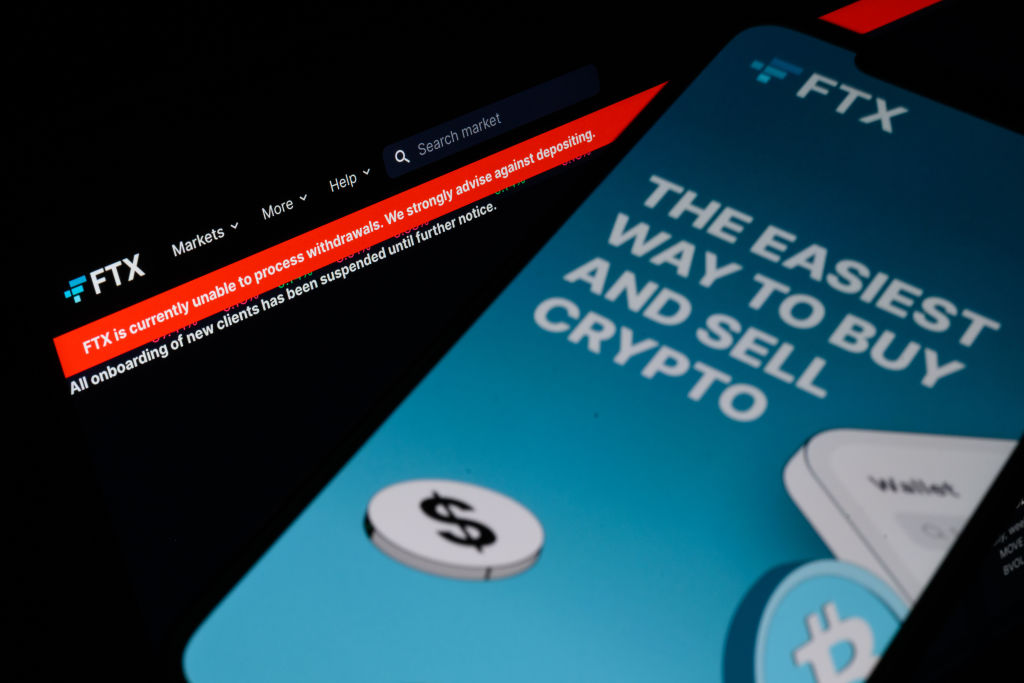

It’s been a great year for those of us who didn’t have the nerve to invest in crypto. The value of Bitcoin, Ethereum and Luna crashed in May. Now, crypto giant FTX has gone bankrupt amid serious allegations of criminal misconduct.

At last! For years, we kicked ourselves for not investing in Bitcoin, ETH, et cetera, when we had the chance. We heard tales of people who went from bums to millionaires, while we grinded in our offices and fretted about debts. Suddenly, we can reframe our risk aversion as foresight! Of course we knew that this would happen! Of course we did!

Really, I shouldn’t joke about this crypto craziness. A lot of people have lost a lot of money. People will lose businesses, homes, and families. Some might even commit suicide. Plus, I didn’t know that this would happen. In fact, I had only a vague idea of what FTX was.

But I, and many others, knew that something would happen. We never trusted the utopian claims people made about crypto-currencies. As much as we envied those who bought Bitcoin for small change and sold them for fortunes, it was clear that a limited number could get rich working in markets disconnected from physical goods and services. I am no economist but I feel that value ultimately has to be attached to something we can use — or, at least, to something we want.

As much as we all knew, and know, that bankers and politicians could, and can, be corrupt and foolish with our dollars, pounds, and euros, we knew that crypto-currencies were not a surefire route to freedom and independence when their value hinged on the good sense and morals of a bunch of weird nerds online. Crypto might have developed since the head of Canada’s leading crypto-currency exchange disappeared and died, taking passcodes worth $250 million in other people’s money to his grave, but the vast majority of users are still alienated from the elite that actually make a difference.

Now, it’s easy to gloat. As the modern classic Onion headline goes, “Man Who Lost Everything In Crypto Just Wishes Several Thousand More People Had Warned Him.”

