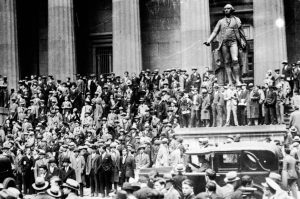

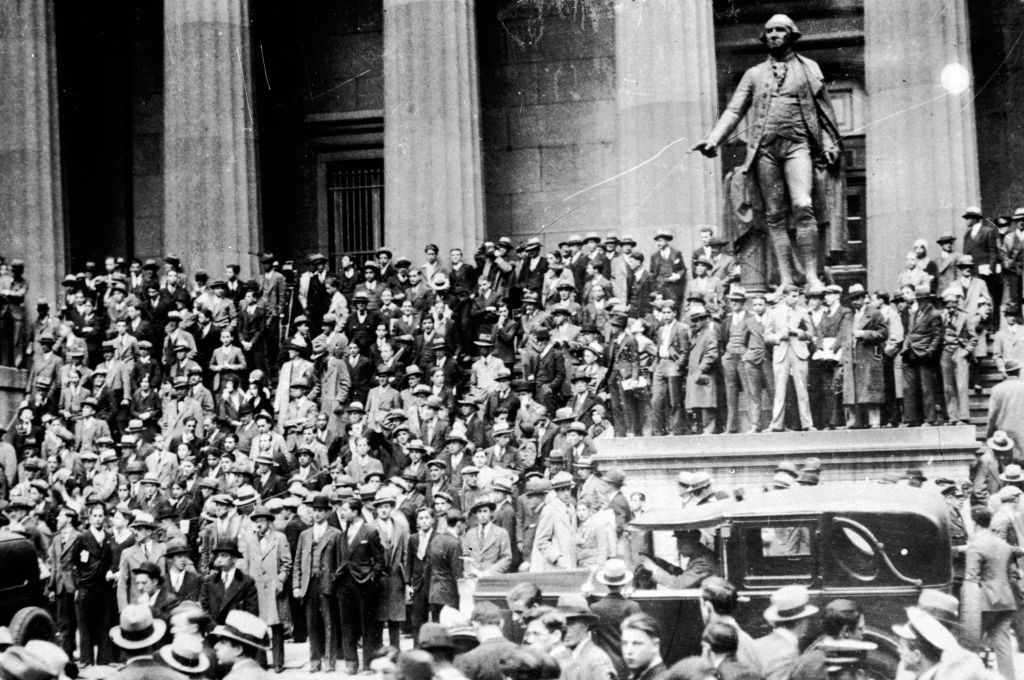

Bitcoin has lost almost a quarter of its value. The tech-heavy Nasdaq index on Wall Street has started to fall. And even leaders of the industry, such as the Google CEO Sundar Pichai, have started to warn about valuations getting out of control. We already knew that AI was driving a boom in investment. But this week there are worrying signs the market is about to crack. The only real question is whether that turns into a full scale crash.

Bitcoin, as so often, is leading the market rout. More than $1 trillion has been wiped off the value of the crypto market over the last six weeks, with Bitcoin itself down by 28 percent since its peak. But that is just part of a wider fall in tech and AI stocks, with the chipmaker Nvidia, which has powered much of the boom, starting to slide, along with many of the other stars of the AI boom. Plenty of stock market experts are starting to think it is looking like a bubble that is about to burst. Indeed, Michael Burry, who became famous in the crash of 2008 and 2009 for accurately predicting the collapse of the market, has started betting against the sector.

There are many worrying signs. The leaders of the boom have reached extraordinary valuations. Nvidia is up by over 1,300 percent over the last five years, and earlier this year became the first company to reach a market value of $4 trillion. It was quickly followed by Microsoft, which has soared mainly on the back of its stake in the leader of the AI boom ChatGPT, which itself became the most valuable start-up ever with a funding round that made it worth $500 billion. Meanwhile every company that managed to attach itself to the boom, no matter how spuriously, has seen its share soar. Goldman Sachs estimates that AI stocks have added $19 trillion since ChatGPT was launched, a huge run-up in valuations.

It is starting to look very like the dot com bubble of a quarter century ago. There is little question that AI is a valuable technology, and one that is starting to have a real impact. At the same time, there is far too much hype, no one has quite figured out how to make money from it, and no one has any real idea which of the new companies will turn into the long-term winners.

This week may or may not turn out to be the moment the bubble bursts. In reality, every investment boom has lots of sharp corrections as it soars upwards, and there is nothing very unusual about a fall of 5 percent or 10 percent in prices before the market starts climbing again. It is only when there is a final “melt-up” that it becomes dangerously over-valued. The AI boom does not look like it has reached that point yet. But there is little doubt that it is turning into a classic bubble. It will be very messy when it finally bursts.

Leave a Reply