I don’t gamble. But in October 2016, I made a bet.

It was obvious Trump didn’t just have skeletons in his closet but a walk-in necropolis. As we stumbled toward November, the question wasn’t whether one of these skeletons would break free, but just how bad the October Surprise would be. It was supposed to be a polling-shifting, election-sealing, reputational nuclear bomb. And if you read the press, that’s what the “Pussy-Grabbing Tape” was.

But to me, it was just another example of Trump being vulgar. And Trump had always been vulgar. And voters liked that he was vulgar, or didn’t care that he was vulgar, or liked that he was so unlike other politicians that he could be vulgar.

On the release of the Access Hollywood tape, some European betting shops said that Hillary had 25:1, 35:1 odds of beating Trump. To me, that was insane. The potential return on a Trump victory was absurdly high, despite the chance of a Hillary win not seeming so certain, and I didn’t really believe the polls anyway. So I made a bet. I saw this as a simple matter of probability, exploiting an inefficiency of the betting markets, and because I won, I could believe my own explanation. I saw what the experts didn’t.

In reality, though, I’d fooled myself into overthinking a coin toss. I just got lucky and hit heads.

On an October Thursday in 2023 — almost seven years to the day since I’d placed that bet — I was on my way to the London crypto conference, Zebu. As co-founder Harry Horsfall would tell me, the name is short for “zero bullshit, always bullish”; it also shares its name with a hump-backed, large-horned Indian cow. They’re rather cute.

For the unfamiliar, to be “bullish” means to be enthusiastic about the future of a market — here, to believe crypto is the future of money and the internet and perhaps everything. To have a zero-tolerance policy for “bullshit,” however, means you also hate most of the current crypto market. Crypto jargon doesn’t just come with a whiff of cow dung; it’s seven courses of PFP, NFT, DeFi, VR, peer-to-peer, virtual reality, digital economy, blockchain future, Web3, cryptographic, biometric AI-generated bullcrap.

During the 2021-22 crypto boom, crypto conferences were all the rage. They were sweaty, passionate, pulsating, DJ’d hypefests, with celebrity guests and loud music. At Bitcoin 2022 in Miami, Mayor Francis Suarez unveiled a roughly $250,000, grotesque “Bitcoin Bull” statue that had been erected outside the Miami Beach Convention Center. The biggest controversy was that its corporate sponsor, TradeStation, had removed its “huge mechanical balls,” to show that “prosperity and wealth shouldn’t have any gender.”

Everyone was making money, and the moneymaking would never end, and Elon was taking DogeCoin to the moooooon. One shitcoin would tell you it could make you a 10,000 percent return; another 15,000 percent; the next 30,000 percent; and why not? Pictures of ugly monkeys were selling for millions, what is money anyway?

Most memecoins were Ponzi schemes, and most buyers knew that. But they bought in anyway, hoping they could get in and out fast enough to make a quick profit. They usually weren’t — they were the suckers left holding the bag — but new opportunities to get rich or robbed popped up every minute, and the fear of missing out can prove very persuasive.

By 2023, crypto events were more reserved. With TornadoCash gone, Celsius imploded, SBF jailed and the Feds down the industry’s neck, the mood at Zebu was mature, almost boring. There were still a few expensive sneakers, colorful blazers and the customary ping-pong table, but most attendees were London finance guys in On Running shoes with light blue shirts and iPhones on gimbals. The first attendees I saw were a group of young “crypto tax advisors” in red branded T-shirts, eating Tesco meal-deal sandwiches outside the Woolwich tube station.

The stands were full of reward-card crypto companies and gaming crypto companies and VR-metaverse crypto companies, and an ugly-monkey crypto social club, but they weren’t promising to change the world. The ambient ambition seemed to be eliciting “Huh, that’s kind of cool,” not raising $100 million in pre-seed funding.

A guy at the Archax stand was telling me they were the UK’s first FCA-regulated crypto exchange, broker and custodian, following KYC compliance, AML checks and offering tokenized money market funds for institutional clients. It seemed like a solid, boring business, not revolution fuel. He was hoping to drum up business from the Red Cross, which had set up a (quiet) stand to accept donations in cryptocurrency.

Most amusing was the stand for “Bumper,” a decentralized finance (DeFi) market, advertised as a way to protect investors from downturns in crypto prices. I pulled up the price chart for their coin, BUMP.

It had lost 88.6 percent of its value since 2021.

