Since the latest growth numbers have come out, much ink has been spilled over the question of whether the economy is in a recession.

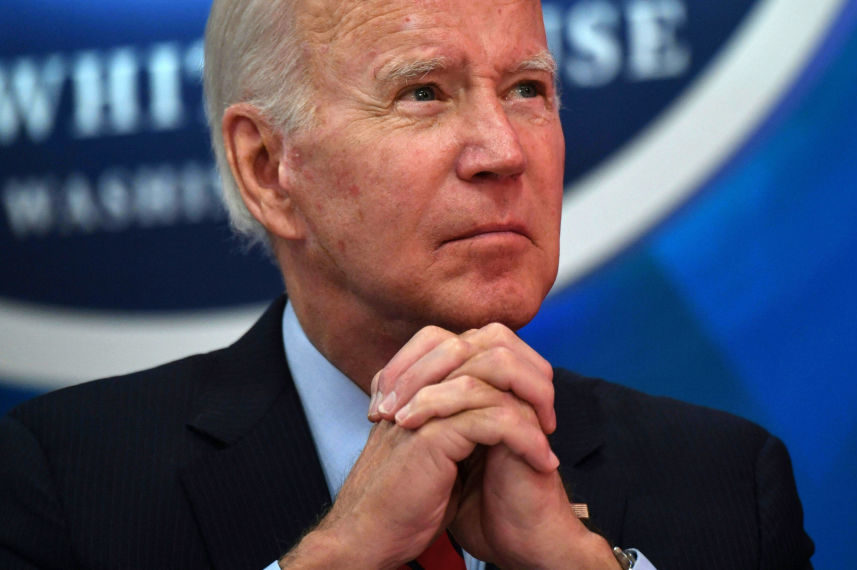

Perhaps unsurprisingly, the Biden administration tried to get out ahead of Thursday’s release with a press statement noting that back-to-back quarters of negative growth doesn’t necessarily mean a recession. Also predictably, Republicans strongly rebuked the idea, saying, “You can’t change reality by arguing over definitions.”

Both sides of the debate will continue to play out, and both sides will continue to miss the point.

Ultimately, it doesn’t matter very much whether growth goes up or down by 0.2 percent. What matters is the general trajectory of the economy. And on that front, the Biden track record is mixed at best.

The latest jobs numbers, unlike the growth estimates, have remained strong. On the other hand, Republicans have pointed out that the states that have recovered quickest from the pandemic are almost entirely governed by Republicans.

The extent to which states can take credit or blame for economic trends, it would seem, depends on which way those trends are going.

Meanwhile, the latest talking point from many on the left has been somewhere between humorous and infuriating. Americans, this line of thinking goes, are “worrying” the economy into recession — they are too “grumpy.” And the result? A “bad vibes” economy.

Of course, these trends are not all President Joe Biden’s fault, despite what his political enemies might say. Inflation, for one, is a multi-faceted phenomenon with plenty of blame to go around. But the focus on Biden should hardly be surprising. After all, it was his administration that injected the latest round of juice into the economy, and it was largely Democrats who argued that any inflation would be transitory — many of whom have since had to admit they were wrong.

On the other hand, Republicans also don’t have much of a leg to stand on. For one, President Donald Trump spent more in his four years in office than President Barack Obama did in eight. The bulk of Trump’s spending came in the last year of his presidency, all while he repeatedly urged the Federal Reserve to accommodate his profligacy. More recently, many Republicans joined with Democrats in support of a giveaway to the semiconductor industry — another $280 billion flying out of Washington’s door.

There is plenty of blame to go around, and it is clear the economic growth rate has seen a huge slowdown. This shouldn’t be surprising. Now that the Fed has been ratcheting up interest rates, sectors that were previously hot — like housing — are beginning to cool. What’s more, while wage growth continues at about 5 percent — a common talking point meant to assure doubters that the economy is actually in great shape — wages are significantly trailing top-line inflation.

There was a time, coming out of the pandemic, when observers thought growth would bounce back to pre-pandemic levels. That’s no longer the case — and if anything, it’s stagflation that’s now the bigger concern. Yet despite all of this bad economic news, Congress continues to head in the wrong direction.

The latest turn is the surprise deal between Senators Joe Manchin and Chuck Schumer over a new reconciliation package ostensibly meant to address climate change and reduce inflation. The humorously named “Inflation Reduction Act” carries a price tag of $433 billion, while supposedly raising $739 billion from a new 15 percent minimum tax on corporations.

We’ll know more when the official estimate from the Congressional Budget Office comes out next week, but as many have noted, these new taxes risk discouraging business investment at a time when it’s sorely needed.

Of course, the deal itself doesn’t stop there. In addition to extending Obamacare subsidies and increasing tax enforcement, it also is likely to have a worrisome impact on prescription drugs. What’s being billed as prescription drug pricing reform is just a price control regime that threatens to undermine drug innovation — and not just for the expensive brand-name treatments that politicians often deride.

Generics and biosimilars, a critical downward influence on drug prices, are likely to struggle under this new arrangement, making it more difficult for them to compete and ultimately creating inflationary pressure in the drug market. This isn’t just bad for consumers; it’s also terrible for already expensive government healthcare programs that need to purchase drugs.

Additionally, Senate Appropriations Chair Patrick Leahy has announced the new appropriation bills for the year. Their release brags about the nearly $1.7 trillion package, with spending increases ranging from 8 to 22 percent. And that’s not to mention another $21 billion in emergency supplemental funding related to the pandemic and other public health concerns.

Talking heads can quibble about whether or not we meet the technical definition of a recession, but the trends are not good, and the impact on everyday Americans is even worse. Politicians may point fingers, but at the end of the day, almost all of them are to blame for the situation we’re in now — and almost no one, it seems, is willing to try to right the ship.

Jonathan Bydlak is director of the Governance Program at the R Street Institute, a center-right think tank, and the creator of SpendingTracker.org.