Can tariffs replace income taxes paid by Americans earning an income under $200,000 annually, as President Trump has suggested?

We seem to have entered a new world in 2025, or rather, reincarnated an older America whose tax receipts were heavily built on tariff payments. U.S. Secretary of Commerce Howard Lutnick recently stated that tariffs could replace income taxes paid by Americans making up to $150,000 per year.

And certain economic nationalists have urged that there is a vital causal connection here worth recalling in an “American system” of tariffs and protectionism, and the growth of American industry. They argue that America’s Gilded Age wasn’t regressive economically; in fact, the country exploded in growth, commerce and inventions.

So, is the postwar age of free trade we have lived in for 80-plus years one that no longer makes sense? If so, what other dominoes would fall besides free trade? Will America’s fiscal policy consist of replacing the hated income tax for most American taxpayers with tariffs, a policy that will build domestic industry at the same time via protectionism? And, most importantly, who would object to that?

None of it is workable, though. It’s not just the relative difference in receipts between income taxes and tariffs; more substantially, it’s a tax base problem. Specifically, the income tax base is much broader than the tax base on which tariffs are built. How much larger? Nearly twelve trillion dollars larger. In a paper for the Tax Foundation, economists Erica York and Huaqin Li found that Americans reported $15 trillion in income in 2021, on which they paid $2.2 trillion in income taxes for an average tax rate of 14.9 percent. In the same year, goods imports were $2.8 trillion, generating $80 billion in revenue on an effective tax rate of 2.9 percent. The tariff rate would need to be much, much higher to replace lost income tax revenue, so high that it would easily destroy the import business upon which the taxes are collected. The power to tax is the power to destroy, and this scenario would demonstrate it. Alternatively, we could drastically cut spending by reducing the size of the federal government to Gilded Age levels to make it work. Right.

York and Li also explored the results of not having an income tax for individuals with annual incomes under $200,000, while letting them keep refundable tax credits. Their model showed that lost revenue would equal around $737.5 billion annually, and approximately $8.5 trillion over 10 years. While it’s difficult to pin down precisely the tariff rates at the moment, given the freestyle model of imposition that Trump has utilized, as of April 2025, Trump’s tariff schedules would equal nearly $167 billion in new tax revenue in 2025. That’s almost $600 billion less than tax revenue income in one year. We need to deal in reality instead of wishful thinking.

Tariffs are a foolish form of taxation. They raise consumer prices, and increase prices for intermediate goods that American companies import and further refine into finished goods for consumption. This reduces the value of worker income, private sector output and returns to investors. While tariffs operate on the import slice of the economy, they impose negative effects throughout the broader economy.

Americans should be asking what a tax system that aspired to collect decent revenue but proceeded neutrally across economic sectors would look like. In short, what is needed is a pro-commerce tax policy, a taxation system that doesn’t unduly impede the supply of goods and services, and ensures that individual initiative reigns supreme in the economy. Taxes should be low and broad, spread out equally across the economy and not targeted at specific sectors, nor progressively imposed on particular earners. Production, supply, investment and employment should be incentivized on an equal basis. Prices should freely adjust to consumer demand, not influenced by special interests attacking or favoring certain parts of the economy. Americans need a tax system that does not target sectors of the economy for privilege or punishment. Pro-supply, neutral basis policy could be a consumption tax, an income tax, or a corporate income tax, imposed at reasonably low levels and on an equal basis. Here is the wisdom behind a flat tax rate, for example. And ideally, we would only have one of these forms of taxation.

Tariffs do the opposite. They are taxes not only on imported consumer goods but also on intermediate capital goods. They undercut the wages and incentives of workers by making certain goods more expensive. They reduce the productivity of companies and capital by raising the price of goods used in business operations, while sheltering domestic industry and permitting it to raise prices, resulting in inefficiencies and job losses in other sectors that typically dwarf the gains accrued to domestic producers.

The tariff and income tax switcheroo builds on the bipartisan desires of Americans to have numerous and generous entitlements and services from the federal government, while not paying the requisite taxes for them. Those burdens are for the next generation to shoulder. The notion of tariffs becoming our chief revenue generator participates in this fiction because we are being told that Americans don’t pay the tariffs, only foreigners. We can have the government we want and make foreigners pay for it, and get something for almost nothing. But this is false empirically on every level of analysis. If we attempt such tariff plans, we’ll get something much worse, and we’ll get it good and hard.

Can tariffs replace income taxes?

We need to deal in reality instead of wishful thinking

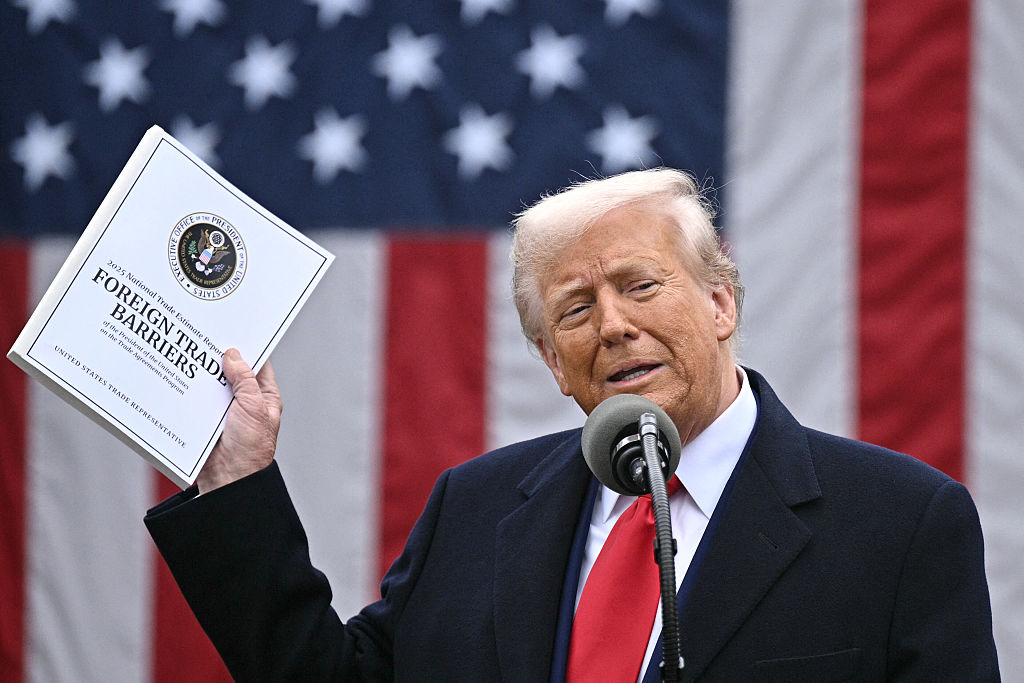

Donald Trump (Getty)

Can tariffs replace income taxes paid by Americans earning an income under $200,000 annually, as President Trump has suggested? We seem to have entered a new world in 2025, or rather, reincarnated an older America whose tax receipts were heavily built on tariff payments. U.S. Secretary of Commerce Howard Lutnick recently stated that tariffs could replace income taxes paid by Americans making up to $150,000 per year. And certain economic nationalists have urged that there is a vital causal connection here worth recalling in an “American system” of tariffs and protectionism, and the growth…

Leave a Reply