It was presented as a bold stimulus to boost China’s ailing economy — but while it excited stock markets in Asia, Western economists were underwhelmed. At a rare press conference in Beijing on Tuesday, the usually gnomic governor of the People’s Bank of China, Pan Gongsheng, unveiled a range of measures designed to “support the stable growth of China’s economy” and see that it hits this year’s target of 5 percent growth.

There was a time when such measures, which included an interest rate cut and more funds to support the stock and property markets, would have quickened the pulse of investors. But this is unlikely to reverse their exodus. It merely confirms fears about China’s deep-seated problems and casts doubt over whether the Chinese Communist Party is capable of meaningfully reforming an economic model that is no longer sustainable.

With the CCP increasingly in every lab and boardroom, the country’s start-up scene is on its knees

The measures “indicated policymakers’ growing concerns over growth headwinds,” said Goldman Sachs. Liu Chang, macro economist at BNP Paribas Asset Management, meanwhile, said that though positive, “we think there is still a worrying lack of urgency behind their words around stimulus.”

The problem for Pan is that not only do few economists believe that 5 percent growth can be achieved, but China is widely believed to be cooking the books. Analysts have long used alternative gauges for measuring China’s economic activity, such as electricity consumption or energy imports, but their skepticism has increased as the country’s economic problems have mounted. Growth in 2013 may have been as low as 1.5 percent, according to an analysis by the Rhodium Group, a research organization, as supposed to the 5.2 percent claimed. This year has probably been tougher.

While President Xi Jinping has portrayed himself as China’s “supreme reformer,” the heir to Deng Xiaoping, his principal achievement since coming to power in 2012 is to put Deng’s reforms sharply into reverse. A property bubble continues to burst with slumping sales and prices, youth unemployment is soaring, and inward investment is plunging amid growing signs of social stress, including a spike in protests.

Beijing has reacted by restricting data about the economy and criminalizing pessimism. The Ministry of State Security, China’s main spy agency, has declared that gloom about the economy is a foreign smear and that “false theories about ‘China’s deterioration’ are being circulated to attack China’s unique socialist system.”

The announcement of these stimulus measures coincided with reports that Zhu Hengpeng, a prominent economist at one of China’s top think tanks has disappeared after criticizing Xi’s management of the economy in a private groupchat. Zhu, who for the past decade has been deputy director of the Institute of Economics at the state-run Chinese Academy of Social Sciences, has been placed under investigation, detained and removed after making comments about the flagging economy and referring to Xi’s mortality, according to the Wall Street Journal.

An economic model that for four decades relied on cheap exports and massive, wasteful state-led investment in property and infrastructure is no longer sustainable. It produced dizzying rates of growth but has also led to soaring debt and diminishing returns, with China littered with ghost cities, containing 60 to 100 million empty or incomplete homes, while companies accounting for 40 percent of China’s home sales have defaulted.

It is widely agreed that China needs to rebalance its economy and that consumers need to spend more, since private consumption accounts for just 39 percent of the economy — extremely low by world standards (the figure in the US is 68 percent). But there is no consumer confidence, with 80 percent of family wealth tied up in property and no meaningful social safety net.

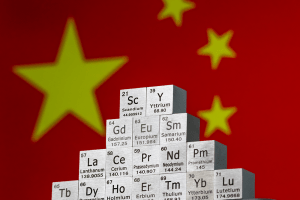

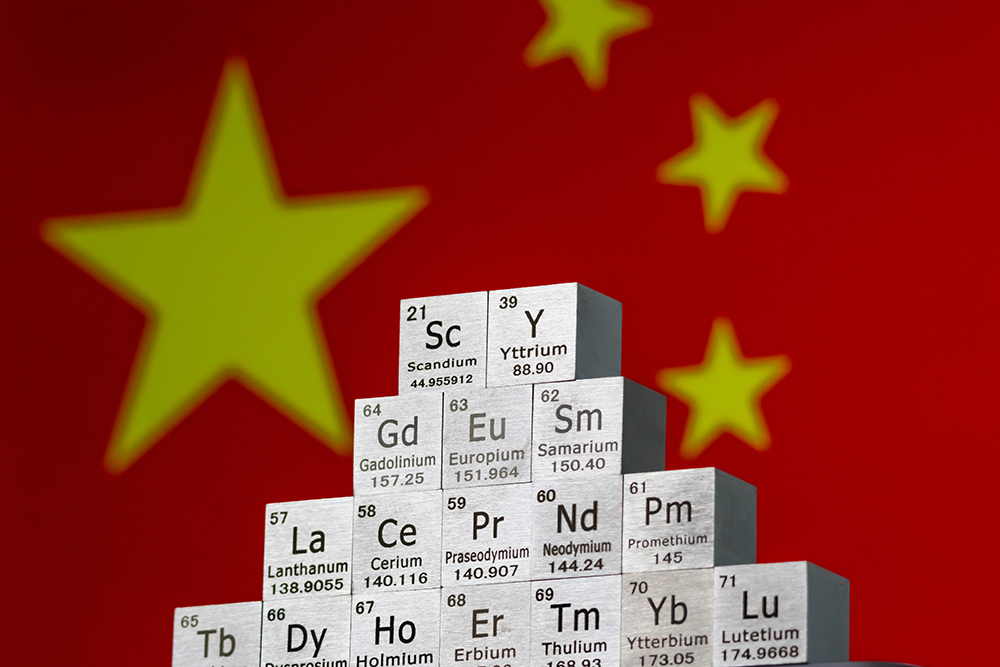

Xi hopes renewable energy technology can replace property as a new motor of growth, and mouth-watering subsidies have been thrown at industries ranging from solar panels to electric vehicles and batteries. This has lead to massive overcapacity and vicious price wars. Yet the benign global environment that accompanied China’s earlier export splurges has gone: the world is much more wary.

Xi’s longer term goal is to build a world-beating “innovation” economy driven by domestic tech, but the most effective way of achieving this — giving more sway to the market and to private companies — runs counter to everything he stands for. Xi has prioritized security and CCP control, even over the economy. He has hobbled China’s most innovative technology companies, which have faced tightening restrictions. With the CCP increasingly in every lab and boardroom, the country’s startup scene i”s on its knees, with one executive recently telling the Financial Times, “The whole industry has just died before our eyes… The entrepreneurial spirit is dead. Last year, China led the world in the number of millionaires leaving the country, according to the Henley Wealth Management Report.

This is the background against which Pan wheeled out his stimulus, hinting that further measures might be in the pipeline. It had more than a hint of desperation about it and came days after Beijing announced it was raising the retirement age — a measure that was also widely criticized as inadequate to fend off a fast-approaching demographic crisis.

The CCP has long cultivated the myth of the technocrat, claiming that its officials have risen through a meritocratic system and are superior to those in the West because they can plan rationally for the long term. That was always a highly tenuous claim and ignores the reality that even the most gifted technocrat can make little real difference in an autocratic system where ultimately the only thing that matters is the opinion of the leader. Indeed, such a system encourages fraud as underlings clammer to tell the emperor what he wants to hear or face the consequences of voicing unwelcome opinions — as the economist Zhu did.

Pan is perhaps the embodiment of that hapless technocrat. He is no doubt aware that China’s troubled economy has peaked and may go sharply into reverse, but unable to mutter the unspeakable — that it is unreformable as long as Xi Jinping remains in charge.

This article was originally published on The Spectator’s UK website.

Leave a Reply