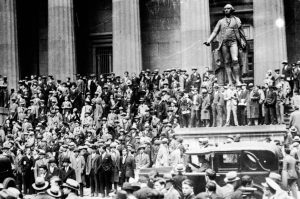

After experiencing its worst crash yesterday since Black Monday in 1987, Japan’s stock market has all but recovered, rising by more than 10 percent today — its biggest single-day gains in history. Nearly all markets in Asia are on the up. But while the FTSE 100 looked set for a rebound, stocks continue to slump today as worries about the US economy intensify.

We’re still in the thick of the turbulence. The dust hasn’t settled

Overall it’s been a miserable couple of days for investors. All eyes were on Wall Street’s opening this morning, with particular attention paid to the tech-heavy stocks that have taken a major hit, including Apple. The company was down by almost 5 percent when the market closed yesterday, after it was revealed that Warren Buffet has sold approximately half his shares in it.

We’re still in the thick of the turbulence. The dust hasn’t settled. Some economists are urging for calm — issuing reminders that, after such a booming time for the stock market, stock value can also fall. Others are not so convinced, as concerns over the health of the world’s biggest economy have yet to be fully understood. It is not yet possible to call this week’s stocks tumble a blip — or the catalyst for a far deeper crash.

What we can be sure of, however, is that another wave of economic uncertainty has hit, and the implications of this will become clear with time. Just over a year ago I wrote about the looming “crash test” — the quick rise in interest rates taking place worldwide that was bound to unearth the skeletons lurking just under the surface of domestic and global economies. The regional banking crisis in the United States became the prime example of what happened when business models were highly sensitive to rate hikes they thought would never come.

Now we are dealing with new circumstances: what happens with central banks that wait too long to start cutting rates, as has been the accusation leveled at the Federal Reserve, which decided to hold rates last week, right before the Bank of England opted for its first cut in over four years. What happens when trillions of dollars of stimulus are no longer covering up the real state of an economy, as US growth rates slow and unemployment rises? What happens if the promised revolutionary technology of the future — like artificial intelligence — doesn’t pan out or pay out as quickly as anticipated and the world’s biggest investors start saying so?

And despite some attempts to pin it all on single factors, it’s the longer trends that are creating this yo-yoing effect in the markets, making it difficult to predict where they’ll settle.

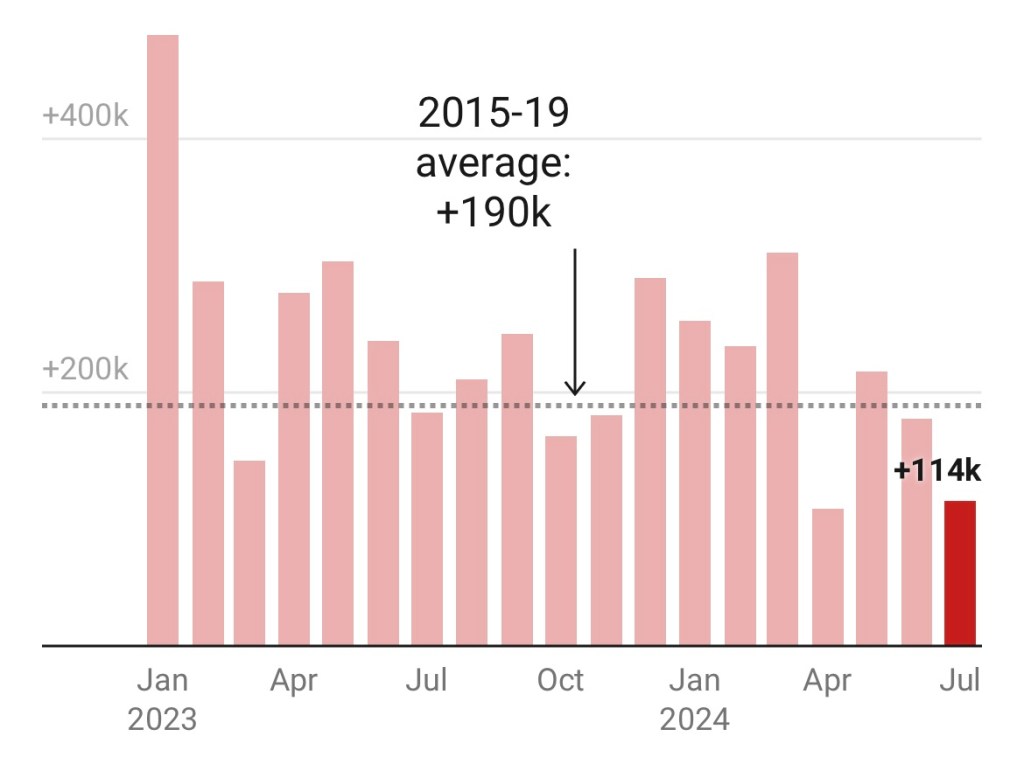

While US job creation in July came in much lower than expected — at 114,000 new jobs added to payroll — this was not wildly out of kilter with lower job figures from recent months. But the spike in unemployment on top of the job creation news — to 4.3 percent — is what seems to have sparked worries for the second half of the year — not least because forecasts for US economic growth this year now look as though they were far too optimistic for 2024.

Monthly US jobs growth

Month-on-month change in seasonally-adjusted nonfarm payrolls

Chart: The Spectator (h5XKt)Source: BLS series CES0000000001, 1-Month Net Change Get the data

That the Fed has still held back on its first rate cut since the inflation crisis has investors questioning if it’s already too late for America to avoid a recession (Matthew Lynn explains why those fears are justified here). Again, this is not an isolated concern or incident: if the Fed has waited too long, adding to pressures that could tip the US into recession, it will be a wrong call that follows along from all the wrong calls that were made when the inflation rate was starting to rise back in 2021, and central banks insisted this would be “transitory.” A delayed rate hike from the Fed is simply another mark against recent decision-making, creating far more investor volatility than might be necessary.

And it’s not just the Fed: the Bank of Japan is in hot water for inching up rates last week, to 0.25 percent — a move that is thought to have sparked lots of the stock volatility, as investors realized it would become more difficult to get their hands on cheap yen. It wasn’t the only big realization this week: Warren Buffet’s decision to sell almost half his Apple shares has not only caused a plunge in tech stock value, but has sparked a far wider discussion about whether the investment going into AI development is worth what it will produce.

That these events have overlapped have no doubt contributed to the levels of volatility we’re seeing from Tokyo to New York City. But it’s the underlying causes of these trends that are most concerning — and suggest that even if markets settle relatively quickly, there are more waves, and crashes, to come.

This article was originally published on The Spectator’s UK website.

Leave a Reply