoin would be integrated into Tron, the blockchain of Hong Kong-based crypto entrepreneur Justin Sun.

Sun is the biggest known investor in Trump’s World Liberty crypto exchange, having poured a reported $75 million into the project.

In February, the US Securities and Exchange Commission paused a fraud lawsuit case against him, citing public interest.

Sun moderated the panel on which Witkoff spoke on Thursday, with Trump’s son Eric Trump also on stage.

When asked about his crypto holdings in an NBC interview at the weekend, Trump said, “I’m not profiting from anything.” Asked directly if he had made money from the $TRUMP token, he replied, “I haven’t even looked,” and then added, “If I own stock in something and I do a good job, and the stock market goes up, I guess I’m profiting.”

Democrats, however, are calling for a federal watchdog to launch an urgent inquiry into the Abu Dhabi deal.

“The deal, if completed, would represent a staggering conflict of interest, one that may violate the Constitution and open our government to a startling degree of foreign influence and the potential for a quid pro quo that could endanger national security,” Senators Jeff Merkley and Elizabeth Warren wrote to Jamieson Greer, the acting director of the Office of Government Ethics.

The optics are, for lack of a better word, astonishing. One of the most controversial crypto figures, currently under federal investigation, leading a panel featuring both the President’s son and the architect of his new monetary instrument.

Imagine, for one second, that Joe Biden had created a personal cryptocurrency. Imagine that coin was being used by a foreign government to funnel money into a company whose founder was convicted of laundering cartel money and violating US sanctions. The outrage would be instant. Congress would be on fire. Subpoenas would flood the West Wing. But Trump is serving his second term, and suddenly all of this is business as usual.

And that alone should terrify every American. Because this is not a side hustle. It’s the emergence of a parallel financial system, where regulatory oversight no longer applies.

This is a monetary order built not on public trust, but on leverage, loyalty, and power.

Americans are being sold a lie. That this is about freedom. That this is populist finance. That it’s a middle finger to Wall Street.

In reality, it’s a middle finger to everyday Americans. It’s a private empire – opaque, offshore, and insulated by political privilege. Trumpworld insiders are raking in billions through anonymous wallets, strategic leaks and handshakes in Dubai, all while hugging the flag.

Even more disturbing is the precedent being set. If this holds, what stops future presidents from issuing their own currencies? What happens to campaign finance laws, to anti-corruption statutes, when stablecoins issued by the White House can flow in and out of shell wallets without a trace?

There’s a name for this: monetary capture. And it’s happening now.

If Trump’s defenders call this “disruption,” let’s be honest about what’s being disrupted: accountability, transparency, and the idea that public office shouldn’t be used as a personal ATM. Because Binance isn’t just a neutral marketplace. It is a platform with a dark history. It helped launder drug cartel money. It processed funds linked to terrorist groups. It openly violated U.S. law.

Now, it’s being legitimized, not by virtue of reform, but because it plays well with Trump’s crypto ambitions, where a president’s financial product can be used to fund a foreign-controlled platform with zero transparency. Where American economic leadership is quietly being auctioned off, one coin at a time.

Leave a Reply