Reports of the death of the US dollar as the world’s reserve currency are greatly exaggerated. Fortunately for America, while the dollar is by no means unsinkable, it will not be toppled anytime soon. Threats exist, but rather than coming from abroad, to paraphrase Lincoln, they spring up among us. How the US manages its economy will largely be the determinant factor in the dollar’s continued supremacy.

Currently, the dollar makes up about 58 percent of foreign currency reserves worldwide, well ahead of its competitors. The next closest currency is the euro at 20 percent, and then the yen and pound sterling, both at about 5 percent — China’s renminbi is at a paltry 3 percent (just ahead of a real powerhouse, the Canadian dollar). While the dollar’s popularity as a foreign reserve currency has fallen — having been at 67 percent in 2002 — economist Desmond Lachman at the American Enterprise Institute said that such a relatively small decline is “not that big of a deal.” “While there has been an erosion, we shouldn’t overstate it, the dollar is still pretty strong.”

Among the most important questions, according to Lachman, is what could replace the dollar? “Maybe ten to fifteen years ago, when Paul Volker was still alive,” said Lachman, “I was at a meeting, and a whole bunch of people were beating up the dollar… and what he [Volker] just said is, ‘look, for the dollar to be replaced, it has to be replaced by another currency.’” Volker then continued, saying, “Are you really telling me that the euro, the Japanese yen or the Chinese renminbi are better than the dollar?” The dollar is not perfect, but there is really not a viable alternative.

For a currency to be used widely in foreign reserves, it must be relatively stable — and the issuing country needs to have liquid, free and open markets, along with easy convertibility (i.e. easy to change dollars into euros or yen, and so forth). Lachman notes that China has “a property bubble and credit bubble that [is] bigger than that in the United States that led up to the Great Recession in 2008.” That already makes the renminbi unappetizing, but the currency is also subject to extensive capital controls, and it is difficult to convert into other currencies.

The euro is also not much of a concern for the dollar, given that it has hovered around 20-30 percent of foreign currency reserves since 2000. Lachman asserts that the persistence of debt troubles in the eurozone will come back to haunt the currency soon enough, which surely weighs on where central banks opt to put their reserves.

The concern over the dollar’s position had seemed to be backed by recent news coverage of countries moving away from the currency. Bangladesh will use the renminbi to remunerate Russia for a nuclear facility being built in the country — and Brazilian president Luiz Inácio Lula da Silva asked, “Why should every country have to be tied to the dollar for trade?… Who decided the dollar would be the (world’s) currency?” Brazil and Argentina have also made murmurs of seeking a common currency to use instead of the dollar.

Lachman dismisses the common currency idea as a “joke”, and understandably so — Argentina has had, to put it mildly, a terrible economic record over the past few decades. As for using the renminbi instead of the dollar for trade, it is mainly between countries with some connection to China – either through direct trade or, in the case of Bangladesh, Russia’s near dependency on China. Lachman notes that “it seems that what [China is] doing is that they are just telling these countries that when we trade with you, we want you to trade in Chinese renminbi and not the US dollar.” Importantly, according to the Bank for International Settlements, as of 2022, about 90 percent (out of 200 percent) of foreign exchange transactions used the dollar and about 50 percent of worldwide commerce was billed in dollars – advantages unlikely to be severely diminished anytime soon.