Before talking about crypto, it’s helpful to get some core terms down.

A blockchain is a decentralized, secured ledger; only its authors can modify or remove their additions. Imagine a group Google Doc that even Google can’t take down, and only you can affect your additions to it. In this analogy, your “digital wallet” is like your Google Account; it’s what allows you to write to the blockchain or control things on the blockchain.

This can be digital assets like music MP3 files, saved as non-fungible tokens (NFTs); but most often, it’s cryptocurrencies, like Bitcoin or Ethereum, which work by writing units of value to a blockchain. Rather than getting their value from gold or guns, cryptocurrencies get their value from their immutability, the fact that no central bank or government can touch them. This was a large motivation for the invention of Bitcoin by the anonymous Satoshi Nakamoto, which launched in the wake of the 2008 global financial crisis. Also, there’s Web3 — an imagined future internet built on blockchain, where services are paid for with micro-payments of crypto instead of advertising.

To some, this all sounds incredibly promising: a new internet-native financial system, free from censorship, built around transparency, completely separate from central banks and interest rates. To others, it just sounds fanciful.

And even though crypto is theoretically decentralized, it functionally isn’t. Most people buy their crypto from lightly regulated exchanges like Coinbase, Binance and FTX, which allow you to cheaply trade crypto and then store your holdings for you, all in one simple place — and what could go wrong with that?

This is a rudimentary description, but you don’t even need to know, let alone understand, any of this. Crypto is that rare industry where you can make an enormous amount of money without knowing anything. You don’t need to know what you’re buying and selling, or what the underlying technology is. All you need to know is that the number goes up.

You can read about the technical genius of the blockchain, or the philosophy behind the Bitcoin whitepaper, but these are usually just fig leaves or aspiration justifications for crypto’s gamblers. For better or (usually) worse, crypto is best understood through one simple concept: the bet.

Sitting on the Tube, on my way to Zebu, I was reading Michael Lewis’s new book, Going Infinite. It’s a biography of crypto’s wunderkind-turned-villain Sam Bankman-Fried, a story that, in Lewis’s telling, is about odds. To “Bank Man Fraud,” everything was just about probabilities of expected returns and bets worth taking. Everything else — norms, morals, people, laws — could pound sand. In his digital journal, Bankman-Fried wrote, “I deeply believe and act as if people are probability distributions, not their means.” And he had an obscenely high risk tolerance.

After all, you can only lose 100 percent (right?!), but winnings can be infinite. In early 2022, SBF told economist Tyler Cowen that he would take a coin-toss bet with ending the world as the stakes, so long as there was a 51 percent chance of doubling the Earth. And he would take that bet again, and again and again, without end, double or nothing.

SBF wasn’t a crypto nerd. He didn’t have utopian hopes of creating a future without central banks, and didn’t want a Web3 economy powered by digital gold. He was a former Jane Street trader focused on market gaps and inefficiencies — and because of crypto’s limited regulation and few serious players, he found a uniquely inefficient and porous market. He started a crypto business because he wanted to earn lots of money, quickly, apparently with hopes of donating it all to save the world, and his plan paid off. For a bit.

He currently resides in a California prison, where he’s beginning a twenty-five-year sentence, having taken customer funds from his crypto exchange, FTX, and funneled them into his crypto hedge fund Alameda which made insanely risky bets on terrible crypto projects, with no stop-loss. This is like your accountant secretly investing all your money in Beanie Babies, but with more money and way higher risk. FTX had an $8 billion hole because of this, and a bank run — encouraged by his fellow crypto felon Changpen Zhao (CZ) of Binance — completely killed the business.

Michael Lewis recounts an episode early on where the company had accidentally mislaid millions of dollars in investor money, held in the cryptocurrency Ripple. SBF’s colleagues said they should inform their investors, as norms and law would require. He disagreed:

He told his fellow managers that in his estimation there was an 80 percent chance that it would eventually turn up. Thus they should count themselves as still having 80 percent of it. To which one of his fellow managers replied: After the fact, if we never get any of the Ripple back, no one is going to say it is reasonable for us to have said we have 80 percent of the Ripple. Everyone is just going to say we lied to them. We’ll be accused by our investors of fraud.

Several members of his team resigned because of this, but Bankman-Fried found the millions in Ripple, investors were none the wiser and the company continued, on its way to printing billions of dollars. The bet paid off. As Matt Levine pointed out in Bloomberg, fraud of this kind is fairly common in the financial industry; it only gets investigated when companies lose the money and creditors find out.

