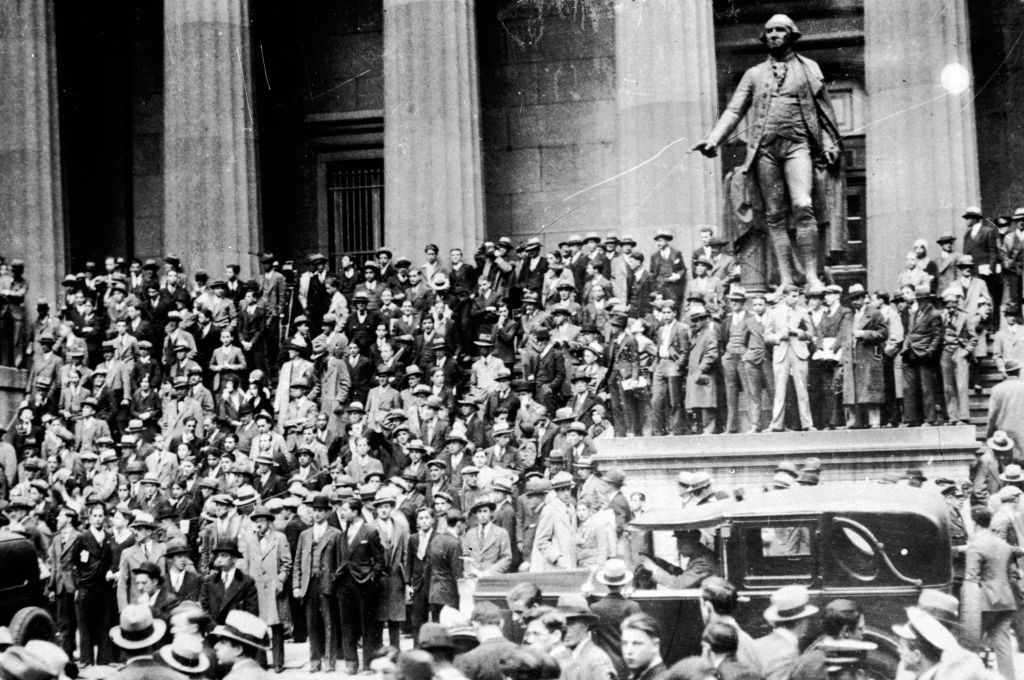

As a piece of financial punditry, it could hardly be bettered. “THIS IS A GREAT TIME TO BUY”, screamed a post on the platform Truth Social on Wednesday morning. Hours later, the S&P 500 surged by 9 percent – its biggest percentage rise since 2008. The only trouble is that the tipster handing out this invaluable advice was the same man whose announcement caused the surge in the stock market: Donald J. Trump.

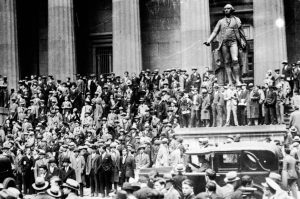

Unsurprisingly, it has raised questions about who knew that Trump was about to do an about-turn and delay tariffs for 90 days – and whether any of them used the information to their personal advantage. Insider trading has long been treated as a serious issue among corporations. The Securities Exchange Act of 1934 made it illegal for those in possession of market-sensitive information, such as an imminent corporate takeover, to undertake trades in relevant shares.

Wednesday’s events are a reminder, though, that it isn’t just corporate executives who can potentially benefit from insider trading – government insiders, too, could make fortunes on the back of policy announcements of which they have advance knowledge. Adding to the accusations flying over Wednesday’s events are data showing a surge in trades shortly before the President announced he was delaying tariffs for 90 days. Was it simply a case of outsiders reading something into Trump’s post about it being a great time to buy – which would be completely above board – or were government figures involved?

Against the charge of impropriety is the fact that the increase in speculative activity before the announcement didn’t just involve people betting that the market would rise. There was also a leap in the number of people betting that the market would fall – people who, as it turned out, were to lose big time.

But then, the overall amount of money being placed on the market is not necessarily where anyone should be looking. If government insiders in possession of knowledge of Trump’s imminent about-turn made a few thousand dollars, that would hardly show up in the market as a whole. But it would still be terribly wrong.

The only real solution is to ban those working in government from trading directly in shares or in any derivatives that involve taking a position on the movement of markets. There are ways to achieve this. Anyone in possession of potentially market-moving information about government policy could, for example, be restricted to investing in blind trusts – where they can specify a general investment strategy but leave the timing and the choice of individual stocks to a manager who is not party to any inside information.

That said, how many speculators who cashed in on Wednesday’s sharp rise in markets went on to cash out before stocks plummeted again on Thursday? The gyrations of the stock market have shown that betting on the stock market is not an easy game even for those who are in possession of privileged information.

Pointedly, there was no post on Truth Social before Wednesday’s close of markets saying “THIS IS A GREAT TIME TO SELL.” Investors take their punditry from Donald Trump at their peril.

Leave a Reply