Could it be that Donald Trump actually wants a bear market now? At some point, one was bound to happen on his watch — after all, US equities weren’t going to keep up their stunning gains from the past two years for the rest of his term. A market correction was inevitable, and it seems we’ve already seen that, as the S&P 500 dipped into correction territory this week. And a bear market was almost certainly coming, given that there have been 27 of them in the S&P index since 1928.

Hartford Funds provides a good summary here, showing that the average decline in a bear market is 35 percent, and they typically last 9.6 months. By contrast, the average bull market lasts 2.6 years, with prices rising 110 percent. Overall, bear markets occur about every 3.5 years, though that figure is skewed by earlier events like the Great Crash of 1929, the Great Depression and World War Two. Since 1945, they’ve happened about every 5.1 years.

The most recent bear market lasted from March 1, 2022, to December 10, 2022. Statistically, the next one would be about three years away — right around the next presidential election.

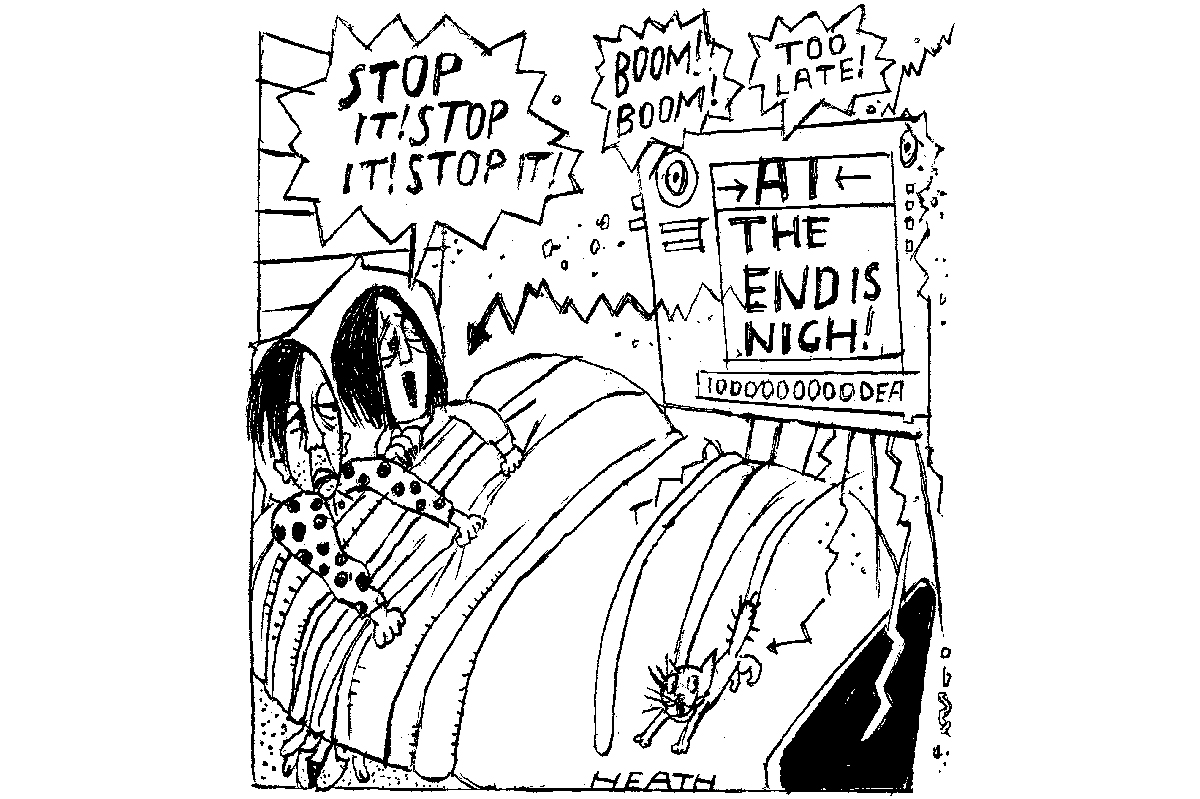

Of course, the world isn’t that simple. Donald Trump doesn’t control the markets. In fact, the more interesting question right now is whether the markets have any real influence over him. It’s hard to pinpoint, but there was a general assumption at his inauguration that he would be good for business — and the markets surged, with the S&P 500 hitting its all-time high on February 19.

Then, a creeping realization set in: maybe he wasn’t all that concerned with what big business wanted. Acknowledging the possibility of a recession didn’t help. And the uncertainty surrounding tariffs didn’t help either.

So where do we stand now? Three key points:

- An economic slowdown was always a possibility. The Atlanta Fed’s GDPNow model suggests the economy is shrinking at an annual rate of 2.4 percent this quarter. That may or may not be accurate, but there’s a reasonable chance that the current slowdown could turn into a recession

- US equity valuations are stretched, sitting at or near the high end of their historical range and relatively expensive compared to other developed markets. The US stock market is massive — accounting for more than 60 percent of global equities — so all serious investors have to be involved. But they can scale back their exposure

- Uncertainty is a major factor — and we have plenty of it right now. It doesn’t take a large number of investors pulling money out to have a disproportionate impact on stock values

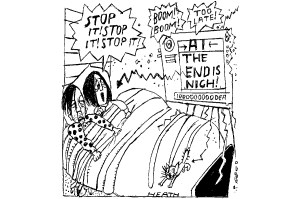

All signs point to a bear market, whether it starts now or arrives sometime in the next couple of years. Trump understands how brutal bear markets can be, and it’s very much in his self-interest to get this one over with as quickly as possible — while pinning the blame on his predecessor.

Leave a Reply