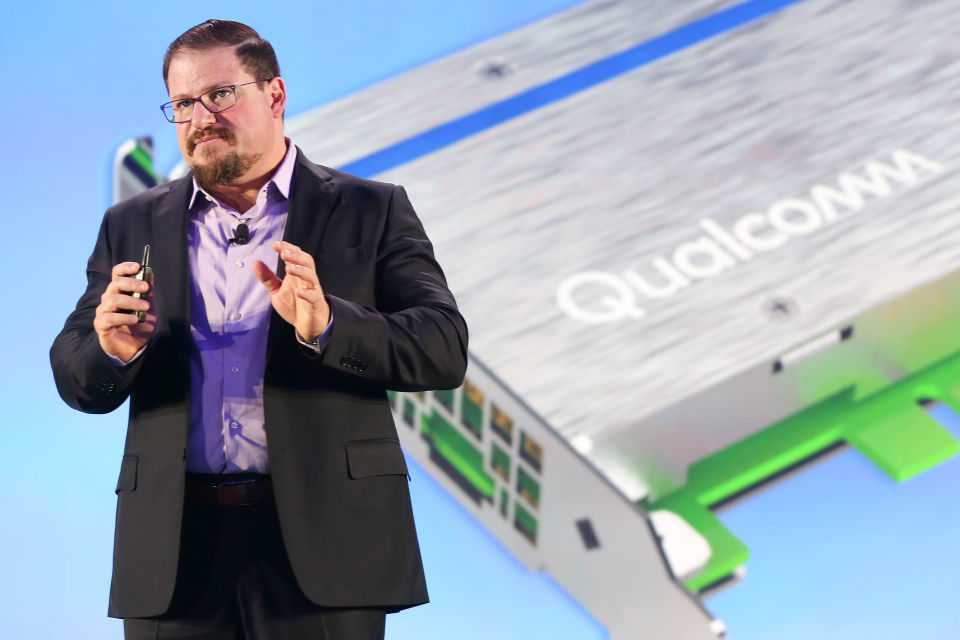

The United States and China are locked in a battle for technological superiority. President Trump has blacklisted tech giant Huawei over concerns the company will leverage its control of 5G networks to spy on behalf of the Chinese Communist party. The crackdown shows the administration is acutely aware of the national security implications of outsourcing network and chip technology. But the concerns don’t end with foreign-owned companies. Qualcomm, US-owned and the one of the world’s largest chip companies, has developed an intensely close relationship with China, potentially making it a trojan horse for communist influence.

Qualcomm has been on Trump’s radar. In 2018, he issued an executive order preventing Broadcom from purchasing Qualcomm in a $117 billion corporate merger. The President warned the takeover could harm national security because Broadcom’s headquarters was in Singapore at the time. Broadcom later moved its headquarters back to the US after the deal was denied.

The US government relies on Qualcomm’s dominance to stay competitive in global tech markets and, in theory, to stave off China. Broadcom’s Singaporean ownership, however, is not nearly as potentially menacing as Qualcomm’s far too cosy connection to China.

The company has risen to new heights over the past decade thanks to its entry to the Chinese economy, including partnerships with Chinese companies for manufacturing and research. Qualcomm now earns over half of its profits in Chinese markets. Qualcomm has a minority stake in SMIC, a Chinese contract manufacturer, and has increasingly relied on the firm for production.

