All is not well with the economy. It’s true that 390,000 jobs were added last month, exceeding estimates, while hourly income is up 5.2 percent since May 2021. However, analysts guessed unemployment would drop a tenth of a percent, which didn’t happen. Gas prices keep rising, as GasBuddy.com reports a 43 cent jump over this time last month. It’s enough of a problem that OPEC has agreed to increase production in July and August.

The economy remains stricken by inflation, with Treasury Secretary Janet Yellen issuing a mea maxima culpa earlier this week. “I think I was wrong then about the path that inflation would take,” she told CNN on Tuesday. “[T]here have been unanticipated and large shocks to the economy that have boosted energy and food prices, and supply bottlenecks that have affected our economy badly, that I at the time didn’t fully understand.” It’s a bit of a cop-out and makes it seem like the Biden administration wants to avoid taking responsibility for exacerbating inflation through its massive spending increases.

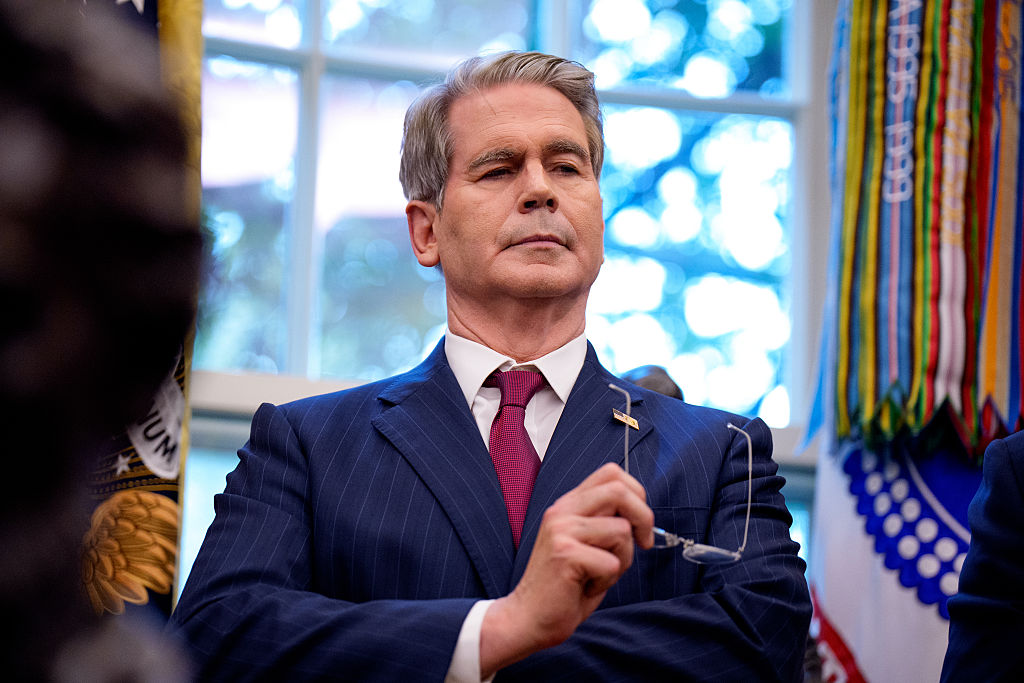

The very public fight in the Federal Reserve over what to do next is also concerning. Atlanta Fed Bank president Raphael Bostic argues for a pause in interest rate hikes starting in September. He reasons that economic conditions swiftly change under certain factors, citing the pandemic and its aftermath. “[S]ome might be surprised by my injecting some caution here,” he writes. “But remember this: even firetrucks with sirens blaring slow down at intersections lest they cause further preventable trouble.”

Chicago Fed president Christopher Waller, meanwhile, wants the opposite. “I am not taking 50 basis-point hikes off the table until I see inflation coming down closer to our 2 percent target,” he told an audience in Germany this week. “And, by the end of this year, I support having the policy rate at a level above neutral so that it is reducing demand for products and labor, bringing it more in line with supply and thus helping rein in inflation.”

The Federal Reserve may go with a middle ground. San Francisco Fed chief Mary Daly recently commented to CNBC that “we need to get the rate up to neutral, which I put about 2.5% in nominal terms…then we look around and see what else is going on.” Fed vice chair Lael Brainard wants to see inflation at its 2 percent target before considering any sort of rate pause.

Analysts remain concerned about volatile market conditions and whether they’re a portent of stagflation, which is when the economy slows but inflation stays high.

“I really think there’s a decent chance we go into stagflation,” Steve Weiss from Short Hills Capital Partners told CNBC. “I think we’re partially there already.” Weiss blamed labor shortages and supply chain issues for inflation’s initial rise in January. He argued that next month rates needed to keep rising.

Norbert Michel from Cato Institute sees things a bit differently: “[T]here are many positive signs that suggest we are not on the cusp of stagflation – the month to month rate of inflation fell last month, and labor markets are still tight, for instance – and it is definitively not the case that a recession always follows when the Fed tightens its policy stance.” He hopes that the Fed will remain focused on bringing down inflation, but isn’t 100 percent sure of what tactic the bank will take. “It is impossible to know for certain, but they have started tightening and they need to evaluate that move over the next months; as far as the bond market’s expectations of future inflation, it appears that people expect inflation to continue calming down.”

The next Consumer Price Index will be released on June 10. That will be likely to guide the Federal Reserve’s next steps, though future rate hikes remain all but certain. That’s a good thing, but the Fed still has a long way to go before inflation is truly under control.