Inflation last month increased to 8.5 percent over a year ago. That’s up from 7.9 percent just last month. It’s the sixth straight month that inflation has been over 6 percent, and the highest it’s been since 1981. The Fed will almost certainly be raising the funds rate steadily for the rest of the year, perhaps by fifty basis point increments instead of the usual twenty-five basis points. The trick, of course, is to rein in the inflation without causing a severe recession.

The price of gasoline rose a staggering 18.3 percent in March alone. But even if you take out the cost of fuel and food, which tend to be much more volatile than other commodities, the “core inflation” was 6.5 percent, again the highest in decades.

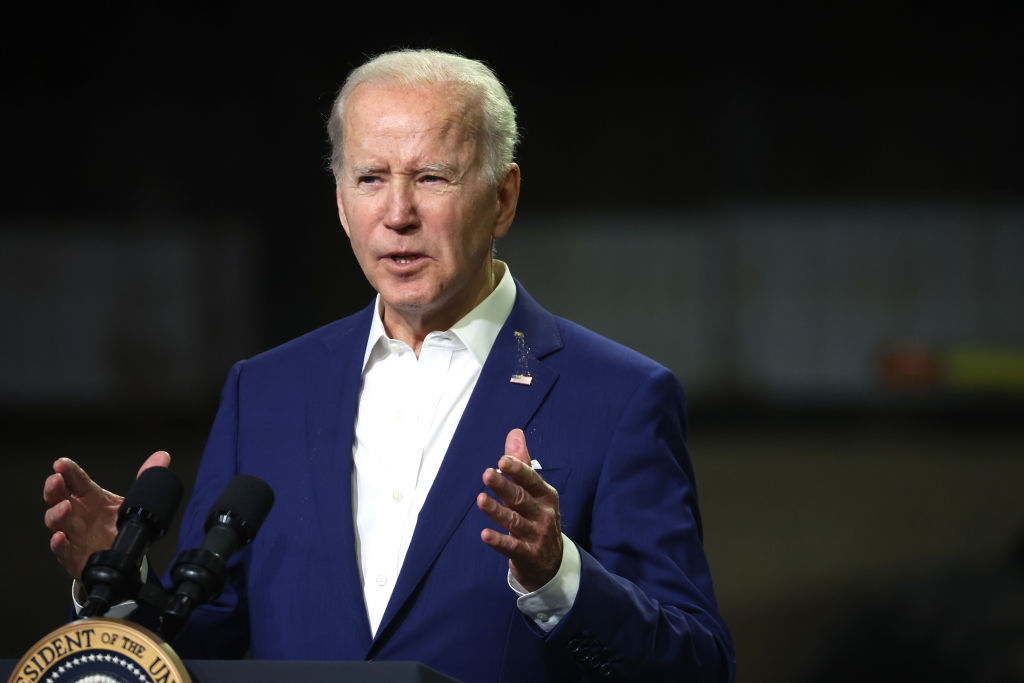

The Biden administration is trying to blame Vladimir Putin for the surge in oil prices. But, in fact, oil prices began rising sharply almost from the minute President Biden took the oath of office in January 2021. Among his first acts were to cancel the Keystone Pipeline, curtail exploration and stop granting leases on federal lands. The Biden administration is the most anti-fossil fuel administration in the country’s history.

The United States does not import all that much Russian oil, now embargoed because of Russia’s invasion of Ukraine. Indeed, it is only because of the Jones Act of 1920, which requires ships operating between US ports to be American-built, owned and crewed, that we import any. But because of the Jones Act, it was much cheaper, before the embargo, for Hawaii to import Russian oil rather than oil from Alaska, because of much lower shipping costs.

The end of the Covid pandemic (assuming it is indeed over) has caused the economy to boom. The economy has added more than 400,000 jobs a month for the last ten months, the longest such stretch since such statistics were first kept in 1939. As a result, unemployment is at only 3.6 percent, about as low as it can go without causing inflation-inducing wage gains. And wages have, indeed, been rising briskly, although not fast enough to outpace the inflation.

The supply chain disruptions that plagued the economy last year and helped push inflation are not yet fully resolved. And the recent surge of Covid in China, which has caused the regime there to quarantine half of Shanghai, among other draconian measures, might well cause disruptions to surge again.

The war in Ukraine has also exacerbated matters. Russia and Ukraine were responsible for about one-fourth of the world’s international wheat trade. But Russia’s wheat is now embargoed and Ukraine’s is blockaded. Wheat is one of the most important foodstuffs, and its price has soared since the outbreak of the Ukrainian war.

In an effort to bring down the price of gasoline, the Biden administration is planning to allow gasoline to have as much as 15 percent ethanol this summer, instead of the usual limit of 10 percent. That will not only increase pollution and engine wear, it will also increase the price of corn, which is the main feedstock of ethanol. The price of corn has been averaging an increase of 25 percent for the last three years.

Once inflationary expectations get built into people’s financial planning, they become a self-fulfilling prophecy, and it is very hard to get them out. In 1981, the last time inflation was this high, the Reagan administration was just coming in, and the inflation rate was falling rapidly as the Federal Reserve induced a recession that finally ended the great inflation of the 1970s. The Fed funds rate was 15 percent in 1981. It’s .33 percent now. And even if all the external causes of the current inflation — commodity shortages, supply chain disruptions, the war in Ukraine, tight labor markets, green government policies, a huge increase in the money supply — were somehow to miraculously disappear (which they certainly won’t), it will take a while to tame the inflation beast.

Meanwhile, the American people know who is to blame, and it’s not Vladimir Putin. The Democratic chances in November are getting bleaker every day.