If you’d asked me five years ago which American party would champion crypto, I would have picked the Democrats. Economic inclusion, censorship resistance and sticking it to Jamie Dimon were the kinds of things they care about. Or used to.

Crypto has attracted its share of hucksters and psychopaths, but it’s potentially a fundamentally different and a better way of organizing society. Blockchain can provide services similar to those from Big Banks, Big Tech and Big Government, but without the corruption and grift that has compromised them all.

Crypto could – and should – be the great Democratic project. If you disagree, consider this: the too-big-to-fail banks are bigger than ever, but can’t manage to pay a decent rate of interest, operate on weekends, or not mistakenly give someone $81 trillion (this actually happened). Also, they keep firing clients they don’t like, possibly for political reasons. Global banks have paid more than$350 billion in fines since the 2008 financial crises, larger than the GDP of Pakistan.

Not to be outdone, Big Tech is also flailing. Bots, spam and political censorship have ruined social media, and Google’s image-generating AI is more woke than a Hollywood airhead. Mark Zuckerberg may be sporting a new look, and Facebook may have gotten rid of its notorious fact-checkers, but this is still the same company that courted the Chinese Communist party and played a key role in the suppression of dissent over Covid policy. Consider me skeptical.

As for global governments, what is there to say? Public trust in all institutions of the state is fading, everywhere. Bitcoin, by contrast, has run for 15 years without ever going down, making a mistake, or needing a bailout. It has never censored anyone –American or Chinese, conservative or liberal. And its much-maligned volatility has mostly resolved to the upside. Since its inception, bitcoin has been both the most accessible investment on Earth and the highest returning – an unlikely combination. There are blockchain-based dollars providing hard currency to ordinary people in hyperinflationary countries and decentralized banks that provide credit to the types of people Wall Street doesn’t want.

Instead of realizing its potential, the Biden administration tried to kill crypto in America. It misapplied dated regulations written for other assets, floated constitutionally dubious restrictions and tried to prevent crypto companies from getting bank accounts. There’s a chance that the 2023 regional banking crisis started with the targeted assassination of several crypto-friendly banks – call it the “lab-leak theory” of bank runs. All of this had a chilling effect on the industry. Capital fled offshore and my American students couldn’t get jobs without relocating.

Biden’s crackdown led to a predictable embrace by Republicans – though some of the pro-crypto members of the GOP seemed to also arrive at their position due to principles of hard money and free markets. Trump was relatively late to embrace the technology, but as is his tendency, went all in once he did. He promised to make crypto a priority, pass sensible legislation and fire antagonistic regulators. He even spoke at a bitcoin conference. The official Republican platform included a section on digital assets.

Critics of crypto, along with sufferers of Trump Derangement Syndrome, explained all this by way of the strong fundraising and intense lobbying the industry conducted before the election to fight for its survival. But Trump’s embrace struck me as authentic. Bitcoin is a populist type of money, and other applications of blockchain are fundamentally anti-elite. As a victim of social media censorship, Trump has personal reasons to appreciate a censorship-resistant technology. At a recent White House crypto summit, an industry attendee reportedly observed how remarkable it was that “a year ago we didn’t know if we were going to jail, and now we are in the White House,” to which Trump replied, “Me too.”

On election night, the first sign of Trump’s impending victory was a surge in his odds on a widely followed crypto-based decision market. The second was the price of bitcoin jumping to an all-time high. Both seemed apropos, for Trump and crypto seemed to be on the right side of history at the right time. But there is no free lunch, and the partnership has had a dark side.

Days before the election, the Trump family announced a multi-million dollar fundraising for their own crypto project. It was unclear why the world needed such a thing or why the Trumps were qualified to offer it. This was foreshadowing, for the project raised tens of millions anyway.

