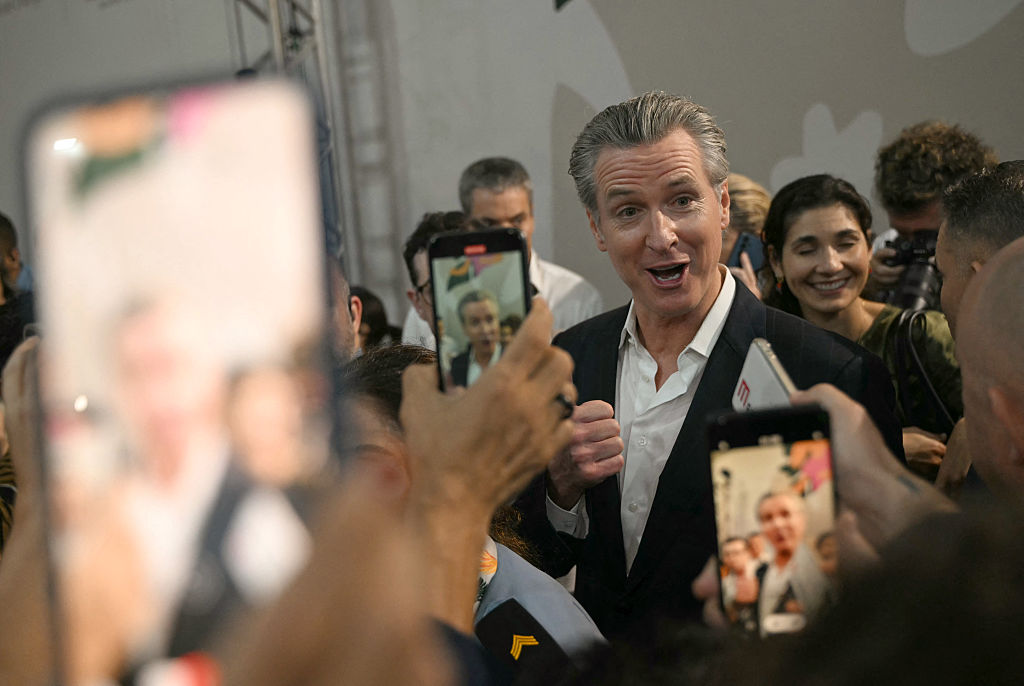

At least there will be some pandas. At his summit with President Biden this week, China’s President Xi pledged to send more cuddly bears to the US, the traditional Chinese way of cementing good relations with other countries. More importantly, there was a significant easing of tensions between the two largest economies in the world.

Military communications will resume, reducing the chances of a catastrophic miscalculation between the two nations, controls on narcotics will be tightened up, and there will be a resumption of high-level diplomatic contacts. It remains to be seen if that sticks. But if it does, one point is surely clear. That could yield a huge “peace dividend” for the global economy.

Xi may well have decided that a slow-motion Cold War with the US is not something he needs right now

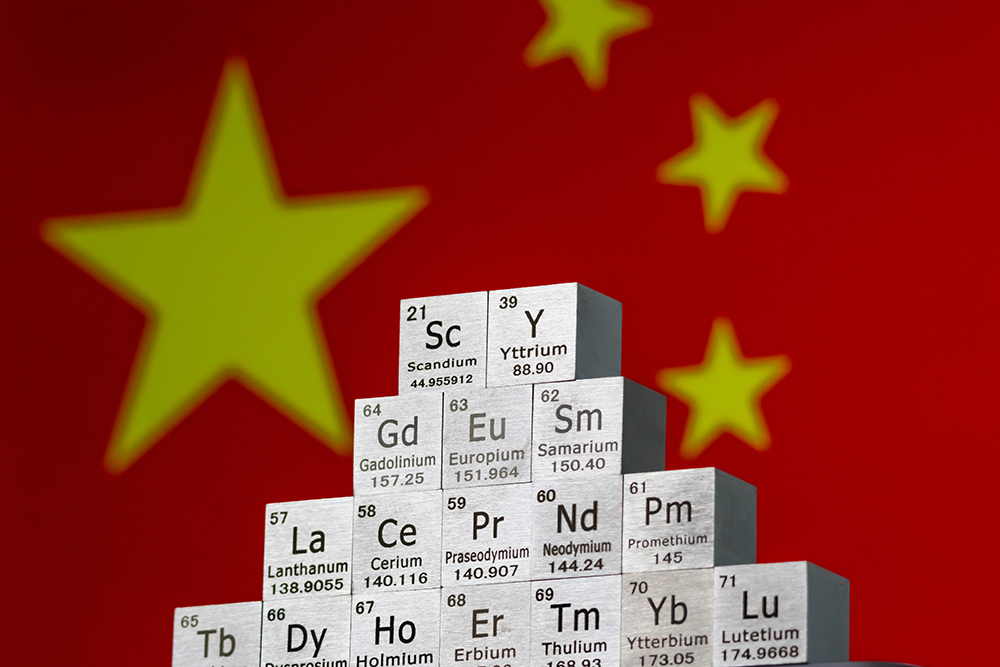

In reality, the tensions between the US and a more aggressive China have been a major drag on global growth. Starting under Donald Trump, and stepped up under President Biden, the US has been putting tariffs, sanctions, and trade barriers in place in an effort to counter the growing economic and military competition from its main rival.

There can be no question that this damaged the economy. The restrictions on technology transfer, especially microchips, has stalled new products. Chinese investment in Europe and the US has been blocked, reducing the amount of money going into new plant and machinery, and especially infrastructure where China has emerged as a major player.

The Chinese stock market has been stagnant, lowering returns for investors around the world (the benchmark Shanghai Composite index is lower now than it was in 2019). Meanwhile, the Chinese have steadily pulled money out of the American bond market, which is one reason why it has been so weak.

According to a report from Brown Brothers Harriman, China’s holdings of US Treasuries were by this month down to $805 billion, the lowest level since 2009. Understandably China didn’t really want to lend money to a government that was so hostile towards it.

Overall, trade has slowed, with Mexico overtaking China as the main exporter to the US. Add it all up, and the simmering conflict was a major drag on global growth.

True, no one would want the US to be weak in the face of Chinese aggression, or to give in to Xi’s demands. But with a Chinese economy starting to struggle with growth slowing, rising youth unemployment, and with a huge debt mountain from over-ambitious property development, Xi may well have decided that a slow-motion Cold War with the US is not something he needs right now. If so, lots of investment will be unlocked, and trade can resume. That will give the global economy a much needed boost.

This article was originally published on The Spectator’s UK website.

Leave a Reply