As missiles fly across the Middle East as Israel and Iran embark on what could well become a wider regional conflict, you might expect turmoil in the financial markets. After all, if the beginning of a third world war doesn’t knock a few dollars off the Apple share price it is hard to know what would. But it turns out that investors, at least for now, appear indifferent.

Looking at a trading screen this morning you would probably think not much was going on in the world. The FTSE 100 was up 30 points. Overnight, the Nikkei was up by 1.2 percent; when Wall Street opened, it was up by a few points as well. Gold was down by 0.4 percent and oil by slightly under 1 percent. It is all very meh. Anyone who thought a major conflict in the Middle East would throw the global economy into chaos will clearly be disappointed. It does not look like it is going to happen.

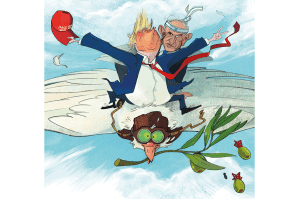

Investors, at least for now, appear indifferent

Of course, investors might just be incredibly complacent. Yet there are two reasons for thinking they may well be right to tune out the news bulletins from Tehran and Tel Aviv. To start with, they are assuming that Israel has already won. As so often before, the Israel military has proved its mastery of tactics, surprise and special operations, and its defensive shield largely protects it from retaliation. Investors are betting that Israeli leader Benjamin Netanyahu would not have started the conflict unless he was sure he could win it.

Next, the energy market has changed. Fracking has turned the United States into the largest oil and gas producer in the world, and there is plenty more to be developed. Even the Canadian prime minister Mark Carney, a fierce opponent of fossil fuels when he ran the Bank of England, is increasing production. At the same time, green energy may be more expensive than its champions predicted, and may require bigger subsidies, but there is starting to be a lot of it. The wind turbines in the North Sea generate 30 percent of the UK’s electricity, and in Spain solar contributes 20 percent of the total, while wind contributes another 20 percent. The result? We rely far less on Middle Eastern oil and gas than we used to. In reality, the war may be a huge event for diplomats, for military strategists and for the fate of the region. To the markets, however, it does not matter very much. Investors have other things to worry about.