Much of the $8 billion hole in FTX customer funds — the missing money that killed the company and Bankman-Fried’s freedom — was spent on a series of random, odd investments. Many of these went to zero, but two — in AI company Anthropic and the cryptocurrency Solana — have covered more than 100 percent of customer funds.

Once again, Sam Bankman-Fried had made the mathematically right call. Once again, he’d bet a lot and gotten heads. The only reason he didn’t win is the world found out about it before he cashed in his chips.

Among the bears, bulls, drunk apes and other creatures of the crypto menagerie was the man I crossed London to meet: the chief zebu of Zebu, Harry Horsfall, a curly-haired, easy-to-laugh, slightly frenetic man, who had also made a bet.

His was in 2013, on a small internet technology known as Bitcoin. He held his first Bitcoin event that year — “It was five weird guys at the back of a pub, and everyone thought we were mad.”

Say he’d bought $500 in Bitcoin at the beginning of that year (at $13.28 each); by the time I was placing my bet on the election of Donald Trump in October 2016, he would have made almost $27,000. In just three years, his bet on a nascent digital standard, used for buying illicit drugs, paying prostitutes and washing dirty money, would have paid off over 5,200 percent. If you didn’t sell at that point, you were a moron. There’s no exit strategy that says 5,200 percent returns aren’t enough.

And yet if you’d done the moronic thing and held onto your Bitcoin you’d have seen them increase to $19,345 each in just over a year. And if you were even more thoughtless and didn’t sell then, by the end of 2024, one Bitcoin was worth over $100,000. How much can you win on a coin toss? That initial $500 would have made you almost $3.8 million.

A few months after Zebu, I spoke with a man I’ll call Steven. Steven is a widower, father of two, and works long hours to support his kids. He wanted a better future for them — and a better life for himself — and in early 2022, was flickering through YouTube when he saw a video from a man named Alex Mashinsky. Mashinsky seemed trustworthy, and after watching some more videos, Steven decided to check out his company, Celsius.

Celsius marketed itself as the bank of the future. Or not a bank, but better. Its slogan was “Unbank Yourself,” which Mashinsky wore on T-shirts. His pitch was that, by cutting out the greedy bankers of traditional finance, Celsius could offer way higher returns on your savings — 20 percent, in fact. It wasn’t going to make you superrich — it wasn’t the 10,000 percent per annum returns promised by some smaller, stranger cryptos — but with enough time, investing enough of his savings, 20 percent gains per year could make a real difference.

Within a few months, Celsius had imploded, indefinitely paused user withdrawal and declared bankruptcy. Celsius was a Ponzi scheme, not a bank, and because it operated without security, banking law and insurance, all the money was gone. The moderators of the Celsius subreddit filled it with suicide hotline posts. Steven’s children were too young to know what was bothering dad, but he started having panic attacks at work: “The first time it happened, I thought I was having a heart attack.”

In February of this year, with bankruptcy proceedings completed, Celsius started paying out creditors. Steven wouldn’t tell me how much exactly he invested in Celsius, but said he’d received less than 30 percent of the money he deposited. And he’d deposited a lot. “Look, if they want to go to college, I’ll figure out some way to do it, because I have to. But it’s going to be hard.”

