For a few days in February 2000, Masayoshi Son was the richest person in the world. A risk-taker and showman, universally known as Masa, he had long been disdainful of Japan’s staid “salaryman” business culture and was riding the wave of dot-com mania. His company SoftBank, founded in 1981, had bet big on the growth of online shopping. The bullish mood didn’t last, and Masa slunk away from the limelight — but only for a while. A techno-optimist, the now sixty-seven-year-old has repeatedly reinvented himself, urging doubters to see beyond the immediate: “You’re limiting your field of vision to thirty years… Start bold and think 300 years ahead.”

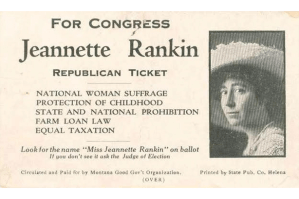

In Gambling Man, Lionel Barber, who for fifteen years edited the Financial Times, argues that Masa is “probably the most powerful mogul of the twenty-first century who is not a household name.” At once a master of consumer psychology and a “trickster” with a fondness for short cuts, Masa has proved a central character in an age of “hyper-globalization” that has seen money and ideas flow freely across the world. This detailed biography documents a career punctuated with attention-grabbing successes and abrupt reversals.

Barber has a journalist’s eye for his subject’s telling idiosyncrasies — a haste to board planes that means he sometimes embarks without socks or shoes, and a penchant for painting landscapes in the manner of Van Gogh. Of particular interest is Masa’s main home, a Batman-style lair in Tokyo. The decor highlights his fascination with Napoleon, but there are also numerous dog baskets for his salon of teacup poodles. Meanwhile, his office features a serene Japanese garden; guests who sit on an elevated platform are afforded a view that’s “not exactly trompe l’oeil,” yet alters their sense of space, exemplifying Masa’s bent for conjuring unusual perspectives.

These rarefied scenes are far removed from Masa’s gritty childhood. Growing up on the volcanic island of Kyushu, in a makeshift house not much better than a cowshed, he felt like an outsider, especially when mocked by other children over his Korean heritage. His father ran a pig farm, and Masa would forever be haunted by memories of the stench. The family later made a small fortune operating slot machines and by his teens Masa could aspire to become a teacher. But that plan was derailed by reading about Den Fujita, a business strategist lauded for introducing Japan to the McDonald’s hamburger. When Masa engineered a meeting with Fujita, the older man impressed two ambitions on him: to get to grips with computing and to learn English.

Masa did both, finding his way to the University of Berkeley, where he imbibed the “frontier spirit of Californian capitalism.” When he hit it off with a professor who had developed a tiny voice synthesizer, he saw the chance to create a commercially attractive product — a handheld device for translating between languages. He became so preoccupied with it that he was late for his own wedding, twice. The episode reveals his defining traits: single-mindedness, a gift for juggling numbers, the knack of forming useful relationships (as he later did with Rupert Murdoch and Steve Jobs), an instinct for being the middle-man between innovators and the market, and a cavalier attitude to formalities.

As Masa branched out — into telecoms, semiconductors, real estate and robotics — a pattern established itself: “A blizzard of ideas followed by intense enthusiasm and focus, leading to overreach, failure and repentance.” Another recurring theme was self-promotion, at times veering towards what Barber calls “tin-eared bravura.” Advisers have often struggled to tell whether Masa is being serious or fanciful. His greatest coup, taking an early stake in the online marketplace Alibaba, turned $20 million into, at peak, more than $100 billion. Among his gravest blunders was losing $16 billion as he backed the office-sharing venture WeWork, whose flamboyant CEO, Adam Neumann, he goaded for being “not crazy enough.” One investor complains that this was “like feeding a monkey alcohol.” A smaller but revealing misstep, which Barber doesn’t mention, was pumping money into a dog-walking app, Wag. When it sought $75 million, SoftBank bewilderingly advanced four times that amount.

Barber has interviewed Masa at length and spoken to more than 150 of his associates. The result is a sure-footed account, efficient rather than ruminative, which applauds his courage and “capacity to effect change” while characterizing him as “good at making promises, even better at spending other people’s money.” His latest incarnation is as a futurist. Insisting that his past punts were “just a warm-up” and that he can make unprecedented sums by pouring investment into artificial intelligence, he thinks of himself as “an architect to build the future of mankind.”

What kind of future might that be? Discouragingly, Masa compares himself to Genghis Khan. Little more cheering is Barber’s suggestion that he resembles both Mr. Spock, Star Trek’s emotionless master of the “mind meld,” and J. Robert Oppenheimer, the father of the atomic bomb.

Leave a Reply