Most of the attention paid to sovereign wealth funds inevitably lands on the Middle East. But it’s Norway’s $1.4 trillion national investment fund that is actually making the most noise.

Case in point: in April the fund’s CEO, Nicolai Tangen, said he believed global “authorities and governments should regulate” the use of artificial intelligence. “We are not seeing a pipeline of regulation coming yet,” Tangen lamented, without specifying the precise guidelines he’d like implemented. But no matter; he then added that Norway’s trio of SWFs — the world’s largest — are developing operational protocols for companies using AI which will be folded into the larger ESG (environmental, social and corporate governance) efforts that power their entire operation.

Tangen is hardly the only high-profile CEO to warn against AI’s potential pitfalls. Everyone from Elon Musk and Google’s Sundar Pichai to Nvidia boss Jensen Huang and even AI pioneer Sam Altman have advocated for government intervention in the nascent technology. But fueled by vast petroleum reserves — and an ambitious global investment agenda — Norway’s SWF owns roughly 1.5 percent of every public company on every global stock exchange. And so what Tangen says really matters.

Dating back to 1967, Norway’s SWF — like its 150 or so global counterparts — was established to invest excess commodities revenue. Today, Norway receives more money from its SWF assets than from oil and gas flows. No wonder Tangen’s predecessor Yngve Slyngstad described Norway as fundamentally shifting from “an oil nation to an oil fund nation” when he exited his perch in early 2020.

Tangen’s demand for government action on AI marks a provocative shift in the power dynamics between big tech and the folks who finance it. And his pronouncements will have considerable influence over a high-growth part of the US economy. Much of this is due to the hefty presence of SWFs — and their $11.5 trillion in combined global assets — in both tech giants and startups. Norway’s funds, for instance, have positions in major AI players such as Apple, Google and Microsoft — the latter being a major investor in OpenAI, the firm headed by Altman that’s behind ChatGPT.

Qatar’s SWF recently poured $250 million into startup Builder.ai, while Singapore’s SWF (aka the GIC) led the funding round for AI-fintech firm Quantexa this past April. Kuwait’s SWF — the world’s oldest: founded in 1953, a full eight years before independence — launched a $200 million tech-investment vehicle in 2019.

In other words, folks like Pandar — along with less powerful industry newcomers — increasingly answer to folks like Tangen. Which is why Norway’s forthcoming fund guidelines will inevitably trickle down throughout Silicon Valley — and to the thousands of individual investors who have bought into Big Tech.

Norway has a tradition of muscling its oil wealth into voguish global social causes — from the environment to gender equity. Between 2009 and 2013, for instance, the Norges Bank investment arm — the state agency officially overseeing Norway’s three-fund system — sponsored ten shareholder proposals at five large American companies, including Staples and Wells Fargo, where they wanted to see shareholders themselves empowered to nominate board members.

More recently, in April 2022, Norway’s fund led the revolt against executive compensation at Apple, where it is the eighth largest shareholder. And Norway backed shareholder proposals calling for greenhouse gas emission cuts at the annual meetings of Chevron and Exxon in early June; the fund has large stakes in both oil giants.