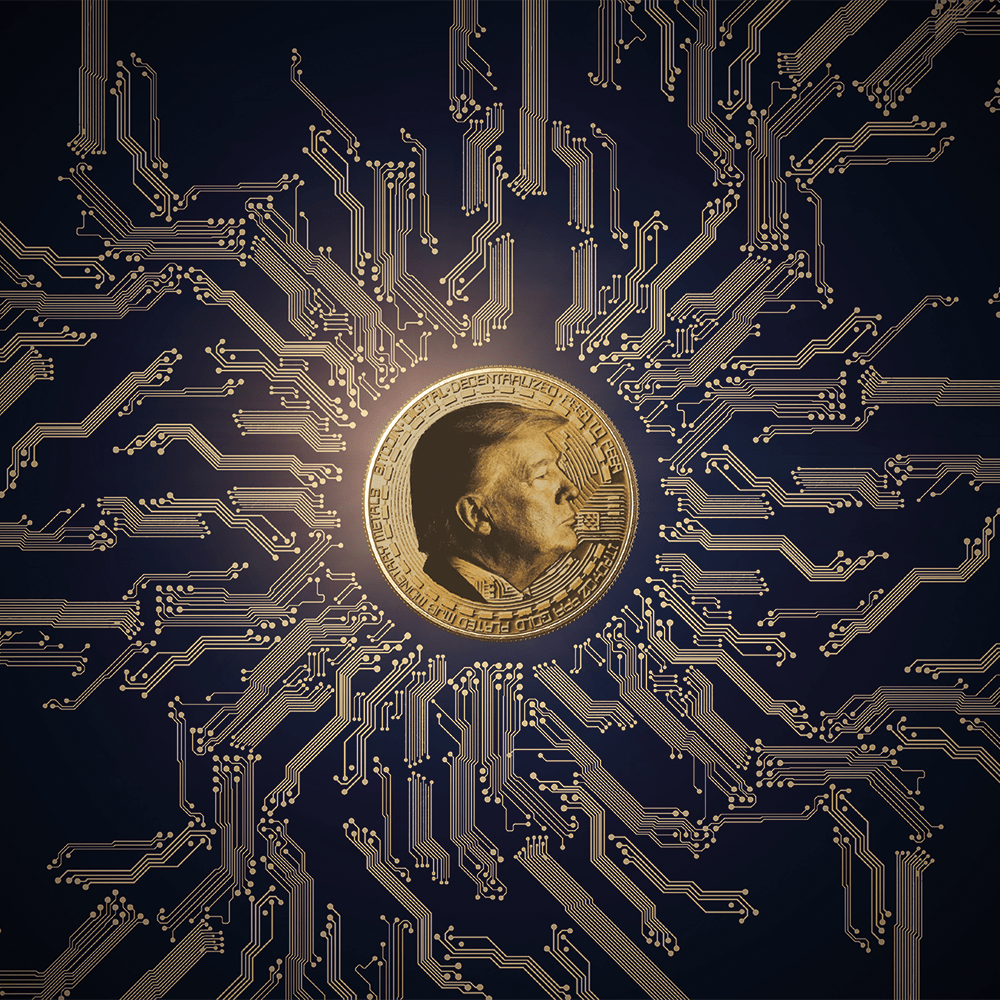

Then shortly before his inauguration, Trump launched a memecoin. This was on a Friday night when most of the crypto industry was celebrating him at an inaugural ball – many attendees didn’t find out until the next morning. The whole thing felt both monumental and catastrophic, a sensation I fear I’ll experience often over the next four years.

Memecoins are cryptocurrencies that don’t really have a point. A cross between gambling and a joke, they are akin to a themed slot machine, but with billions potentially at stake. They are controversial even within the crypto industry. To the purists, they are a misapplication of a technology meant for a higher purpose. But they’ve always been popular, perhaps because they aren’t so serious. You may have heard of the original, Dogecoin – its biggest fan being Elon Musk and his Department of Government Efficiency. But there are countless others, and now there’s $TRUMP.

There are problems with the President of the United States issuing such a coin. There’s a possibility of insider trading and backdoor bribery. What if Vladimir Putin buys a bunch right before a ceasefire negotiation? Or what if the President bases policy decisions on whatever benefits his coin? But my biggest issue with $TRUMP is that it’s not even a good memecoin. Part of the appeal of a true memecoin is that the distribution is fair: there are no insiders. A coin that has no point can just be given away. This stands in contrast to more serious crypto projects that need to raise money first, so they favor insiders and venture capital funds for early coin distributions.

Indeed, one reason the industry came to loathe the Biden administration was that restricting access to any new project’s coin was the only way to be compliant – unless it was a memecoin.

The $TRUMP coin was the worst of all worlds: a highly touted coin that had no point, most of the supply of which was kept by Trump and his affiliates. This didn’t stop buyers, many of whom were new to crypto, from bidding the price from less than one dollar to more than $70. The coin represented the vast majority of Trump’s net worth, at least on paper. The mania only abated when Melania launched her own memecoin – revealing a more selfish intent. At the time of writing, $TRUMP trades near $12 and $MELANIA is almost worthless.

The response from leaders in the crypto industry was a deafening silence. Only a few brave souls dared to call it what it was: a money grab and a poor representation of the tech. Many confided concern in private, but didn’t want to upset an incoming president. Joe Biden tried to kill their livelihood; Trump was going to make crypto great again.

This pattern of excitement, outrage and dissonance has repeated several times since then. At the time of writing, Trump has signed two executive orders on crypto and the vast majority of their provisions are great: an embrace of the technology, sensible regulations and a coherent federal approach. But some of it is controversial, such as establishing a Strategic Bitcoin Reserve, something that I strongly oppose.

Bitcoin is fine on its own. Government ownership imports government influence and threatens its free-market ethos. You’d think that all the other outspoken capitalists in my industry would agree, but they’ve apparently been bought off, either by the prospect of better regulations, or simply making money. I’ve long believed that bitcoin will eventually become a geopolitical asset. It’s scarcer than gold but easier to store. Most importantly, it comes with its own censorship-resistant payment system. Such an asset is desirable at a time of global fracturing. But not for the dominant superpower and issuer of the reserve currency. America doesn’t need reserves, it needs to shore up its finances and maybe not try to reverse decades of globalization all at once.

Crony capitalism has arrived on the shores of crypto, and the experience is bittersweet. Bitcoin is big enough to matter, but the industry around it will inevitably divert resources from private enterprise to government lobbying. I remain excited about all that blockchain and crypto can achieve – with sensible regulations.

But I’m also concerned by the motives of those who embrace it in Washington. To add injury to insult, Trump’s aggressive tariff policies have now tanked crypto prices – along with everything else. All of which reminds me of the line from a Stealers Wheel song: “Clowns to the left of me / Jokers to the right / Here I am, stuck in the middle with you.”

This article was originally published in The Spectator’s May 2025 World edition.

Leave a Reply