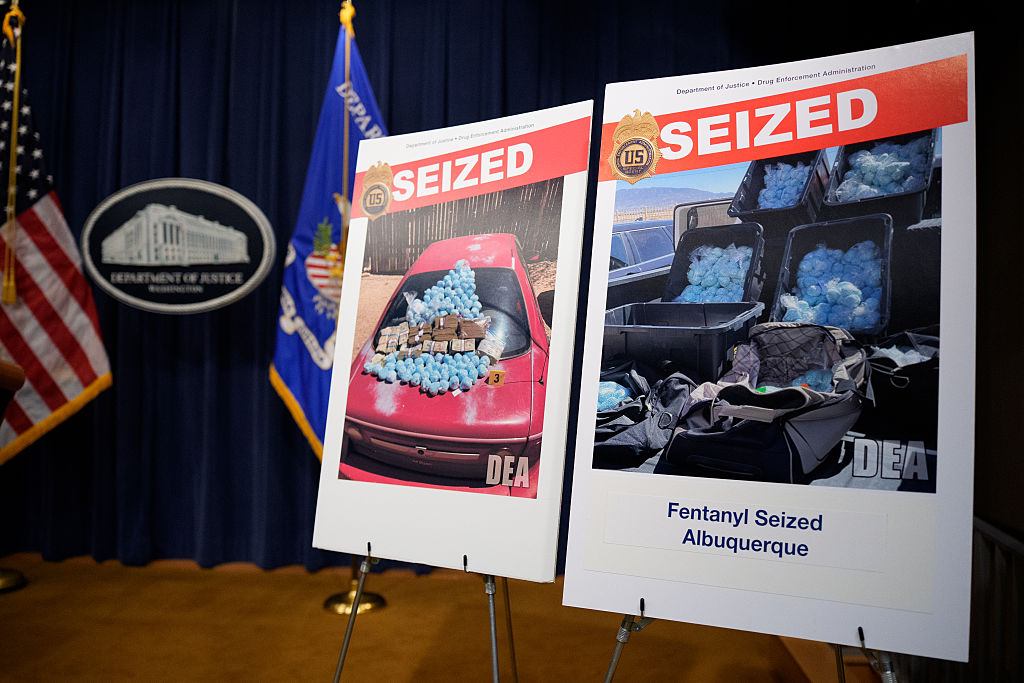

In 2014, Qualcomm announced it would use SMIC to produce its Snapdragon processors, which are commonly used in smartphones, boosting its image in the eyes of the Chinese government. By 2016, SMIC said they were able to ‘mass’ produce the chips. Qualcomm also relies on TSMC, a Taiwanese company, to manufacture the Snapdragon chips. Shortages of pharmaceuticals and personal protective equipment in the aftermath of the coronavirus outbreak showed the dangers of offshoring key American industries to Asia. Qualcomm’s foreign reliance raises further concern because the US government purchases its chips for national defense and intelligence. How can the US government guarantee the safety of these chips when they are manufactured abroad?

The Pentagon has spoken openly about reshoring chip manufacturing to avoid potential supply chain disruptions: ‘The Department closely tracks domestic manufacturing and production of all defense sectors critical to our supply chains, and microchips is certainly one that will continue to play a key role in most, if not all, major defense programs.’

Michael Chertoff, the former secretary of Homeland Security, warned in a Wall Street Journal op-ed in November that Qualcomm’s monopoly on the US chip industry constituted a national security threat.

‘American reliance on a single chip provider creates an inviting target for adversaries, who would need to find and exploit only one vulnerability to execute a destructive cyberattack,’ Chertoff wrote, adding that the Pentagon has some motivation for preserving this potentially damaging monopoly: ‘In the Pentagon’s view, maintaining the company’s economic health is also essential because it is a critical player in the competition with China to develop 5G technology.’

It’s hard to make that argument stick when Qualcomm is actively working with China to retain access to its markets and manufacture its most valuable products. The company even had a relationship with Huawei until the Trump administration essentially banned US companies from working with the 5G monster. Qualcomm is so dependent on China, in fact, that its leaders have pitched the company as a ‘stabilizing force’ between the US and its most powerful foreign adversary. This attitude indicates that Qualcomm has accepted the risks of doing business with the CCP and values profit over loyalty to America.

Qualcomm hasn’t grown purely through creating a good product and navigating the realities of a global market. They’ve used dirty tricks, such as hiring the relatives of Chinese officials and bribing officials with travel, gifts, and entertainment. Qualcomm paid $7.5 million in 2016 to the SEC to settle charges they had violated the Foreign Corrupt Practices Act. Meanwhile, in order to retain its monopoly, Qualcomm has allegedly stomped on other US companies seeking to compete in the chip market. They have managed to win out on 83 patent cases from complainants who accused them of intellectual property theft. Individuals familiar with Qualcomm’s legal strategy say the company plasters defendants in paperwork with the goal of bankrupting them before the case makes its way to completion. When Qualcomm faced patent disputes with Apple, it used a public relations firm to plant unflattering stories in the media, including suggesting CEO Tim Cook was exploring a presidential run to disrupt his relationship-building with Trump.

***

Get three months of The Spectator for just $9.99 — plus a Spectator Parker pen

***

Jeff Parker, the CEO of ParkerVision, has been fighting Qualcomm for years over claims it infringed on several of ParkerVision’s patents and will be going to trial against them in federal court in Florida later this year.

‘As Qualcomm cozies up to Xi Jinping and China with partnerships and bribes, it has not only done so at the expense of American innovation and small businesses, but American jobs,’ Parker told The Spectator. ‘From my experience when somebody seeks to hold them accountable, Qualcomm doesn’t just fight back, but plays dirty.’

Qualcomm did not return a request for comment.

Qualcomm has managed to avoid major scrutiny of its relationship with China, with Trump even announcing from the East Room that he made a call to Xi Jinping on the company’s behalf in regards to a potential merger. The administration also wants to argue on Qualcomm’s behalf in an antitrust appeal against the Federal Trade Commission. But American consumer sentiment is turning on China in the aftermath of the coronavirus outbreak and Trump has promised an ‘America First’ policy agenda. Outside of its value to the US government, Qualcomm would ordinarily be the type of company in Trump’s crosshairs.