It’s not often that anyone — much less an academic — writes a book that launches a revolution, but that’s exactly what Burton Malkiel did in 1973 when the Princeton economist published a short, potent book called A Random Walk Down Wall Street. As of 2023, the book is in its thirteenth edition.

Malkiel famously insisted that “a blindfolded monkey throwing darts at the stock listings could select a portfolio that would do just as well as one selected by the experts,” and then he spent his entire career doing his best to prove that hypothesis. Known today as “the high priest of passive investing” or “the Prophet of Passive,” Malkiel was the first prominent market player to advance the idea that an “index fund” — a mutual fund that mirrors the holdings of a stock index — if bought and held for a long period, would easily outperform any similarly sized fund of stocks “actively” picked, bought and sold by a portfolio manager over the same period. Active stock-pickers might have a few good years and even a handful of great ones, but over time, Malkiel argued, even the great ones would find it next to impossible to compete with the returns of the markets as a whole.

Three years after Malkiel’s book was published, John “Jack” Bogle, the founder of the Vanguard Group, took the economics professor’s advice to heart and launched the world’s first index fund, the First Index Investment Trust. Malkiel joined the board the following year; he would advise Bogle and his fellow financial insurrectionists for more than three decades. Together, Malkiel and Bogle had started a “passive” revolution that would change the entire face of the global financial services field and bring safety and security to tens of millions of small investors.

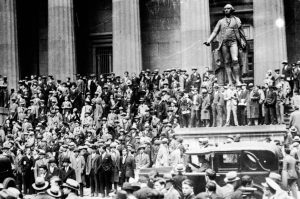

The passive revolution proceeded rather like Mike Campbell’s bankruptcy in The Sun Also Rises; it happened “gradually and then suddenly.” By 1996, passive equity investment funds held roughly $72 billion in assets, while active funds held more than $1.2 trillion, making passive a mere 6 percent of the total mutual fund business, according to Morningstar. Even a decade after that, passive investing was only a small fraction of the total fund market. The turning point for passive investing — which Wall Street had called “Bogle’s Folly” for some thirty years — came with the financial crisis of 2008-09. The rapid and seemingly remorseless decline of the stock markets over the eighteen months starting in October 2007 made small investors skittish. If they could lose so much so quickly — and more to the point, if the “experts” could — what hope did they have to save enough for retirement? Never mind getting rich, how were they going to avoid having to eat cat food in their dotage, living off the pittance provided by Social Security?

Salvation came in the form of passive investing. Yes, indexes had fallen during the Great Recession, just like everything else. But they had not fallen as far as, say, Lehman Brothers stock. Moreover, even with the struggles of those eighteen months factored in, indexes, as a whole, appeared to rise, remorselessly, over time. In the aggregate, active-fund managers could not demonstrate anything close to the consistency of indexes. And that, as they say, was that. An investment that would never “go to zero,” (as Lehman did) and that appeared, at least, to be guaranteed to rise over time? Bogle’s Folly became the safest bet in finance.

By the end of 2021, a dozen years after the index fund revolution kicked into high gear, passive funds had surpassed their active counterparts. According to the Investment Company Institute, by the end of that year, passive funds accounted for 16 percent of market capitalization versus just 14 percent for active funds. In just over a decade, more than $2 trillion had flowed from active to passive management in the United States alone. Small investors had finally reached the same conclusions reached nearly fifty years earlier by Burton Malkiel. Passive investing offered them things they could not get from active management: broad diversification, exceptionally low investment costs (i.e. fees and commissions) and above all peace of mind, the belief that their nest eggs were safe and would, over the long run, outperform even the best stock pickers.

The passive revolutionaries had won, in large part because they provided solace to an aging nation that was suddenly (understandably) fixated on retirement security.

Today, passive index investing is a vital component — often the only component — of small and average investors’ portfolios. According to data reported by S&P Global, in any given year the S&P 500 beats the returns on 60 percent of the actively managed Large Cap funds in the country. Any gambler would take those odds. But the odds get even better for passive investors. Over three years, only 20 percent of active funds beat the S&P. At ten years, the number falls to 12.5 percent, and at fifteen, it stands at 12.02 percent. In other words, fewer than one in eight Large Cap funds will beat the S&P over a fifteen-year-span — and those funds are managed by men and women with MBAs from Wharton and CFA (Chartered Financial Analyst) designations. The average amateur doesn’t stand a chance. Index funds are the safe play.

Or at least they’re the safe play for individuals. The safetyism inherent to a passive strategy could spell doom for economic dynamism. All three of the major potential risks posed by passive investing are the outgrowth of its essential violation of market principles, ironically employed in the capital markets setting. A retreat to safety can be a double-edged blade.