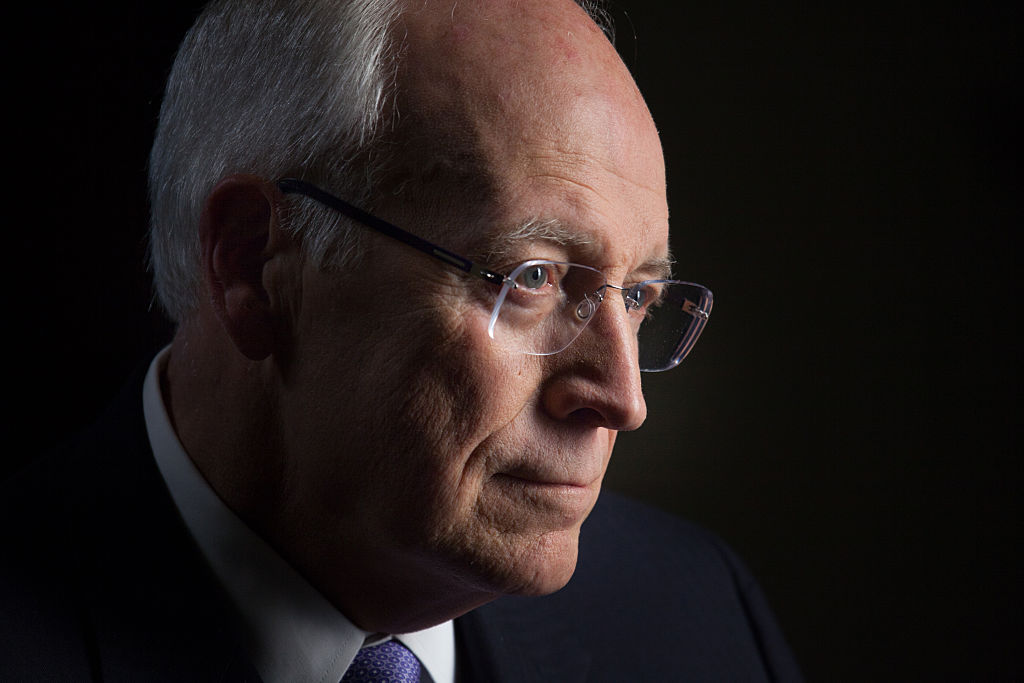

“Norway is the only country in the world that has aggressively used its sovereign wealth to meddle directly in the governance of American corporations,” says Jim Copland, senior fellow at the Manhattan Institute for Policy Research. And it’s not just America — in late spring, Norway was part of an investor group that blocked the appointment of Paulo Scaroni, a suspected Putin sympathizer, as chairman of Italian utility giant Enel, of which it owns 2.17 percent.

Still, AI is an entirely different beast, particularly given the way it is an intersection for startup cash and long-term capital. From Netscape to Facebook to OpenAI itself, disruptor-founders have historically sought financial footing initially via venture capital — followed by an eventual IPO. But AI represents the first major new technology to arrive in what is emerging as the era of sovereign wealth supremacy. Why beg for cash in Palo Alto, when it’s literally flowing from the earth in Oslo and Riyadh?

Indeed, fueled by the war in Ukraine and an insatiable global demand for energy, some $1.3 trillion in unanticipated oil revenue is expected to reach the coffers of petroleum producers through 2026. The windfall leaves SWFs nearly limitless in their investment capabilities. Which makes AI — with its potentially limitless need for investment — a particularly ripe target market. Also limitless is AI’s potential to upend every element of contemporary society, leaving the specter of unfettered SWF participation all the more eyebrow-raising.

Like the internet and social media before it, AI demands a robust regulatory framework. The question is who should regulate the regulators? Tangen speaks as if he’s placing his cards with global governments, but his actions clearly suggest a shadow agenda. If he truly had faith in good governance, Tangen would allow those governments to take on AI organically. Instead, his fund’s forthcoming guidelines— developed unilaterally and slated to arrive in August — will have an outsized impact on AI policies just as they’re being written. True, Tangen’s new rules may ultimately be rendered redundant by any eventual governmental regulations, such as those currently being developed by the EU. But his first-mover maneuvering — and enviable economic resources —will secure Tangen a permanent seat at any regulatory table.

Norway’s actions also mark a turning point for AI and ESG. The two have met before; in late April, for instance, a group of major UAE business leaders spoke of a “tangible sense of urgency… to address sustainability, ESG and climate issues.” Echoing business leaders across the globe, they also touched upon AI’s potential for discriminatory housing or hiring practices — which, along with race-based facial-recognition blunders, worry civil liberty watchdogs.

Considering the reach of the funds involved here, this concern is warranted. Last year, for instance, Saudi Arabia’s mammoth Public Investment Fund announced a $776 million joint venture with the Chinese AI leader SenseTime to develop a “national AI ecosystem.” Although officially listed on the Hong Kong Stock Exchange, SenseTime is partially owned by China’s state-owned Internet Investment Fund; in January 2022, SenseTime was sanctioned by the Biden administration after claims its flagship facial recognition software was being used by Chinese authorities to nefariously surveil their Muslim Uighur minority. (PIF also has big stakes in tech giants such as Uber and SoftBank.)

What we haven’t heard before are people like Tangen demanding not merely rules around specific AI applications — such as facial recognition — but a complete rethink about how AI might influence corporate operations as a whole. Guided by progressive principles, Tangen is clearly clamoring for an investment revolution, not evolution, when it comes to AI — with fund leaders like himself leading the charge. After all, despite his trepidation about AI, Tangen clearly concedes to its inevitability. “Force yourself” to use AI — even if you have to beg an intern to teach you,” he told Fortune in an interview earlier this month. His own company has apparently gotten the message and has deployed AI to improve operational efficiency by at least 10 percent each year.

Ultimately, the most ominous part of Tangen’s plan is that he feels confident enough to lay it out. After all, governments typically tell the money folk how to behave — not the other way around. At this moment of immense political uncertainty — if not a full-scale global leadership crisis — Tangen’s bravado further confirms the seemingly unstoppable power grabs of global wealth funds. The era of sovereign wealth supremacy is clearly upon us — and AI may very well represent their canniest investment yet.