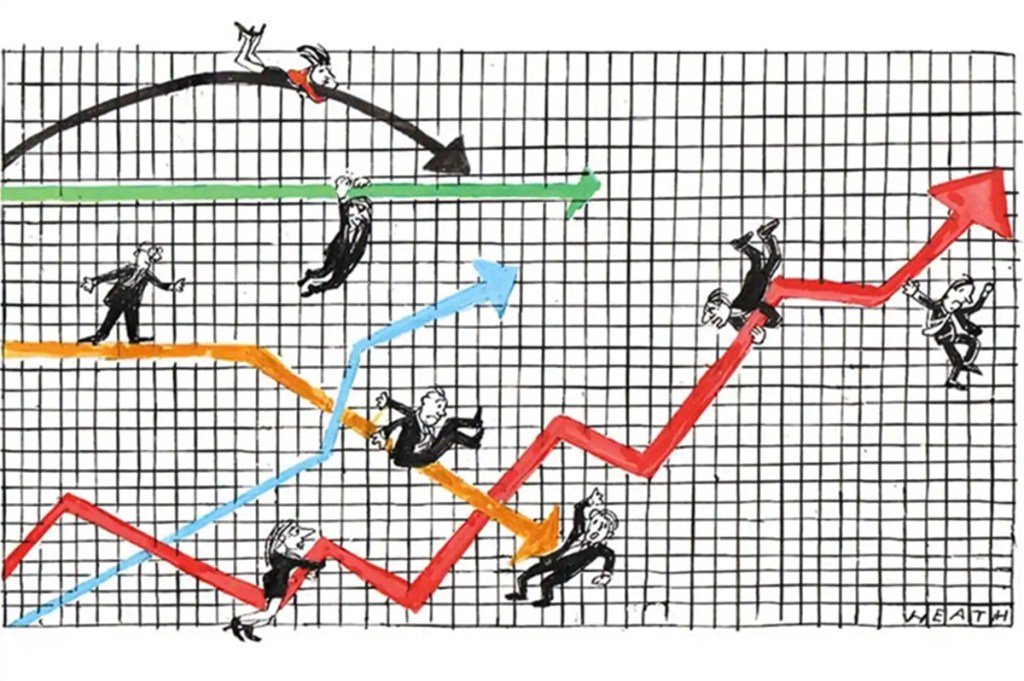

A powerful dollar, though, requires maintenance, and that is where the concerns arise. Lachman pointed to profligate spending and unsatisfactory monetary policy as key contributors to the desire of countries to diversify their currency reserves. When America runs massive budget deficits, racking up debt, that raises questions about the long-term stability of the economy. The same goes for monetary policy that is either excessively loose — as it was for years — or unable to tame inflation — as it is today. It has also been erratic. “One minute they’ve [the Fed] got their foot flat on the accelerator, and next they are slamming on the breaks. That is not the way to run a currency,” said Lachman.

There is also the avoidable problem caused by the debt limit controversy. However remote the chance of a default actually is, by holding the threat of it over the economy’s head, policymakers make the dollar that much more of a risky bet (and both sides of the aisle are to blame). “The immediate thing that they could do is somehow come to some sort of agreement on the debt ceiling,” said Lachman, “[the debt ceiling fight] could really destabilize the dollar if we go to the brink.” A foreign country is likely to stock their foreign currency reserves with fewer dollars than it otherwise would have if it looks like a US default is a possibility.

Spending, monetary policy and political malpractice are all easily addressable if there is the will to do so. Where things get more complicated is regarding sanctions, which some commentators have criticized Washington for using excessively. This pushes countries to look for alternatives to the dollar, either because they are under sanctions or are concerned that they may eventually be. “There’s fears by some central banks that the US is weaponizing the dollar,” said Lachman, “we’ve had sanctions on Iran and Russia, which had their reserves frozen, so they don’t want to hold their reserves in US dollars where the US can freeze their assets.”

The difficulty with sanctions, however, arises with the fact that while all of these concerns are true, some sanctions are also necessary. Those on Russia and Iran are critical to punishing these countries for their illegal activities (invading Ukraine and pursuing a nuclear weapon, respectively) and hampering their ability to engage in those and other malign activities. Undoubtedly, the US has overused sanctions — there are many cases where restrictions should be pared back or eliminated — but sanctions are a vital tool for use in certain exigent circumstances, even if it impacts how countries view the dollar’s viability as a foreign reserve currency. Not using them would be just as costly, though in other ways (like Iran having access to billions more dollars to fund its international terrorism).

In the case of Russia in particular, the EU (with the euro) and Japan (with the yen) also froze the country’s central bank assets, so the dollar is not alone. There is also the recognition among most countries friendly with the US that they have nothing to fear from Washington. The impact on the quantity of dollars in foreign currency reserves will primarily be caused by adversarial countries like China or fence-sitting countries wary of the US, though it is doubtful that even those countries will fully ditch the dollar.

The US can take solace in the fact that the dollar does not have any serious competitors, but it is also important to recognize that Washington can torpedo itself if it cannot get a hold of fiscal and monetary policy. Whether the necessary sanity will prevail in the halls of Congress, however, is an open question.