The Putin price hike. That’s the line the Biden administration is using to absolve itself of blame for higher gas prices.

“Russia is one of the three largest oil producers in the world,” White House spokeswoman Jen Psaki said in a social media video meant to deflect criticism from President Joe Biden. “And the fact that they started this conflict, invaded a foreign country, and they are such a big producer of oil in the world is the reason why the global oil markets are disturbed and why gas prices are going up.”

The administration banned Russian oil imports this week, with the House of Representatives approving a similar ban on Thursday. The official White House Twitter account vowed that American oil and gas production is about to hit record highs but criticized companies for not taking advantage of over 9,000 permits available for use on federal land.

The White House also pushed for more alternative energy vehicles saying that vulnerabilities in the economy and national security are because the US relies too much on fossil fuels. “When we have electric cars powered by clean energy, we will never have to worry about gas prices again. And autocrats like Putin won’t be able to use fossil fuels as weapons against other nations.”

Yet libertarian and right-leaning economists don’t buy the line that Putin deserves all the blame for higher gas prices. “The US economy has been looking at rising oil prices for a while,” Christine McDaniel, senior research fellow at the Mercatus Institute, told me over the phone. “Even before the invasion, Americans were already seeing rising prices at the pump. This has just exacerbated it. I think the last estimate was that the Ukraine invasion has added about 75 cents to the prices that Americans are paying at the pump.”

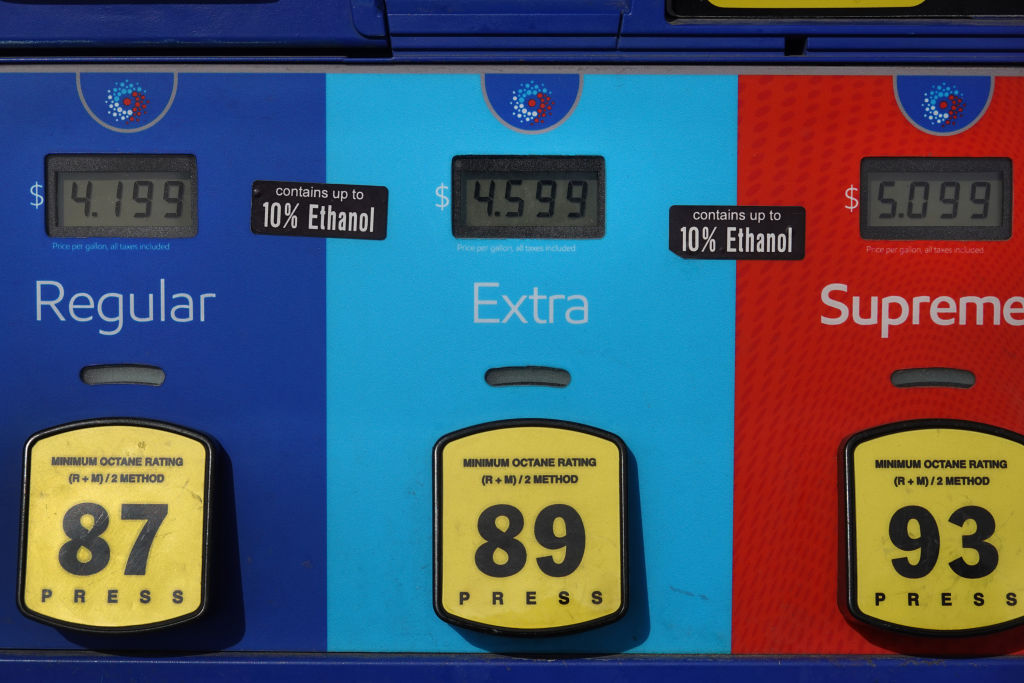

Data shows that gas prices started rising in April 2020 before really taking off in January 2021. This suggests that banning Russian oil to the US and blaming Putin for the aftereffects is a bit premature.

“We’re talking a drop in the bucket for US energy and petroleum product consumption,” said Scott Lincicome, general trade and economics director at the Cato Institute. “We’re just not talking about a big game changer for US oil and gas prices — particularly at the retail level. That’s good. I don’t think you’re really talking about crushing the US economy by banning imports of Russian petroleum to the United States.”

Where things become more worrisome is the decision to revoke Russia’s “most favored nation” status, as announced by Biden on Friday, which will allow America to more easily impose tariffs on Moscow. “In the sanctions game, you don’t want your sanctions to be permanent,” Lincicome said, explaining that sanctions should be a way to get sanctioned countries to change their policies. “You don’t want the sanctioned entity to go, ‘Well, hell, we’ve already gone past the point of no return. The cake is already baked. I might as well keep bombing Kyiv or whatever, right?’”

Biden’s announcement to revoke Russia’s “most favored nation” status is a little surprising because Hungary Prime Minister Viktor Orbán said earlier Friday that the EU wouldn’t put in place their own import ban on Russia. Europe relies heavily on Russia for fuel. It’s not known whether the latest sanctions on Russia mean the EU is ending those deals.

As for American politics, Biden might escape criticism for now. McDaniel said that Americans from both sides of the political aisle favor the oil ban. However, the administration may run into problems if other problems persist. This includes rising prices due to growing demand, supply shortages, and inflation.

“The Fed is under pressure to get inflation under control,” said McDaniel. “How do you do that? One way that can happen is to slow things down and rising prices [gas, food, etc] will slow things down. That’s probably not the way they wanted to slow things down, but it is another way to get there. We have this major disequilibrium in the market.”

This is especially troubling since inflation rose almost a percentage point from January to February of this year and up 7.9 percent from February 2021. The Federal Reserve is expected to announce an interest rate hike next week, with five or six more possibly expected this year.

It’s a good way to start slowing inflation but government spending also needs to slow down. Right now, however, the White House hopes the so-called “Putin price hike” line gets enough focus that Democrats retain control of Congress in the fall.