The dotcom bubble. The financial crisis of 2008 and 2009. The oil price spiral of the 1970s. The launch of the single currency. It would be fun, in a nerdish kind of a way, to debate which was the most seismic economic event of postwar history. But in fact the answer would be this: the ‘Nixon shock’, a fateful day when the final link between gold and the money you carry around in your pocket, or on your bank card, was finally severed. And it happened 50 years ago this week.

A half-century on — enough time for some historical perspective — how’s it going? Well, since then we have seen a couple of rounds of hyper-inflation, and may be heading into another; a couple of spectacular asset bubbles; the worst financial crisis the world has ever known; the lowest interest rates since records began; and debt exploding on a scale that would once have been unimaginable. Stable? Not exactly. The gold standard was not perfect, far from it. But in reality we are still reeling from the Nixon shock, and trying to work out what a functioning monetary system might look like.

Even with worries about inflation rising, gold has hardly been performing well. It has fallen sharply over the past week, and even more over the past year: down from $2,000 an ounce 12 months ago to $1,740 now. But gold is not the same thing as money any more, whatever its true believers might try to claim. That ended half a century ago.

Gold, along with silver, had been the base of all money throughout most of human history. Under the postwar Bretton Woods system, mainly designed by John Maynard Keynes, the dollar was linked to gold, and other currencies were linked to the dollar. A tenuous link was maintained between a pound, a yen, or, as it then was, a franc or a deutschemark, and a stash of the precious metal stored in a vault somewhere. In extremis, and in a roundabout way, you could swap some folded bills for actual gold.