The most obvious of the issues with passive investing is that it largely turns off markets’ price-discovery mechanism. Price discovery is the central function of markets: sellers of assets have an idea of the price at which they will be willing to part with the asset, and buyers have an idea of the price they will be willing to pay. Based on the vicissitudes of supply and demand, buyers and sellers adjust their ideas until they reach an agreement, that is, until they “discover” what the market price of the asset is. In an ideal free market, both sellers and buyers acquire as much information as possible about supply and demand and then use that information to negotiate and determine the real value of an asset. It’s simple, efficient and time-tested.

With passive investing, however, there is neither the need nor the opportunity for the price-discovery process. Buyers decide to own an asset, not because they have determined that it’s worthy of capital, but simply because it has been placed in the basket of assets that they will own. No one negotiates a price. No one adjusts price expectations based on information and circumstances. No one discovers the real value of the asset. They just buy it.

Active investors, by contrast, still play by traditional market rules. They still seek information about the assets they intend to hold, and they still enable the price-discovery mechanism to determine value. Passive investors are free riders in the market-mechanism game. They gather no information of their own on an asset’s value, do no (tacit) negotiation of their own and rely exclusively on the research efforts and decision-making of others. The catch here is that as passive numbers increase and active numbers decrease, the free riders come to outnumber the people who work for a living, meaning that more and more individuals, with greater and greater financial stakes, come to rely more and more heavily on fewer and fewer analysts with smaller and smaller stakes. That, in turn, means that the risk of mistakes in information-gathering and, by extension, in asset valuation can have greater and greater consequences. In short, one active fund manager’s screw-up can have exponentially inflated repercussions.

A related risk of extensive passive investing can be found in the potential for decreased competition among corporations within an index and decreased sensitivity to its implications on the part of asset managers. With the price-discovery mechanism turned off for a majority of asset owners, the need for asset sellers to compete for investment dollars — the need for them to offer a good value and a sensible price — is diminished. Likewise, the incentive for fund managers to encourage competition is diminished.

If, for example, both United Airlines and Delta are in the same index (and they are both in the S&P 500), and if they’re both, as a result, held by all S&P 500 index funds (and they are), then neither has any market-related motivation to be better than other. Why should one airline take risks, offering new services or cutting costs or… whatever… when fund managers are unable to buy or sell their stock anyway? It’s a passive fund. The whole point is to hold all the stocks in the basket for as long as possible. Why should either airline care at all about performance? Similarly, why would the manager of a passive fund care? He’s going to own both anyway. If one outperforms and the other underperforms, it’s all a wash to him. There is no incentive whatsoever for anyone to do any better than anyone else.

At the same time, an active fund manager — who does her research and is not obligated to hold every corporation in the index — might hold only one of the two airlines. And she might, as a result, encourage the management of that airline to take risks, to do whatever they can to boost revenues, cut costs and grow the business. She would have a clear and inarguable incentive to want her airline to beat the other airline good and hard, and she’d make it clear to the airline’s management that they have a clear and inarguable interest in the same.

In the end, passive asset management encourages risk avoidance and mediocrity. The bigger passive grows, the more corporations will settle for “good enough.”

The final risk posed by the rise of passive investments is the concentration of assets and power in a very few hands. In 2018, John C. Coates, the John F. Cogan Jr. professor of law and economics at Harvard Law School, wrote an essay called “The Future of Corporate Governance Part I: The Problem of the Twelve.” He argued that passive index investing would lead to major distortions in corporate governance and corporate behavior. “The effect of indexation,” he wrote, “will be to turn the concept of ‘passive’ investing on its head and produce the greatest concentration of economic control in our lifetimes.”

That same year, Jack Bogle wrote an op-ed for the Wall Street Journal in which he wondered if, perhaps, his creation had become too successful for its own — or anyone else’s — good. The passive investment revolution he inaugurated had, unintentionally but inarguably, given enormous amounts of capital and, by extension, enormous economic and political power to a very small collection of men and women. “Three index fund managers,” he wrote, “dominate the field with a collective 81 percent share of index fund assets,” a condition that he deemed unwise, uncompetitive and ultimately unhealthy for the function of free and fair capital markets. Bogle was unflinching in his assessment, despite the fact that one of those “fund managers” was the company he had founded forty-four years earlier. He knew that those firms — Vanguard, BlackRock and State Street, known collectively as “the Big Three” of passive asset management — had become so big and so powerful that they could intimidate corporate executives into doing exactly what they insisted, whether it was ultimately good for the company and its shareholders or not.

Couple this concentration of resources and power with the increasing temptation to inject political, non-pecuniary considerations into investment decisions and engagement (which I identified and explained in my book The Dictatorship of Woke Capital) and it becomes inarguable that the passive investment revolution possesses the potential to be every bit as destructive and anti-capitalist in its ultimate outcomes as the French or Russian Revolutions before it.

Despite its name, “passive” investment is one of the most complicated and convoluted issues facing free economies in the twenty-first century. While it is, in almost every way, an enormous and unqualified blessing on the individual level, it presents several very real and potentially destructive dangers in the aggregate. Bogle’s Folly could soon prove itself worthy of the name.

This article was originally published in The Spectator’s August 2024 World edition.

Leave a Reply