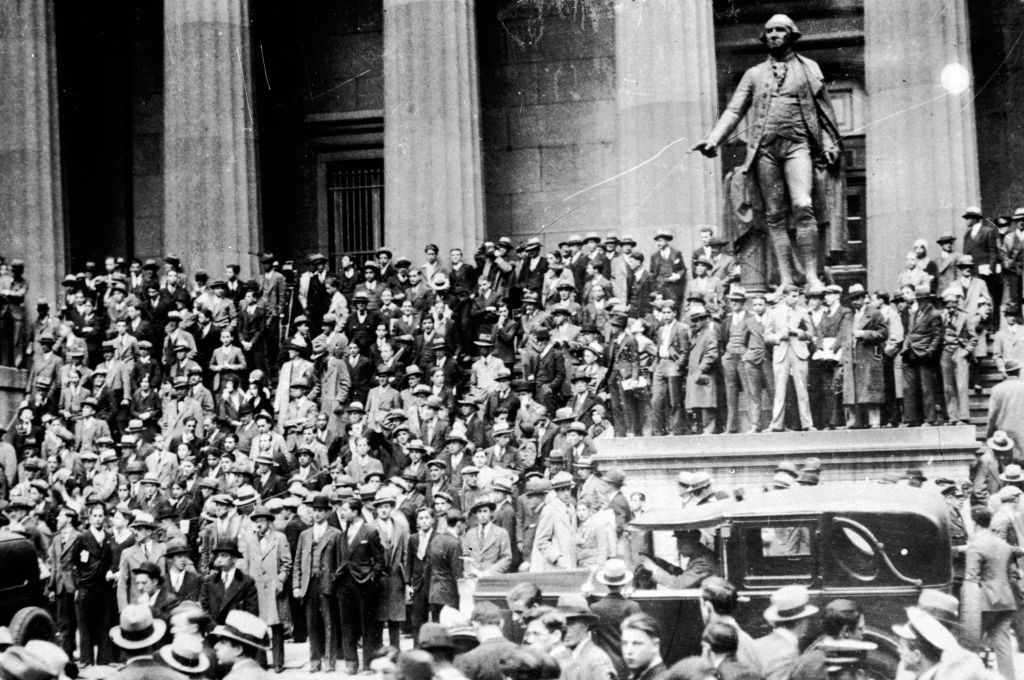

Still, we shouldn’t gloat too much, and not just because it’s mean. The worst aspects of crypto, after all, are a kind of reductio ad absurdum of the modern world. It has no intrinsic value, sure, but does the 21st century have news for us about the direction of economic life or what? Financialization and deindustrialization have conspired to ensure that much the same is true of vast stretches of first world economies.

The value of crypto appears to crash with a greater suddenness and force than the value of fiat money. It would take a fool to jeer about impoverished Bitheads too much, though, as inflation — and even hyperinflation — threatens us. How safe are our savings? Safer, maybe, but how much?

In the wake of the FTX scandal, questions are being asked about the integrity and credibility of the financial and philosophical spheres inhabited by its eccentric CEO, Sam Bankman-Fried. (Bankman-Friend seems to be on the lam following accusations of misusing funds.)

As well as crypto spaces, these include organizations devoted to such novel causes as “long termism” and “effective altruism.” Just how moral are effective altruists, people are wondering, if their leading backer was involved in an enormous scam? Long-termists, meanwhile, are devoted to improving mankind’s long-term prospects — but Tyler Cowen justifiably asks how much we can trust people who think about our future if they didn’t see this great big looming danger in their own. Would you trust a dentist with advanced tooth decay?

These are good questions, but there are a lot more to be asked, and of more important people. Sam Bankman-Fried was no dissident outsider, after all. He was one of the top donors to the Democrats. He worked with the World Economic Forum. He spoke on panels with Tony Blair and Bill Clinton. Forbes put him on the cover of their magazine — with, granted, the potentially telling sentence, “He’s a mercenary, dedicated to making as much money as possible (he doesn’t really care how) solely so he can give it away (he doesn’t really know to whom, or when).”

The collapse of FTX raises questions about the vulnerabilities of crypto and alternative systems of financial and philosophical thought — but it also raises questions about the mainstream. How weird utilitarians and San Francisco effective altruists were taken in by Bankman-Fried is worth asking. But why Biden, Blair and the WEF — and the people around them — thought he was the kind of chap they wanted to associate themselves with is also curious. Carelessness and gullibility, or worse, are not confined to any one sphere in this sorry tale.

Ultimately, crypto is not going anywhere. Its appeal may be dimmed but it will not be extinguished. As Murtaza Hussein writes, it has a deep value for those who want to bypass governments and financial institutions. Even as it has been rocked by bad news in the West, it has been thriving in Africa and South America.

The bright-eyed idealism of its early years has faded — and it deserved to. As in the case of all utopianisms, an imaginary jungle sprouted from a seed. Many people have been suffering because of it. Let’s not pile all our money into crypto. But let’s also not pretend that it is a deranged alternative to a stable and secure status quo.