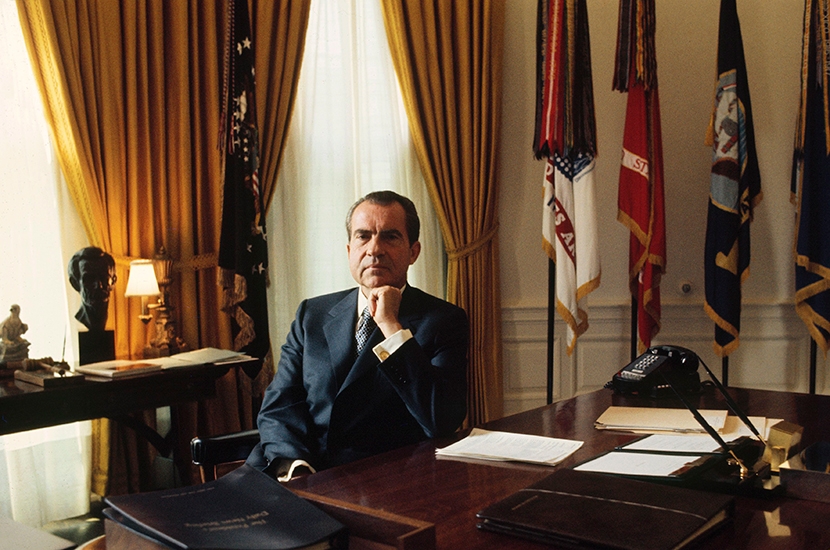

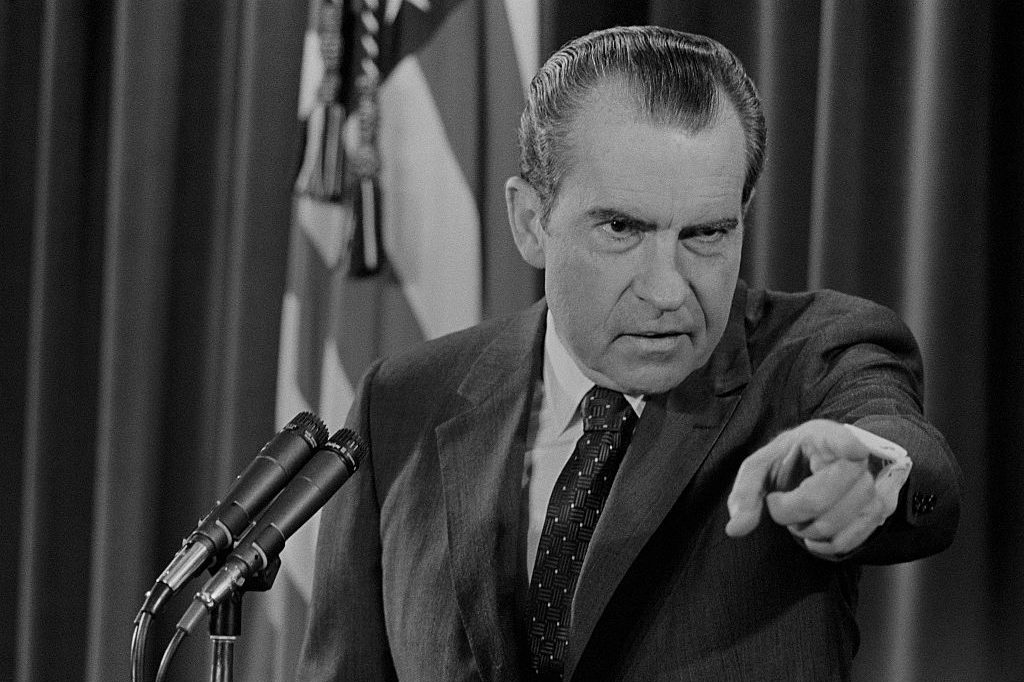

As 1971 dragged on, and with the Vietnam war proving unsustainably expensive, along with new social programs, President Richard Nixon decided the United States could no longer afford to maintain that link. With inflation rising, its reserves were draining away, as other central banks decided to cash in on the American promise to convert dollars into gold. On August 13, Nixon decided to end the link. Two days later, he announced the decision in a TV broadcast, choosing a Sunday night when the markets were closed. It was temporary at first, as these things often are, while reforms to Bretton Woods were discussed. As it turned out, it never came back.

The global economy entered a new era of free-floating exchange rates, and what economists refer to as pure ‘fiat money’: that is, money that exists on nothing more than the promise of a central bank, and ultimately a government, to maintain its purchasing power. The Washington Post writer William Greider later described it ‘as the precise date on which America’s singular dominance of the world economy ended’. A new book on the subject, Three Days at Camp David: How a Secret Meeting in 1971 Transformed the Global Economy by Jeffrey Garten, of the Yale School of Management, argues that the world was never the same afterwards.

Professional historians might debate whether 50 years is enough time for any real perspective on the experiment. The rest of us will probably decide there is plenty of evidence, and not much of it is very encouraging. True, we no longer have the periodic exchange rate crises that used to cripple governments, especially of economies in relative decline (the UK was especially prone to them). But otherwise it has been a very bumpy ride. The oil price explosion triggered the inflationary spiral of the 1970s, followed by the battle to stabilize prices with crushing interest rates and skyrocketing unemployment during the 1980s. That was followed by the rampant dotcom bubble, a crash, followed by another bubble, and then the financial collapse of a decade ago, as banks and financial institutions went bust on an unprecedented scale.

But by far the most extraordinary trend has been the rise of debt. According to the IMF, by the close of last year, global debt hit $281 trillion, the highest on record, equal to 335 percent of global GDP. It has been going up every year, spurred on by central banks printing cash. When there was a link between money and gold, that was impossible. You would need a lot more of the metal than exists on this planet to finance all that borrowing and probably a few others as well. With fiat money, there is no limit to how much you can magic out of thin air.

Of course, the gold standard was far from perfect, and neither was the dollar-linked version created after World War Two. Even by the early 1970s, the United States was no longer dominant enough in the global economy to carry the system by itself. That is even more true today (in 1970 the US still accounted for 40 percent of global output, but it is less than half of that now). And yet the system of central bank money that has emerged since then is far from perfect either. It has created massive instability, endless boom and bust cycles, soaring inequality, and sent asset prices through the roof, as well as creating unprecedented levels of debt. It has taken governments a while to realize it means they can print money without limit; now the penny has dropped there is no way of knowing when they will stop.

Slowly, we may be edging towards a different monetary system. That is certainly part of the story behind bitcoin: people are looking for a form of money that is independent of the state, in the way that gold used to be. One point is certain. A half-century on from that fateful day, we are still shaken by the Nixon shock and figuring out how to cope with its aftermath.

This article was originally published in The Spectator’s UK magazine. Subscribe to the World edition here.