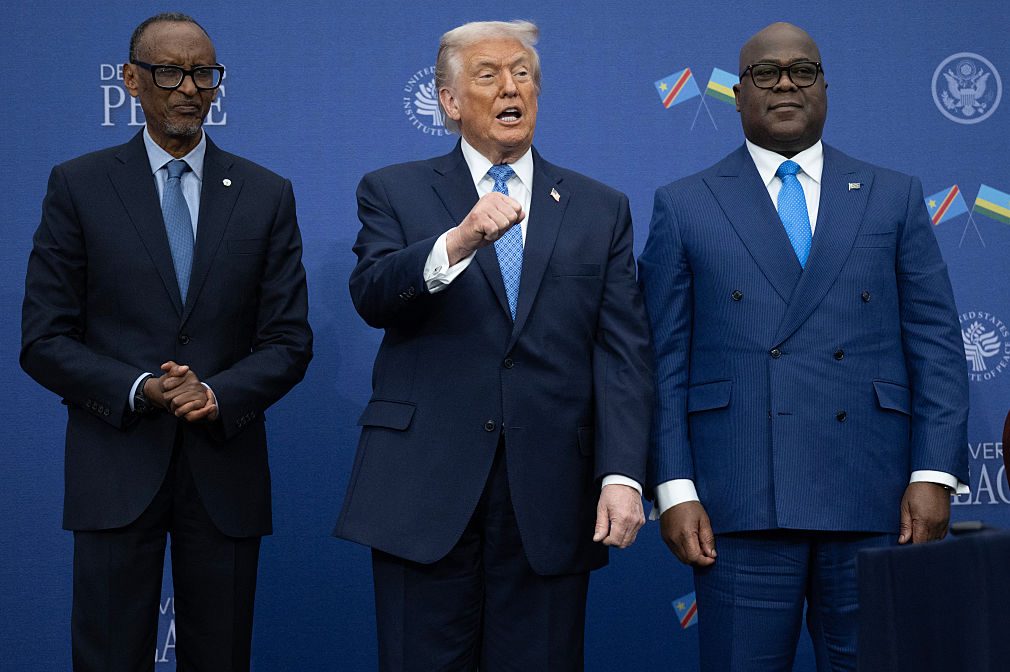

In 2024, crypto took off again, and the party was back. There were new celebrity coins — from Caitlyn Jenner (twice), and the “Hawk Tuah” girl — and both presidential campaigns twisted themselves to appeal to the crypto lobby. Kamala Harris promised “to protect cryptocurrency investments so black men who make them know their investment is safe.” Donald Trump — who previously called Bitcoin “a scam against the dollar” — launched his own sloppily made crypto exchange and cryptocurrency. With his re-election, Bitcoin surged.

Yet nothing has actually changed. Crypto has had no real innovations or applications — finance is still centralized, and the web remains ad-supported.

In mid-November, the platform pump.fun exploded in popularity, fueled by a TikTok-born resurgence in memecoins. For the unfamiliar, pump.fun is a blend between FTX and TikTok Live, letting you launch your own “shitcoin,” then livestream yourself talking about it to pump its value. These coins are pointless; but if you can convince viewers to buy yours, you can then sell your entire stake and take all their money. The practice is known as “rug-pulling” and pump.fun ran on it.

Initially, it was entertaining; the only place where you could watch a thirteen-year-old boy flip the bird to his idiot viewers as he stole $30,000 from them. But it soon became obvious that the service had little to no moderation, and users started threatening to livestream themselves doing immoral acts unless their shitcoin hit a certain market cap. And things got very dark, very quick.

A man threatened to hang himself; another, to shoot up a school; another, to kill his dog. A woman had sex with a dog; a man punched himself repeatedly; another threatened to waterboard a person tied up in the background behind them. The sex shows were relatively tame compared to people streaming themselves playing Russian roulette (thankfully, never getting unlucky). Crypto was supposed to free us from the evils of traditional finance, I remind myself, as I hear of the armed teenager who said he’d kill his entire family with a shotgun unless his coin reaches a market cap of $60,000.

After a few days of chaos, pump.fun turned off the livestreaming feature.

The first iPhone was released in January 2007; the Bitcoin whitepaper was released in October 2008. Over the following seventeen years, smartphones have fundamentally changed the way we live, work and communicate; what crypto has done is make some people rich, many more poorer, and driven some to suicide.

Maybe we’re still early. That’s the view of Horsfall, who remains enthusiastic about many of the theoretical applications that excite me about crypto — micropayments improving online media, NFT tickets enhancing the events experience, adding fairness to music royalties and so forth.

Digital projects such as Lightning are working to make fractional Bitcoin transactions easy and inexpensive, and companies like Block (owned by Twitter’s former chief hippie, Jack Dorsey) are working on user-friendly crypto payments, through CashApp and their crypto wallet Bitkey.

The early internet was filled with tech nerds tinkering on protocols and servers, who did so because they loved tech and it was cool to them.

Crypto, by contrast, is the territory of gamblers, speculators and frauds, and there are few tinkering nerds. It’s filled with people who believe in a future because they’re betting on it, or who have realized it’s easier to get rich selling a dream than actually building it; or who just want you to buy that dream so they can rob you.

Satoshi Nakamoto isn’t the avatar of modern crypto. It’s Sam Bankman-Fried.

This article was originally published in The Spectator’s January 2025 World edition.

Leave a Reply